According to a recent CryptoQuant Quicktake post, while Bitcoin (BTC) has seen a steady rise in price from November 2024 to February 2025, sentiment in the cryptocurrency’s futures market has not shown a corresponding uptick.

Bitcoin Futures Sentiment Index Signals Caution

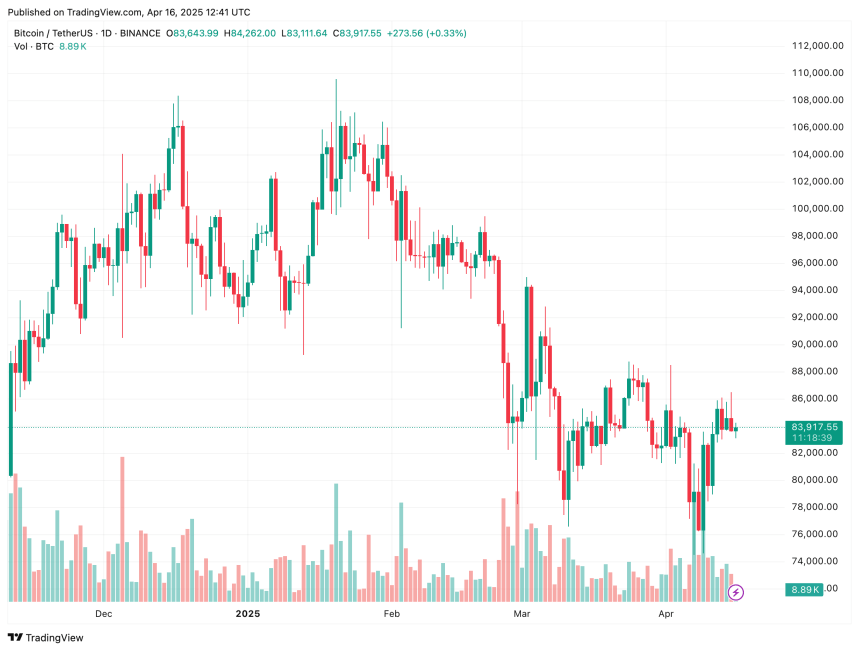

Bitcoin’s price surged from approximately $74,000 in November 2024 to a peak of $101,000 by early February 2025. However, following US President Donald Trump’s tariff announcements, risk-on assets – including BTC -have experienced a significant pullback.

After hitting a potential local bottom of $74,508 earlier this month on April 6, the apex cryptocurrency has recovered some of its recent losses. The top digital asset is trading in the mid $80,000 range at the time of writing.

Despite this recovery, BTC’s futures sentiment has continued to decline since February. Even as the price holds near local highs, sentiment in the futures market has notably cooled.

CryptoQuant contributor abramchart highlighted this divergence, noting that it could indicate increasing caution or profit-taking behavior despite the ongoing bullish trend. The analyst commented:

This indicates a cooling interest or increased fear in the futures market, possibly due to macroeconomic uncertainty, regulatory concerns, or expected corrections.

A look at the BTC futures sentiment index shows a resistance zone around 0.8 and a support level near 0.2. The index is currently hovering around 0.4, pointing to a predominantly bearish sentiment across futures markets.

Similarly, Bitcoin’s average price has steadily declined from its early 2025 highs. It is now ranging between $70,000 and $80,000, signalling possible market indecision amid heightened tariff tensions.

According to abramchart, if futures sentiment remains low, BTC could face extended price consolidation or even downward pressure in the near term. However, any emerging bullish catalyst could quickly shift the sentiment and renew upward momentum.

Is BTC Close To A Momentum Shift?

Some analysts believe Bitcoin may be nearing a breakout. After consolidating in the mid-$80,000s for several weeks, on-chain metrics suggest BTC may be undervalued at current levels. Indicators such as BTC exchange reserves and the Stablecoin Supply Ratio support this view.

In addition, momentum indicators like Bitcoin’s weekly Relative Strength Index have begun to break out of a long-standing downward trendline – raising hopes for a potential bullish rally back toward $100,000.

However, several risks still remain. The recent appearance of a ‘death cross’ on BTC’s price chart – combined with persistent macroeconomic concerns related to trade tariffs – could still weigh heavily on market sentiment. At press time, BTC trades at $83,917, down 1.8% over the past 24 hours.