Onchain Highlights

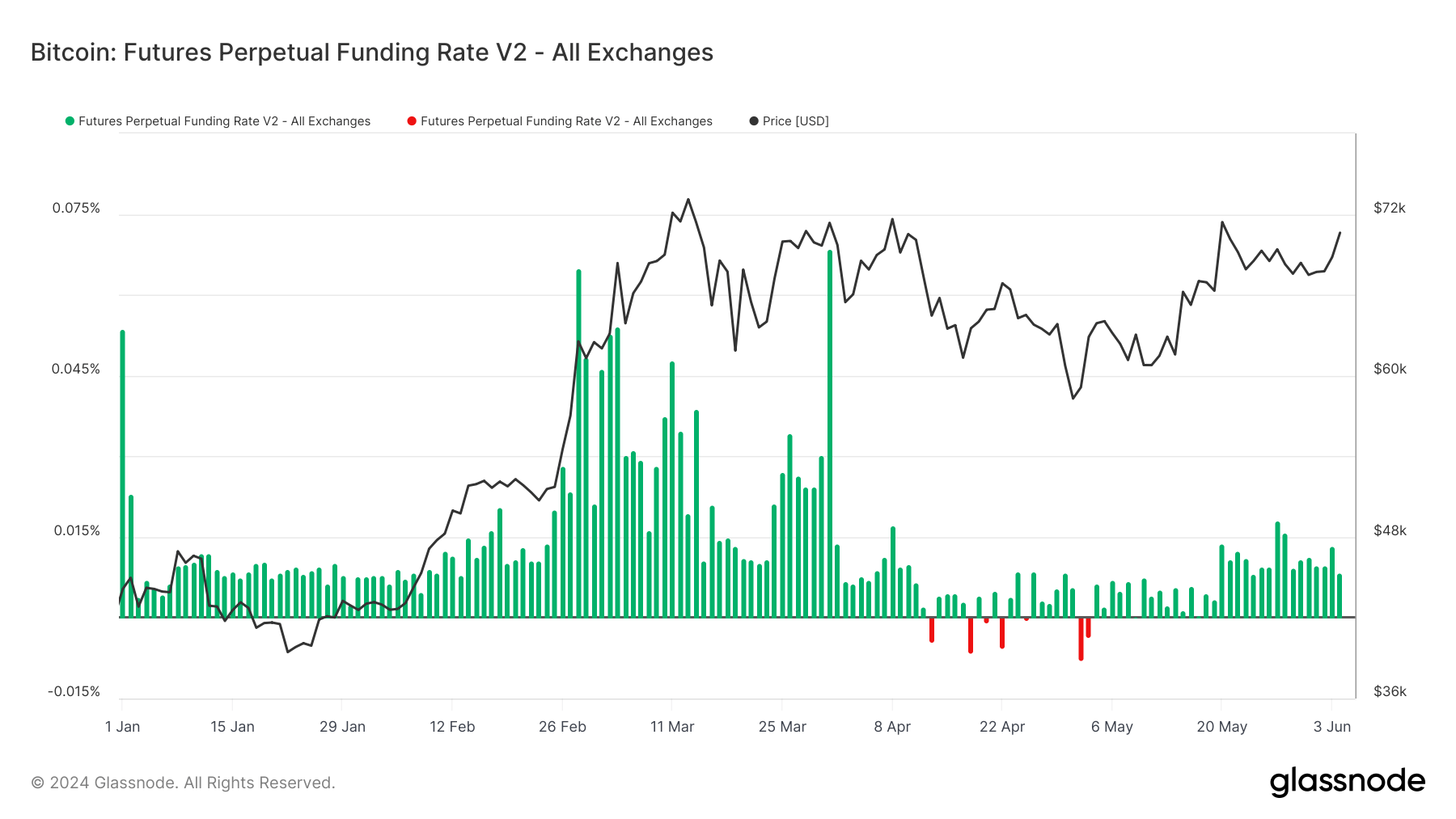

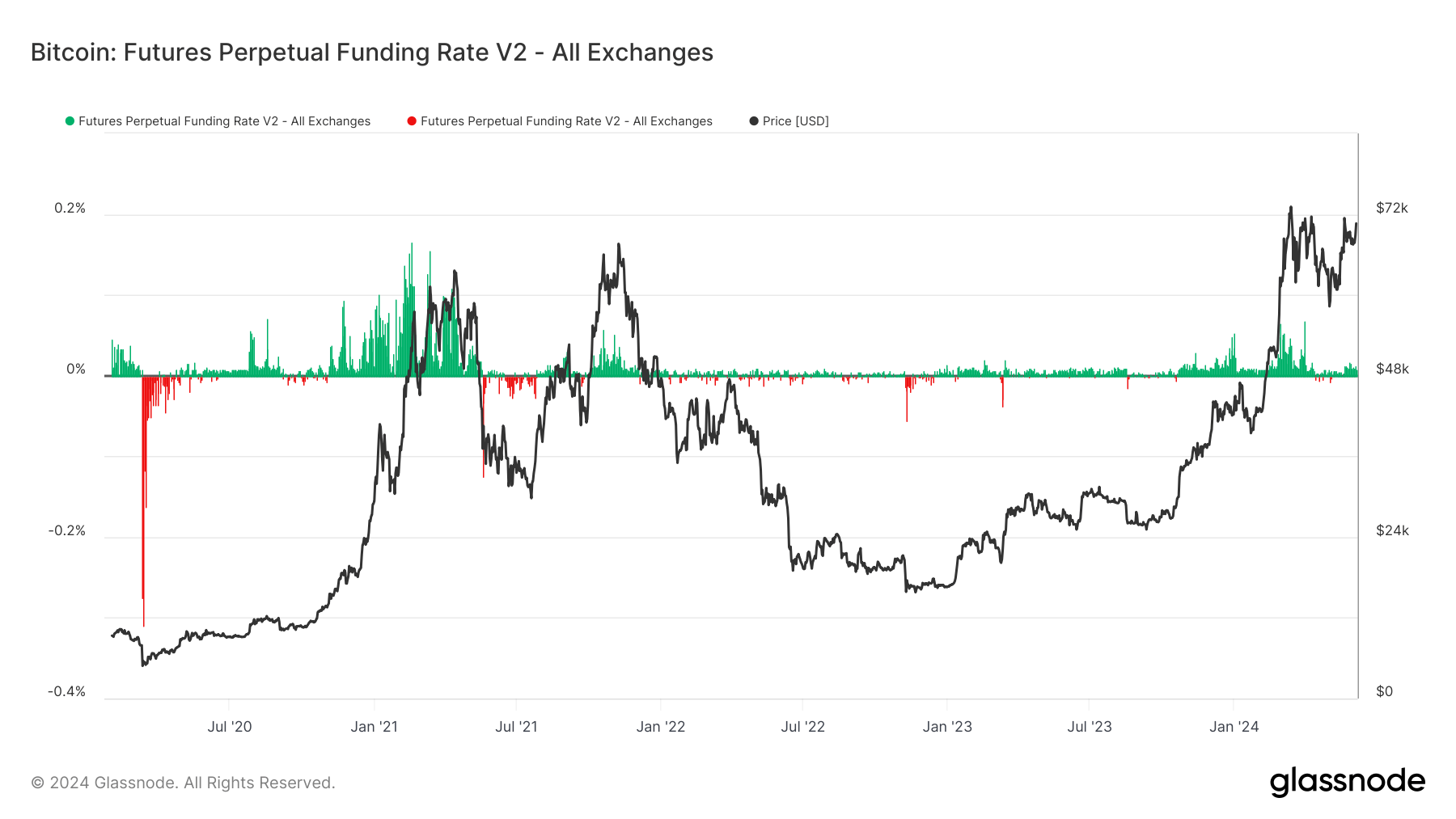

DEFINITION: Bitcoin future perpetual funding rate V2 is the average funding rate (in %) set by exchanges for perpetual futures contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions.

Bitcoin futures perpetual funding rates provide valuable insights into the market’s current forces. Throughout 2024, these rates have fluctuated, reflecting trader sentiment and market volatility.

Initially, the year saw positive funding rates, indicating bullish sentiment as Bitcoin’s price rallied. However, the start of Q2 market turbulence led to several instances where funding rates turned negative, signifying a shift towards bearish sentiment. Notably, these negative funding rates often coincided with significant price drops, suggesting traders’ anticipation of further declines.

Despite these fluctuations, the funding rates have shown resilience, often rebounding quickly. This pattern illustrates a persistent underlying optimism among traders. The recent trend towards positive funding rates, even amid market corrections, indicates that many traders view these downturns as temporary rather than indicative of a longer-term bearish trend.

The perpetual futures market’s behavior suggests a nuanced trader perspective, balancing between caution and optimism. This dynamic is crucial for understanding potential future market movements, as shifts in funding rates can provide early signals of changing market sentiment.

The post Bitcoin perpetual funding rates fluctuate with market sentiment in 2024 appeared first on CryptoSlate.