A popular crypto analyst has explained how the Bitcoin price could be at risk of further downside based on the current distribution of BTC supply around the price.

This Bitcoin Price Range Holds A Critical Supply Barrier

In a recent post on the X platform, prominent crypto pundit Ali Martinez discussed how the price of Bitcoin could suffer more decline. The rationale behind this bearish projection revolves around the average cost basis of several BTC investors.

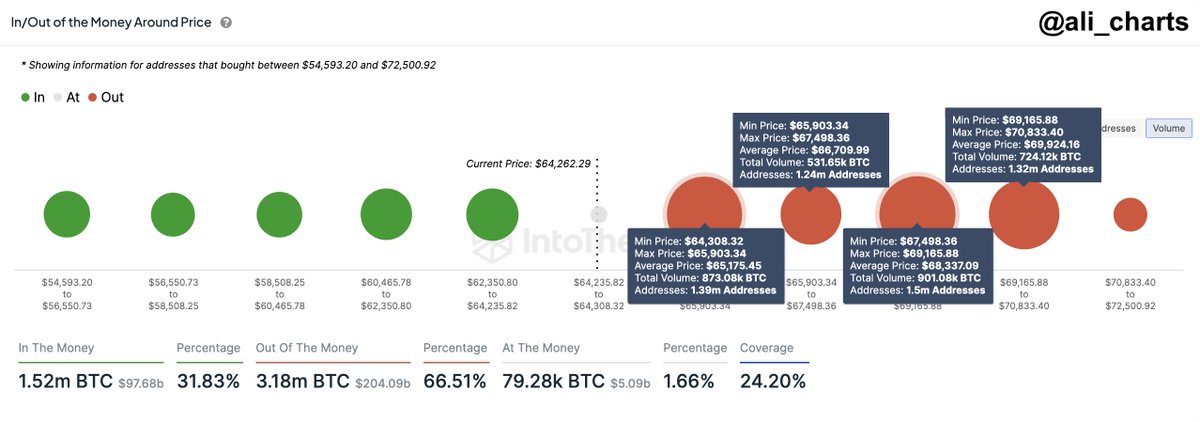

Data from IntoTheBlock shows that around 5.45 million addresses purchased approximately 3.03 million BTC within the price range of $64,300 and $70,800. As highlighted by Martinez, this has led to the formation of a crucial supply barrier within this price bracket.

For context, a supply barrier refers to a price range where a large amount of cryptocurrency was acquired. From the size of the dots in the graph below, it appears that Bitcoin currently has a significant supply barrier above it.

This price range becomes especially relevant when the Bitcoin price falls below this level, as BTC holders within the supply barrier might start selling in order to cut their losses. This could lead to intensified selling pressure and potentially steeper price correction for the premier cryptocurrency.

Furthermore, a large-scale offloading and continuous price decline could negatively influence the market sentiment, triggering panic selling amongst other investors. If the selling pressure is significant, this could add to the downward pressure on the price of BTC.

As of this writing, the Bitcoin price stands around $64,460, reflecting a mere 0.2% increase in the past 24 hours.

Bitcoin Miners Are Capitulating

Typical investors might not be the only class of participants contributing to the selling pressure facing the Bitcoin price at the moment. The latest on-chain revelation shows that the Bitcoin miners have also been active in the market in recent weeks.

According to data from IntoTheBlock, Bitcoin miners have offloaded more than 30,000 BTC (valued at approximately $2 billion since June). This represents the fastest rate of decline in BTC miners’ reserves in over a year.

The blockchain analytics pegged this sell-off to the reduced profitability of the miners following the recent halving event. The fourth halving event, which occurred in April 2024, saw the miner’s reward fall from 6.25 BTC to 3.125 BTC.