Data shows the Bitcoin Open Interest has seen a surge to a new all-time high (ATH) recently, a sign that volatility could be brewing for BTC.

Bitcoin Open Interest Has Been Going Up Recently

As pointed out by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the Bitcoin Open Interest has just set a new record. The “Open Interest” here refers to an indicator that keeps track of the total amount of BTC-related derivatives positions that are open on all centralized exchanges.

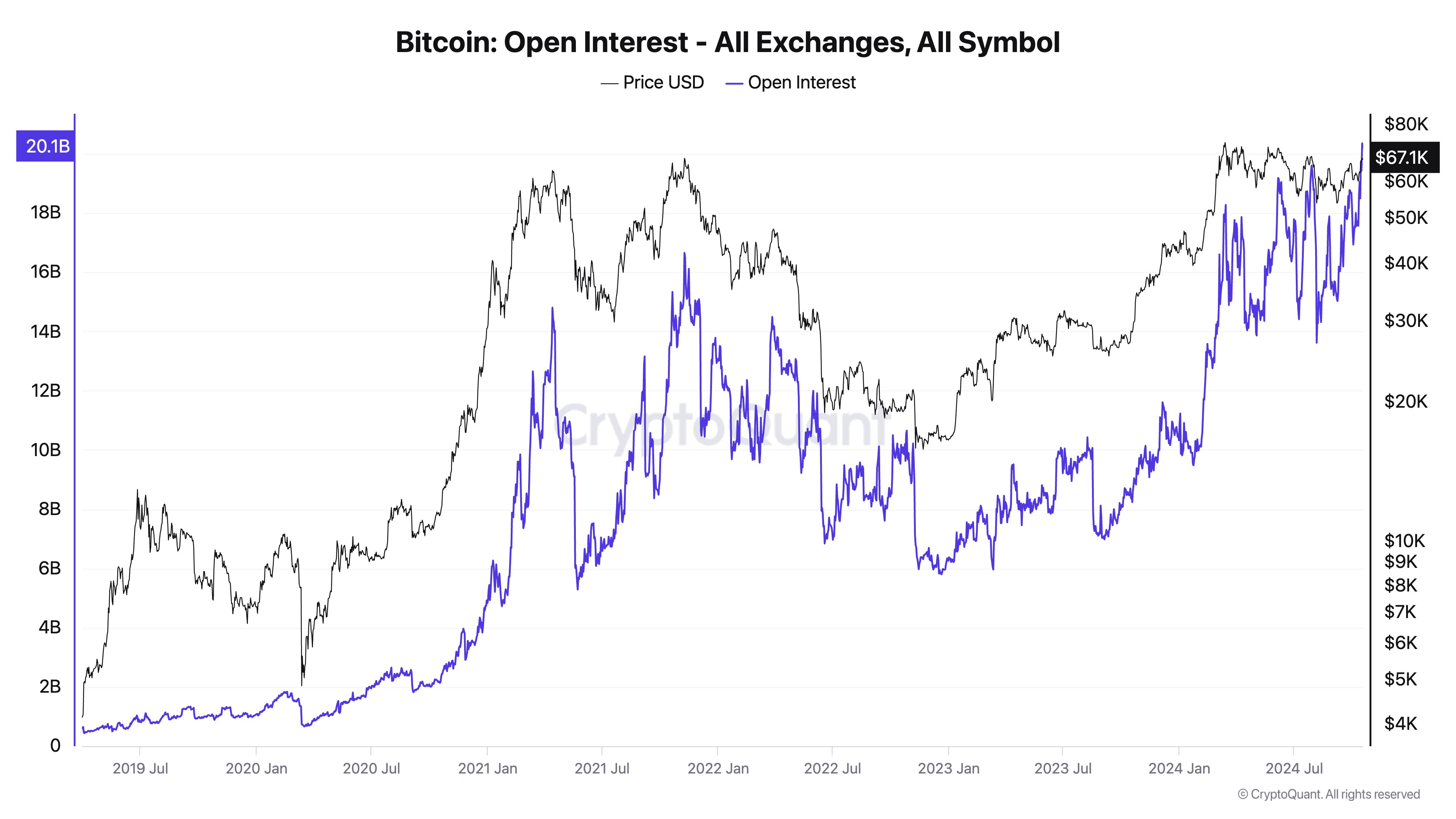

Below is the chart shared by Young Ju that shows the trend in this metric over the last few years:

As is visible in the graph, the Bitcoin Open Interest has been on the rise recently, which suggests that the investors have been opening fresh positions on the market. Following the latest continuation of the increase, the indicator has hit a value of $20 billion, which is a new record. As for what this high could mean for the cryptocurrency’s price, a high Open Interest is generally followed by sharp volatility in the asset.

On paper, this volatility can take the coin in either direction, but from the graph, it’s apparent that peaks in the indicator have, in fact, usually led to tops for the cryptocurrency.

The source of the volatility is usually mass liquidation events, which can be probable to take place when the market has a large amount of positions with high leverage involved.

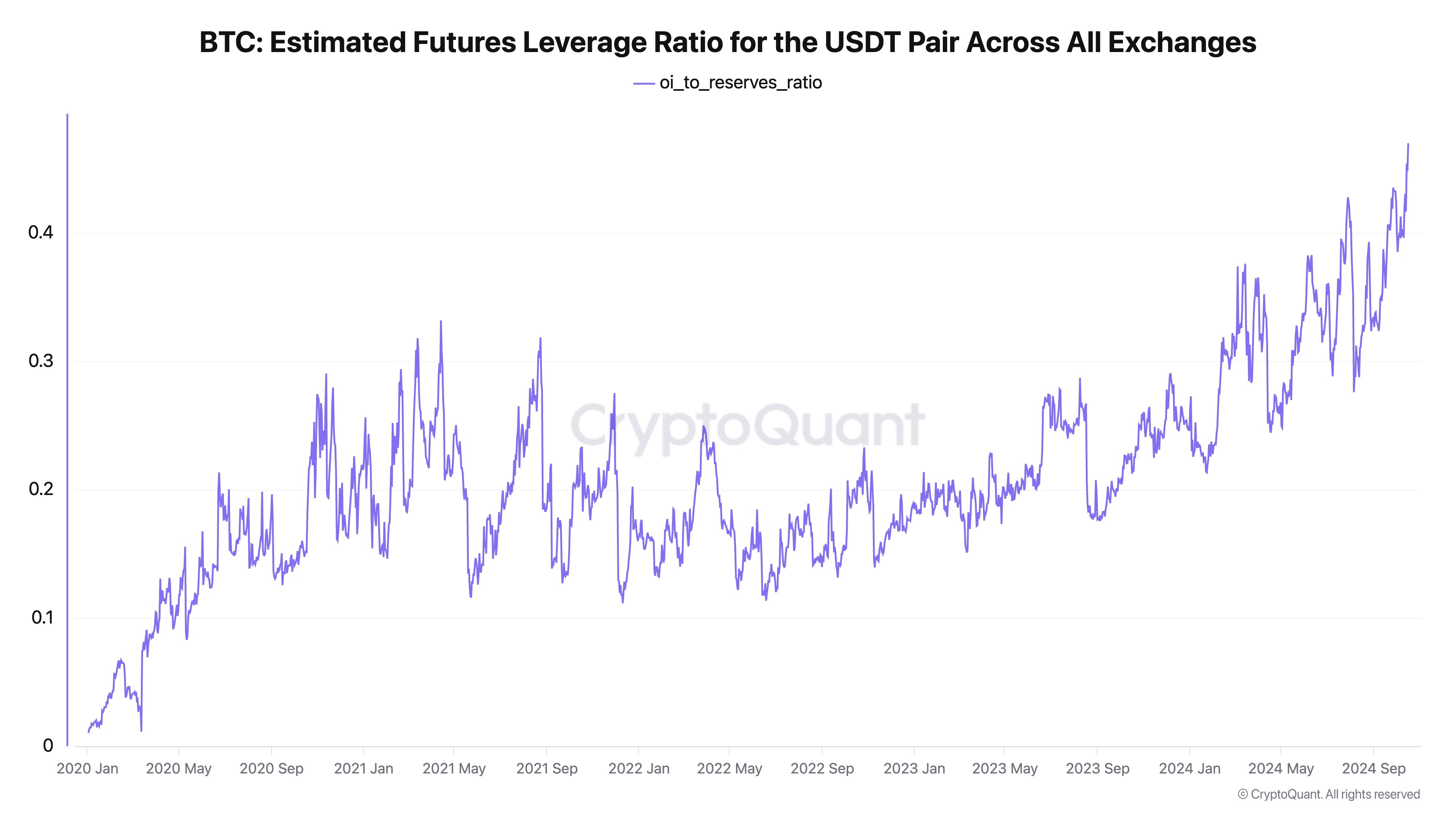

In another X post, the CryptoQuant CEO shared the data for the Bitcoin Estimated Leverage Ratio, which basically tells us about the average amount of leverage that users are currently opting for.

The Estimated Leverage Ratio is calculated as the ratio between the Open Interest and the total exchange reserve of the underlying asset. In the current case, Young Ju has posted the version of the indicator that tracks the positions that have Tether’s stablecoin, USDT, as the collateral.

While this certainly doesn’t cover the entire market, this version of the metric can still provide us with a hint of the general trend being followed by traders as a whole.

As displayed in the above graph, the Bitcoin Estimated Leverage Ratio for the USDT pair has shot up recently, which implies the investors have increased their appetite for risk.

Thus, with all this leverage involved, BTC could truly be at risk of seeing a volatile explosion. Considering that these new positions that have been popping up could be long positions, the traders betting on a bullish outcome may once again be the ones to get caught up in the volatility.

BTC Price

Bitcoin had crossed above the $68,000 level yesterday, but the asset appears to have seen a pullback since then as it’s now down to $67,200.