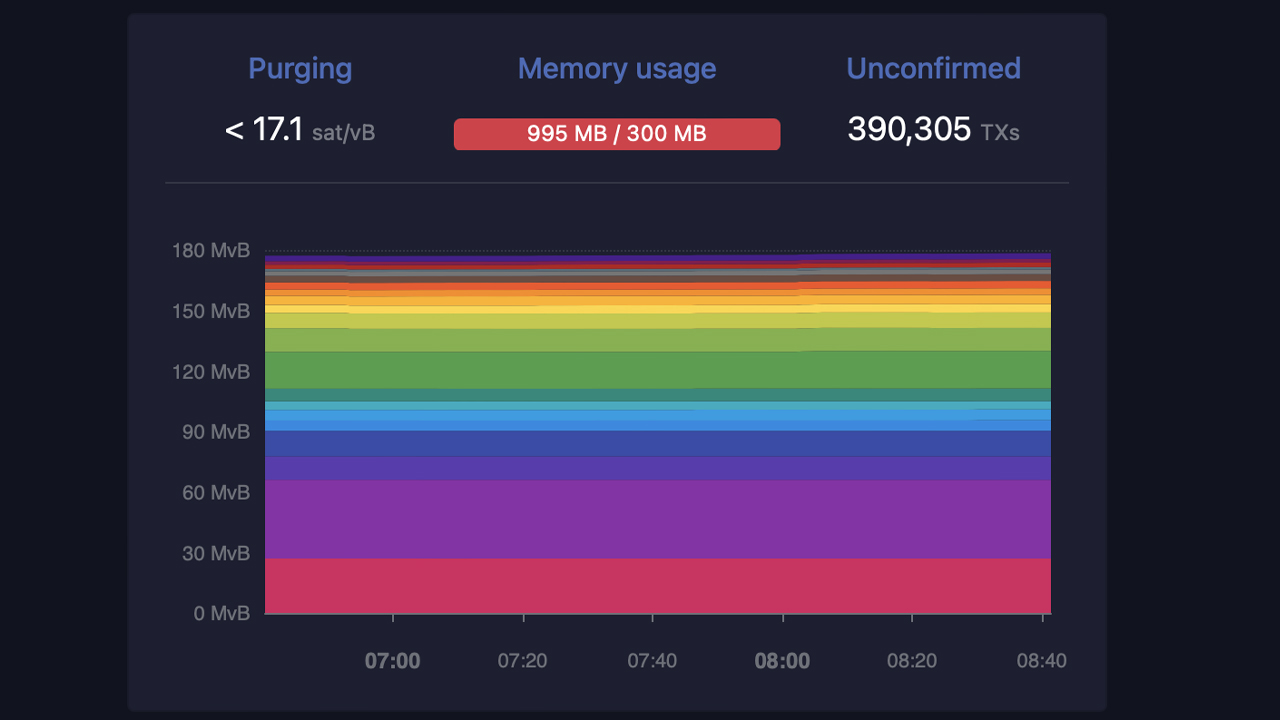

In just under two weeks, the number of unconfirmed transactions on the Bitcoin network has skyrocketed from 134,000 to over 390,000, causing a bottleneck in the mempool. This surge in unconfirmed transactions has resulted in a staggering 343% increase in transaction fees, which have risen from $1.99 per transaction on April 26 to a current rate of $8.82 per transaction as of May 7. Bitcoin miners are struggling to keep up with the demand, leaving many users frustrated and unable to complete their transactions in a timely manner.

Bitcoin Network Struggles with Unprecedented Traffic and Soaring Fees

As of Sunday, May 7, 2023, the Bitcoin network is experiencing a major traffic jam due to an overwhelming number of unconfirmed transactions. The latest statistics reveal that a whopping 390,000 transfers are currently stuck in limbo, waiting for confirmation.

This backlog can be attributed to the surge in minting and transferring of Ordinal inscriptions and BRC20 tokens, which have flooded the network. In fact, the Bitcoin blockchain is now hosting over 13,000 BRC20 tokens and a staggering 4.17 million Ordinal inscriptions, further exacerbating the congestion.

To clear the current backlog, a whopping 179 blocks would need to be mined. Given the average block time of 10 minutes, it would take approximately 1.24 days to mine the required number of blocks. This backlog has caused transaction fees to skyrocket by a whopping 343% over the past 11 days. As per bitinfocharts.com data, the average transaction fee currently stands at 0.00031 BTC or $8.82 per transfer.

Bitinfocharts.com further shows the median-sized Bitcoin transaction fee currently stands at 0.00018 BTC or $5.16 per transfer. However, the situation is far from ideal, as per mempool.space. The website reveals that a low-priority fee will set you back $7.74, while a medium-priority fee costs $7.90.

For those who need their transactions processed urgently, a high-priority fee of $7.99 per transfer. Adding to the frustration is the fact that the current block time is longer than the ten-minute average, with the last block taking a whopping ten minutes and 55 seconds to be discovered.

The clogged mempool has been a hot topic on social media lately, with users expressing a range of opinions on the matter. While some are excited about the surge in activity, others have labeled the rise of non-financial transactions as a DDoS or an attack.

Bitcoin is not under attack.

The anemic block size increases simply weren’t sufficient to meet demand, and Lightning didn’t see mass adoption.

Quit whining. Either accept that a huge mempool and high fees will be the norm, or properly increase the block size.

— Sam Patt (@SamuelPatt) May 7, 2023

Despite the optimism of some, the rise in unconfirmed transactions has not led to a significant increase in Lightning Network adoption. This is because it is still expensive to open and close a channel, and non-custodial solutions are few and far between.

At precisely 11:07 a.m. (ET), the largest crypto exchange in the world, as measured by trade volume, has temporarily halted bitcoin (BTC) withdrawals. The exchange has attributed this decision to a “congestion issue” that the Bitcoin network is currently grappling with.

“Our team is currently working on a fix until the network is stabilized and will reopen BTC withdrawals as soon as possible. Rest assured, funds are SAFU,” Binance wrote on Sunday morning.

What are your thoughts on the current state of the Bitcoin network? Do you think the surge in unconfirmed transactions and fees is a temporary setback or a sign of deeper issues? Share your opinions in the comments section below.