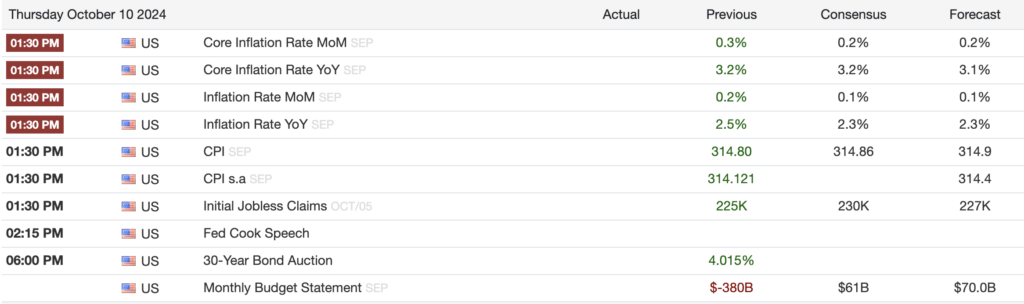

Upcoming US inflation figures, set for release today at 1:30 P.M. EST, could influence Bitcoin’s trajectory as the cryptocurrency hovers above $61,000. Analysts expect the Core Inflation Rate year-over-year for September to hold steady at 3.2%, with a slight monthly increase of 0.2% forecasted.

Recent trends show Bitcoin’s resilience amid economic data releases. In September, despite the Consumer Price Index rising by 0.2% and the Federal Reserve implementing a 50 basis point rate cut, Bitcoin maintained stability above $60,000. This steadiness suggests investors may have already priced in modest inflation fluctuations.

Demographic shifts and rising housing costs could exert upward pressure on core inflation. Owners’ Equivalent Rent, a significant component of CPI, increased by 0.49% in August, influenced by unexpected population growth and heightened housing demand. If today’s data reflects continued inflationary pressures, it may affect market expectations regarding future monetary policy.

Market participants will also monitor the Federal Reserve’s comments, particularly any insights from Fed Cook’s speech at 2:15 P.M. EST, for indications on future policy moves. Initial Jobless Claims and the Monthly Budget Statement may further influence investor sentiment.

The post Bitcoin poised for big day of US macro data including inflation, jobless claims, budget, bonds appeared first on CryptoSlate.