Data shows the Bitcoin derivatives Open Interest has shot up to a new all-time high (ATH) recently. Here’s what this could mean for the asset’s price.

Bitcoin Open Interest Has Registered A Steep Rise Recently

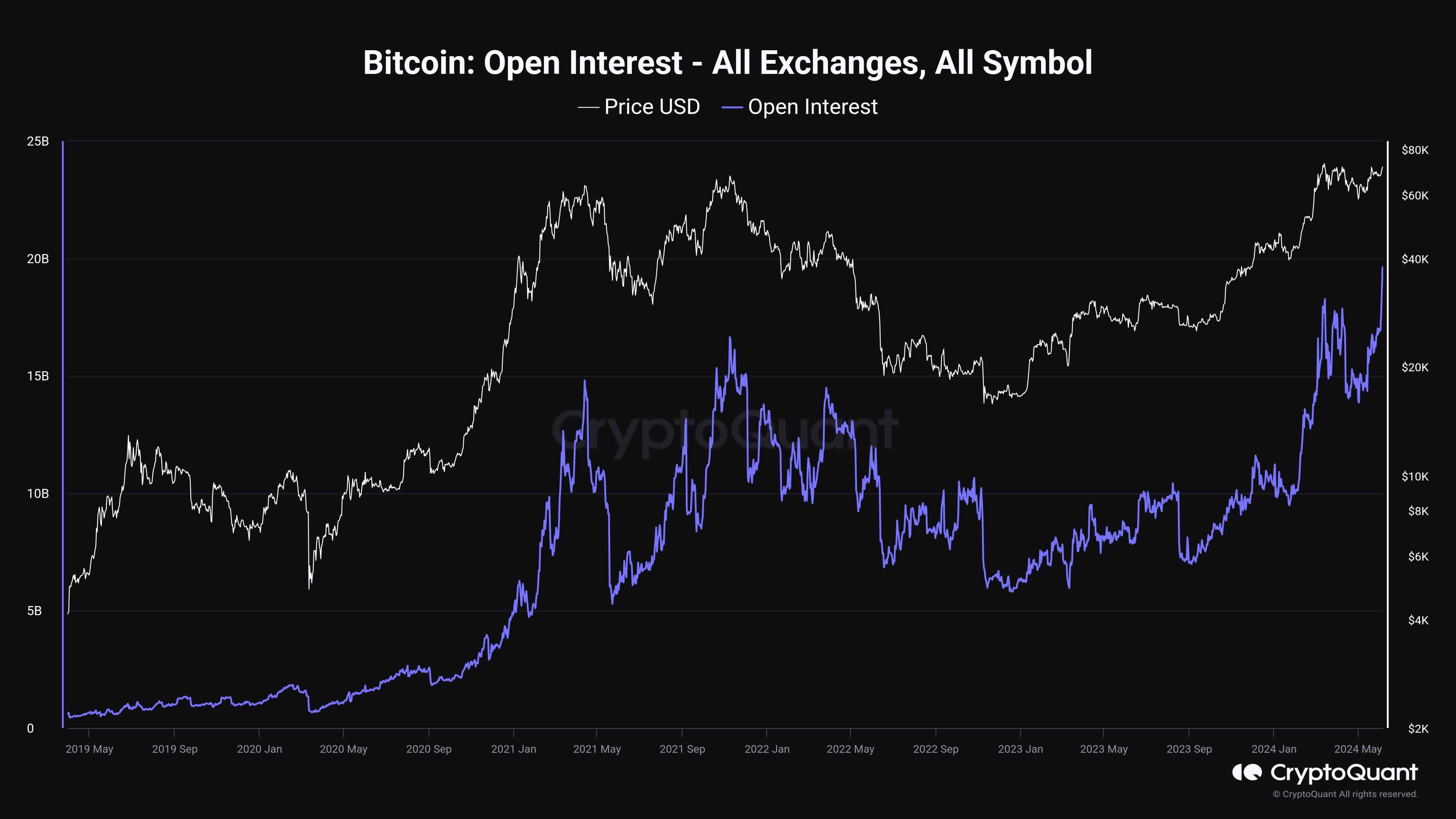

In a post on X, CryptoQuant Netherlands community manager Maartunn has discussed about the latest trend in the Open Interest for Bitcoin. The “Open Interest” here refers to the total amount of derivatives positions related to the cryptocurrency that are currently open on all exchanges.

When the value of this metric rises, it means the investors are opening up fresh positions on the market right now. Generally, the total amount of leverage in the sector goes up when this trend forms, so it may lead to the asset’s price registering a higher degree of volatility.

On the other hand, a decrease in the indicator suggests the derivatives users are either closing up positions of their own violation or getting forcibly liquidated by their platforms. Either way, the coin could become more stable following such a drop, due to the decreased leverage.

Now, here is a chart that shows the trend in the Bitcoin Open Interest over the past few years:

As is visible in the above graph, the Bitcoin Open Interest had sharply risen earlier in the year when the cryptocurrency’s price had witnessed its rally towards the new ATH.

In this surge, the indicator had surpassed its record value set during the peak of the 2021 bull run. As the price fell to consolidation following the mid-March ATH, though, the metric also observed a cooldown.

With the latest recovery run for Bitcoin, however, the trend has once again seen a reversal for the Open Interest, as investors have rapidly started opening new positions. The indicator’s value has now surpassed the high seen earlier in the year, and by a margin at that.

It would appear that speculation has made a return in the market in full force and as it has often happened historically, these extreme levels of Open Interest could once again result in some sharp price action for the cryptocurrency. The direction of these fluctuations, of course, can be in either direction.

As mentioned earlier, the reason volatility goes up after an increase in the Open Interest is due to a rise in the leverage. When leverage increases, mass liquidations become more probable to take place in the market. It’s these high amount of liquidations that can trigger chaos in the market.

In an earlier X post, Maartunn had shared how the the aggregated Open Interest in the cryptocurrency sector as a whole had been approaching an ATH. Therefore, it would appear that Bitcoin isn’t the only coin that has been witnessing an increased appetite for speculative activity recently.

BTC Price

At the time of writing, Bitcoin is floating around $71,000, up more than 4% over the past week.