The post Bitcoin Price Analysis: Key Trends Before the US Election appeared first on Coinpedia Fintech News

Bitcoin sent waves of excitement when it touched $73k closing October. However the shift in winning odds of Trump acted as a great resistance and rejected the price support. Let’s dive deeper into the charts and try to understand what could happen with Bitcoin and its investors.

Short-Term Insights: A Mixed Bag

The short term trend of Bitcoin is positive however, there are some warnings not to be ignored. Currently, it is trading at $68,640 with a nearest resistance at $69,000. This could force the price to any of the directions depending on the traders present in the market.

Bitcoin has recently witnessed a noticeable dip in the momentum. The MACD line crossed below the Signal line showing that sellers are leading. The RSI has also fallen from 79 points to 54. This is a clear sign that the positive momentum is losing stream. In the last 24 hours, 101,433 traders were rekt. A total of $229.17 million worth of crypto funds was liquidated. Most of this came from long positions. This is a matter of cautiousness for investors.

Medium-Term Outlook: Caution Ahead

Looking at the medium-term picture, Bitcoin’s story becomes a bit more complex. It did break above $67,241, which is usually a good sign and could mean prices might reach up to $84,547. But, the drop below $71,000 raised red flags, hinting that further declines could be on the table. Trading volume has also been weak during these moves, which doesn’t add much confidence.

Experts rate Bitcoin as negative in the medium term. This means that while a jump is possible, traders should be ready for sudden moves either way over the next few months.

What to Expect Next

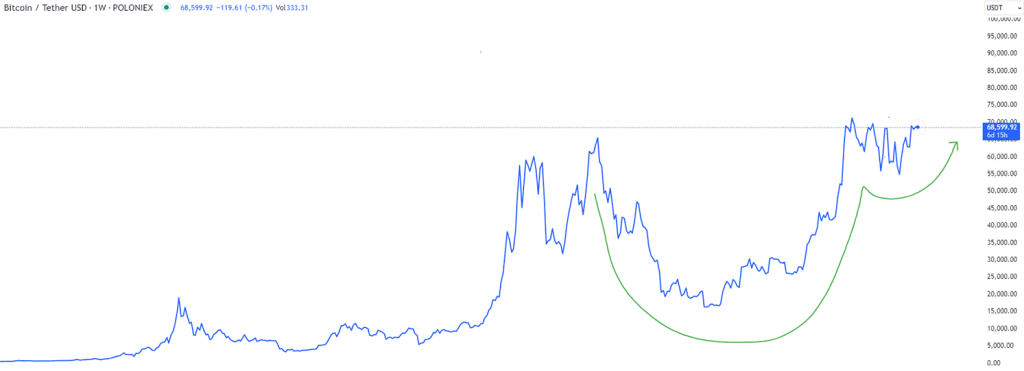

Long-term, the outlook seems brighter. Bitcoin is still in a rising trend channel, which suggests optimism among investors. A strong move above $67,241 could set the stage for prices to head even higher, potentially past $84,000. There’s even a cup-and-handle pattern forming on the weekly charts, which some see as a bullish sign pointing to $100,000. But if the break below $71,000 holds, more declines might come.

With the U.S. election close, market conditions could shift quickly. New policies could affect investor confidence and Bitcoin’s short-term direction. While short-term trends show uncertainty, long-term indicators still hint at growth.

For now, keeping an eye on market updates is key. Bitcoin’s journey could take interesting turns, especially as election results unfold.