Bitcoin is set to close out a volatile week, marked by an attempt to break its all-time high (ATH) that ultimately ended in a retracement to lower demand levels. Despite this pullback, market sentiment remains largely positive.

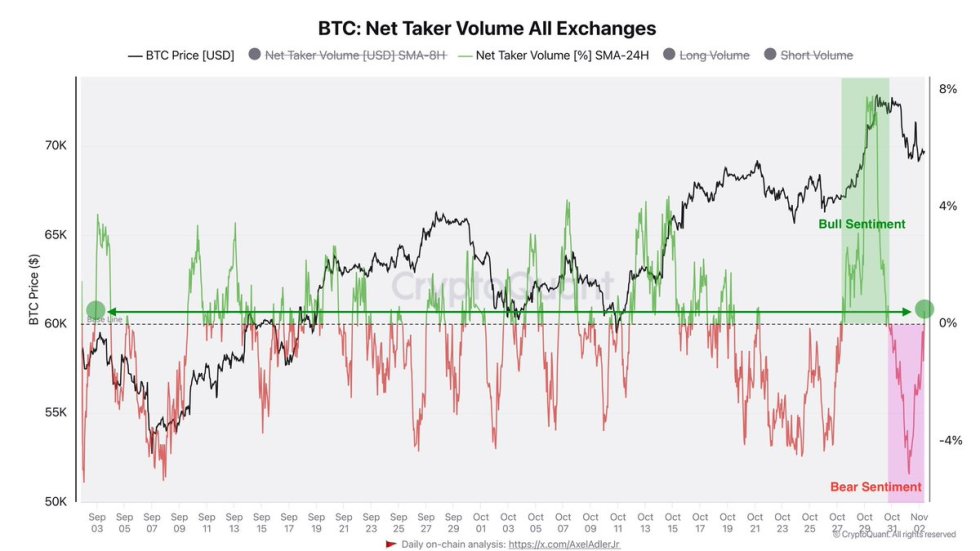

Key data from CryptoQuant reveals that the Net Taker Volume (SMA-24H) across all exchanges currently indicates a bullish outlook, as buying pressure outweighs selling pressure in this metric. This trend highlights growing confidence among investors, aligning with the broader sentiment seen after the recent U.S. election results, which have injected fresh optimism into the crypto market.

Analysts anticipate an uptrend for Bitcoin, supported by strong buying interest from retail and institutional players. The data underscores that while Bitcoin faces short-term hurdles around its ATH, the underlying demand suggests another rally may be on the horizon.

With the election impact still unfolding and Bitcoin’s price consolidating above key demand zones, the coming days will be crucial in setting the stage for its next major move. Whether Bitcoin can reclaim its upward momentum and break into price discovery will depend on sustained demand and the continuation of this bullish trend across exchanges.

Bitcoin Prepares For A Volatile Week

Bitcoin is gearing up for one of the most pivotal weeks in its history, with major events on the horizon that could shape market sentiment for the rest of the year. The US election on Tuesday and the Federal Reserve’s upcoming interest rate decision on Thursday will create a high-stakes environment for BTC and the broader crypto market.

These two events are expected to drive volatility and inject uncertainty into price action, making this an exceptionally critical moment for Bitcoin.

Prominent analyst and investor Axel Adler recently shared data on X that underscores a positive outlook for Bitcoin. His analysis highlights the Net Taker Volume (SMA-24H) across all exchanges, which indicates the balance between aggressive buy and sell orders. This indicator reveals a bullish sentiment, with buying interest exceeding selling pressure. This data suggests that buyers are preparing for a potential price surge, further strengthening the bullish outlook for BTC as it heads into this decisive week.

However, Adler warns that the path to new ATH is uncertain. While the Net Taker Volume hints at a possible upward trajectory, the sheer scale of this week’s events could lead to increased volatility. Historically, such events have triggered sharp market reactions, making BTC susceptible to rapid price swings in either direction.

If the Fed signals an interest rate cut, or if election results favor crypto-friendly policies, BTC could see a powerful rally. Conversely, any indications of tighter financial conditions or regulatory risks could dampen sentiment and lead to a pullback.

Overall, Bitcoin faces both a significant opportunity and substantial risk this week. The actions of the U.S. government and central bank will be pivotal in determining whether BTC can capitalize on current bullish momentum and possibly achieve new all-time highs.

BTC Holding Crucial Level

Bitcoin is currently trading at $68,500, following a 7% pullback from its recent high of $73,600. Despite the retrace, BTC remains resilient above the $67,000 mark, a crucial support level that has held firm amid market volatility. This level is key for maintaining a bullish outlook, as any drop below it could signal further correction and dampen momentum in the short term.

However, if BTC can hold steady above $67,000 and recover toward the $70,000 level, it would set up a strong foundation for a renewed push toward its all-time highs. This scenario would likely reinvigorate bullish sentiment, positioning BTC to challenge the previous peak of $73,794 and potentially enter price discovery territory.

The market is closely watching these critical levels, with $67,000 acting as a line in the sand. As long as BTC stays above it, confidence in the bullish trend remains intact. Breaking through the $70,000 barrier could act as a catalyst, drawing in new buyers and putting BTC on a direct path to retest and possibly surpass its all-time highs, solidifying its position as the market leader.

Featured image from Dall-E, chart from TradingView