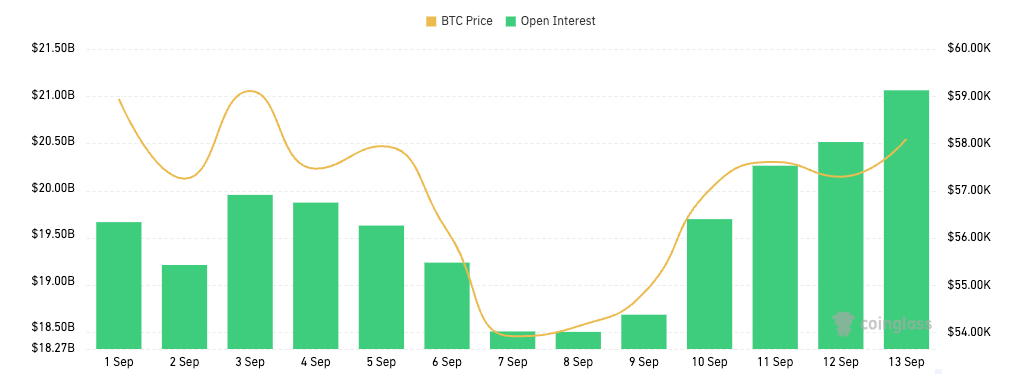

Between Sept. 7 and Sept. 13, Bitcoin options open interest increased from $18.46 billion to $21.06 billion, following Bitcoin’s price rise from $53,900 to $58,100.

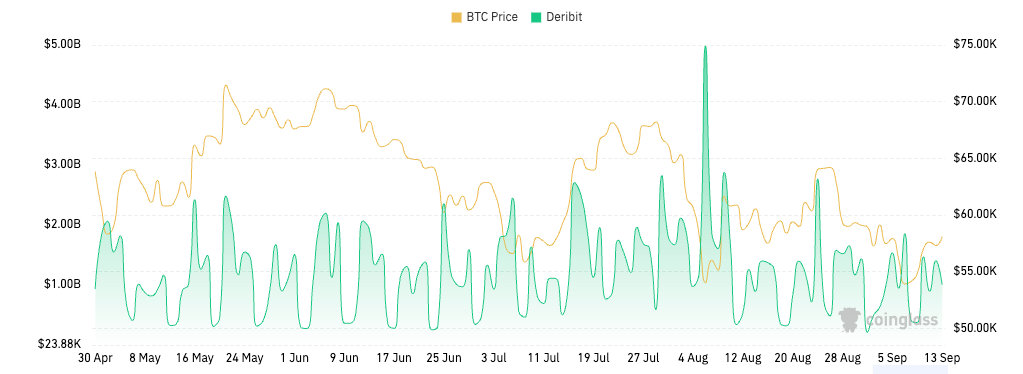

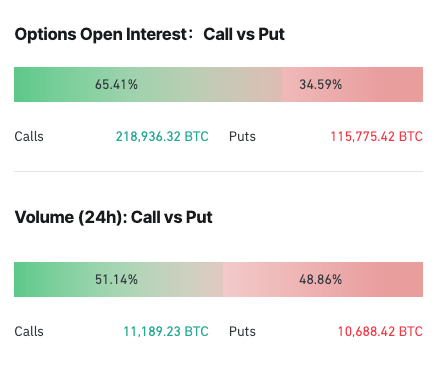

Despite this rise in OI, daily options volume remained relatively stable, with fluctuations consistent with yearly averages. On Sep. 12 and Sep. 13, $1.41 billion and $1 billion in options were traded, respectively, with the call/put split nearly even—51.14% of volume coming from calls (11,189 BTC) and 48.86% coming from puts (10,688 BTC).

This balance in trading volume indicates near-term uncertainty. The market shows no clear preference for a directional move, with traders hedging risks and waiting for more signals.

However, the open interest distribution is heavily skewed towards calls—65.41% (218,936 BTC) of OI comes from calls, compared to 34.59% (115,775 BTC) from puts. This signals longer-term bullish sentiment. While daily volume suggests indecision, most existing positions are preparing for future price appreciation.

The divergence between balanced volume and call-heavy OI suggests that while traders remain cautious in the short term, they expect further upside for Bitcoin. This is typical in markets with near-term volatility but medium-term bullish expectations. If Bitcoin’s price continues to rise, the dominance of calls could push the market higher, creating the potential for increased volatility near key strike levels.

This pattern points to a market awaiting confirmation of the next big move, with optimism building below the surface.

The post Bitcoin options volume shows short-term indecision, long-term optimism appeared first on CryptoSlate.