Investors’ and traders’ hope about an impending massive price rally for Bitcoin is alive again as the digital asset experiences renewed strength toward crucial resistance levels such as the coveted $100,000 mark. Given the recent price upswing, BTC’s short-term outlook looks promising for significant gains.

A Big Move For Bitcoin To New All-Time Highs Approaches

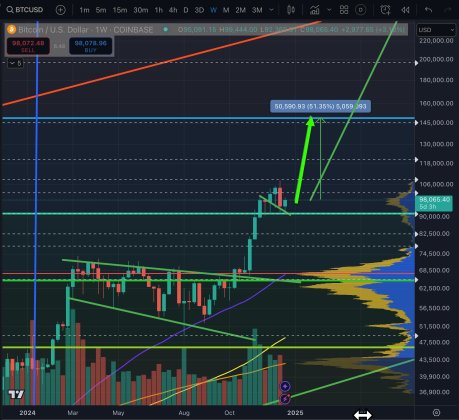

As Bitcoin regains upbeat momentum, Micro2Macr0, a macroeconomist and investor, has weighed in on Bitcoin’s trajectory, predicting that its next significant move might be close. His forecast has sparked optimism within the community about a possible rally to a new all-time high in the near term.

The expert points to a critical support range and indicators that indicate an imminent price breakout to higher levels. His bold prediction comes amid heightened market anticipation about a deeper correction for BTC, suggesting a swift rebound.

Presently, Bitcoin has witnessed a notable recovery to the $99,000 threshold, gradually aiming at the $100,000 level. Thus, the analyst expects Bitcoin to conclude the week in bullish territory if it can maintain between the $99,000 and $100,000 range over the next few days.

In the event that this happens, the $145,000 is the measured move for the next significant rally. Meanwhile, Micro2Macr0 is confident that this substantial thrust may occur in the following months, at the very most quarters.

With the $99,000 and $100,000 range being key for BTC’s next major move, investors and traders are keenly watching for market signals in order to position themselves for the much-anticipated rally to a new all-time. This demonstrates investors’ robust optimism and confidence in BTC’s long-term potential.

BTC Short-term Holders Offloading Their Holdings At A Rapid Rate

Even though BTC is gradually entering into bullish territory, a notable shift has been cited among short-term holders. Axel Adler Jr, a macro researcher and author reported that short-term investors are seizing the opportunity to sell their Bitcoin holdings at substantial profits.

On-chain data shows that this sharp selling activity lingers around investors who acquired BTC within the last few months following the cryptocurrency’s recent price surge to a new peak in December. Specifically, this trend indicates profit-taking behavior, which is typical during bull market phases.

Adler highlighted that active profit-taking by these investors may cause a local correction and a price drop should demand slow down. Since selling coins at a loss in a bull market is not always the best course of action, short-term holders’ sales are likely to decline in the event of a price drop.

As a result, the market could stabilize at support levels, which are around the $90,000 threshold. Despite heightened selling activity by STHs, long-term holders continue to hold their positions, reflecting confidence in Bitcoin’s future growth.