Crypto analyst CryptoCon has provided valuable insights into the Bitcoin price action in this cycle. Based on his analysis, the next thirty days could be a game-changer, with BTC set to witness a significant move to the upside.

Why The Next 30 Days Could Be A Game Changer As The Bitcoin Price Makes its Move

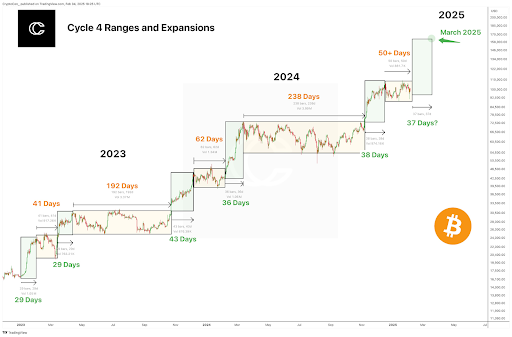

In an X post, CryptoCon predicted that the Bitcoin price could rally to as high as $160,000 in the next thirty days. This would be a game-changer for the market, especially considering the bearish sentiment in the crypto market at the moment. The analyst noted that Bitcoin has spent about 583 days ranging in this cycle.

On the other hand, the analyst remarked that the Bitcoin price has spent just 175 days, making meaningful price action to the upside. In line with this, he alluded to how patience is key, considering how Bitcoin ranges for most of the cycle. However, CryptoCon is convinced that the next 30-day sprint of great price action that the market is about to witness is worth the wait.

The analyst’s accompanying chart showed that the Bitcoin price could record up to 37 days of expansion on this next leg up. The chart also showed that the flagship crypto could rally to as high as $160,000 in March following this upward trend. This is bullish for the broader crypto market as altcoins are also expected to rally as BTC moves to the upside.

Before now, CryptoCon had already assured that the bull cycle wasn’t over despite the crypto market facing the largest liquidation event in this cycle, with over $2 billion wiped out from the market.

BTC’s Trend Remains Uncertain For Now

While the Bitcoin price could rally to $160,000 in the next thirty days, crypto analyst Ali Martinez has stated that BTC’s trend direction in the short term remains uncertain. He noted that the flagship crypto is consolidating between $90,900 and $108,500. The analyst added that the trend remains uncertain until there is a clear breakout beyond this range.

However, crypto analyst Kevin Capital suggested that the Bitcoin price could soon record a massive bounce to as high as $111,000, marking a new all-time high (ATH) for the flagship crypto. He noted that all the major liquidity on the monthly heatmap is to the upside towards this $111,000 price level. The analyst added that this cannot be ignored, especially after a massive capitulation. He further remarked that he would be shocked if BTC didn’t grab this liquidity and head lower.

At the time of writing, the Bitcoin price is trading at around $97,800, down over 1% in the last 24 hours, according to data from CoinMarketCap.