Bitcoin has faced significant volatility and uncertainty as it approaches a pivotal week, with tomorrow’s U.S. election expected to play a key role in determining its price action. BTC is holding steady above the $68,000 mark, a critical level that has shifted from resistance to a solid demand zone. Analysts see this level as essential for maintaining bullish momentum, especially with high-stakes events on the horizon.

Key data from Coinglass reveals a notable drop in Bitcoin’s open interest, suggesting that many investors are closing their positions amid the uncertainty surrounding the election and the Federal Reserve’s upcoming interest rate decision on Thursday. This decline in open interest reflects a cautious market stance as traders anticipate the election outcome and its potential influence on broader financial markets and Bitcoin’s trajectory.

With BTC managing to hold above this demand zone, the coming days will be crucial for confirming its direction. A sustained hold could strengthen BTC’s outlook, setting it up for a potential breakout. Conversely, increased selling pressure tied to market reactions could put this level to the test. The week ahead could be a defining moment for Bitcoin’s price action as macro events unfold.

Bitcoin Investors Preparing For This Week

Bitcoin is gearing up for what could be the most defining week of this market cycle. Approaching all-time highs, BTC is facing heightened volatility as two critical events unfold: the U.S. presidential election and the Federal Reserve’s decision on interest rates.

These events are poised to impact Bitcoin and global financial markets, potentially shaping global trade policies and economic stability.

Recent data from Coinglass highlights that investors are bracing for a turbulent week as open interest in Bitcoin dropped significantly, with many traders opting to close their long and short positions before the election.

This retreat in open interest signals caution, as the crypto market anticipates significant volatility stemming from the election results and the Fed’s rate decision. Coinglass shared an analysis on X, emphasizing that Bitcoin’s price could experience extreme swings regardless of who wins the election, likening it to a “wild rollercoaster.”

This week is crucial for Bitcoin and the broader global economy, with analysts suggesting that the election could set the tone for international economic policies and trade relations in the years to come. The Fed’s rate decision, scheduled just days after the election, adds additional uncertainty, as it could dictate monetary policy direction and market liquidity.

With BTC teetering near historic highs, investors are closely watching these events to learn about market direction. Whether Bitcoin breaks to new heights or experiences a pullback largely depends on the unfolding economic landscape. For now, Bitcoin remains on edge, with investors poised for a week that could define its trajectory for the months ahead.

BTC Testing Crucial Liquidity

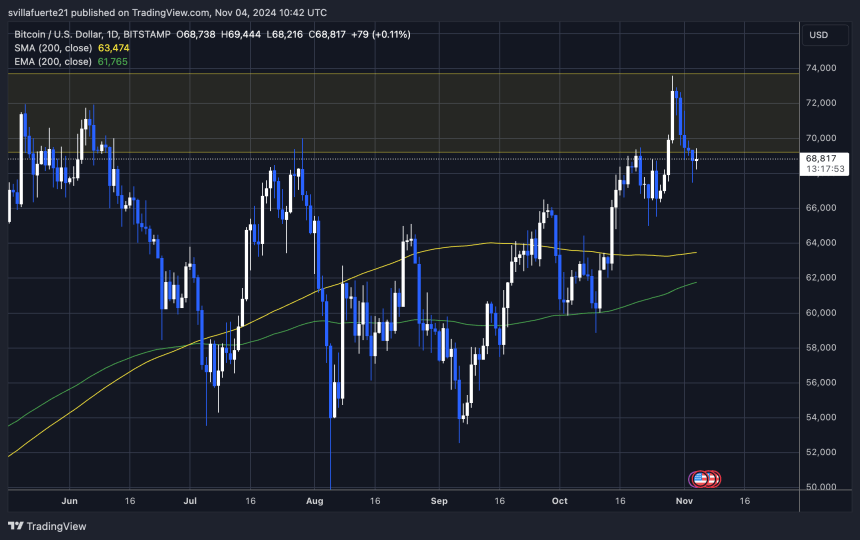

Bitcoin is trading at $68,800 after falling short of breaking its all-time highs last week. This week promises heightened unpredictability for BTC’s price action, driven by major events in the global economy. Key levels will be essential to watch: if Bitcoin can maintain support above $68,000, it will likely set the stage for another attempt to surge past its record high.

However, volatility may test this support, potentially shaking out “weak hands” before any significant upward momentum. Should BTC dip below $68,000, further pullbacks could follow, allowing institutional buyers to accumulate before a renewed push.

If Bitcoin successfully breaks above its $73,794 all-time high, it will enter a price discovery phase, where the lack of resistance can trigger a rally fueled by FOMO (fear of missing out) among investors. This upward momentum in a price discovery zone often leads to rapid price increases as more buyers enter the market.

As Bitcoin edges to this level, market participants remain watchful, anticipating a potential breakout that could redefine the broader market sentiment and establish new highs for the cycle.

Featured image from Dall-E, chart from TradingView