Though buyers stand a chance, Bitcoin is steady when writing, teetering at the $60,000 level. After rejecting August lows, the bounce above the round number at $60,000 to as high as $63,000 by the end of last week was impressive.

However, from the daily chart, prices are moving sideways in a possible accumulation, bounded by the August 8 bullish engulfing bar.

Bitcoin Is Moving Sideways And “Boring”

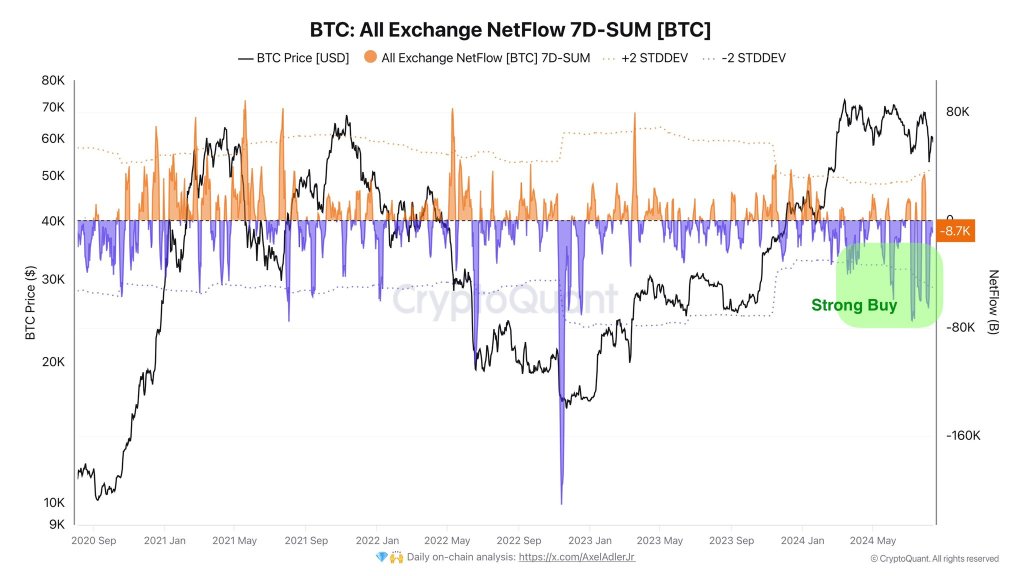

Amid the optimism, the crypto market is quiet and even boring. Picking out this state of affairs, one analyst on X, citing on-chain developments, observed that the dull market explains the generally low activity. For instance, the analyst said that the Bitcoin netflow has stood at -8,748 BTC over the last seven days.

This means that more BTC was bought than sold, indicating accumulation amid the general market lull. That traders and investors are looking to buy at current prices is a net positive for bulls and might help steady prices in light of the dizzying fall to as low as $49,000 on August 5.

The possible accumulation is unsurprising and aligns with the broader crypto market behavior. So far, Bitcoin, like Ethereum and even XRP, is in a bullish recovery after the crash in early August. Even though the bull bar of August 8 lifted sentiment, there has been no follow-through.

The immediate resistance is $63,000, while support is between $57,000 and $60,000. If buyers are to press on, breaking $63,000, it will likely set up the base for another leg up to $70,000 and even all-time highs.

Miner Liquidation Risk Low, BTC Holders Accumulation

Even so, before then, Bitcoin is moving sideways and inside a bullish bar, a net positive for upbeat traders from an effort-versus-result perspective.

On-chain data second this preview. According to Glassnode, Bitcoin is at the HODLing stage, and users are keen to accumulate. The decision to double down as spot rates when prices are lower could suggest confidence and expectation of even more gains in the coming days.

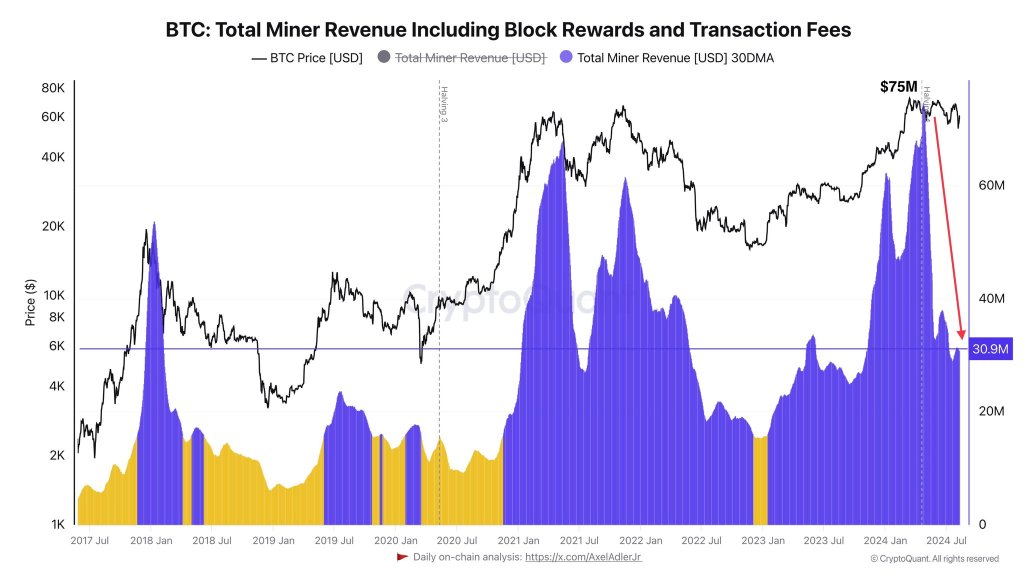

Encouragingly, the possible leg up won’t face headwinds, especially from miners who may choose to dump. Weeks after Halving in late April, miners began dumping BTC, forcing prices lower, as evident throughout June. For now, there is stability as the hash rate–a measure of computing power–picks up, looking at YCharts.

Daily miner revenue, one analyst notes, fell by roughly 60%, crashing from $75 million to as low as $30 million after Halving. Meanwhile, over the last 720 days, their reserve fell by 50,000 BTC as they sold to upgrade their gear and stay competitive. Even as they liquidate, the analyst is confident miners are not in immediate danger since their reserves remain at over 713,000 BTC.