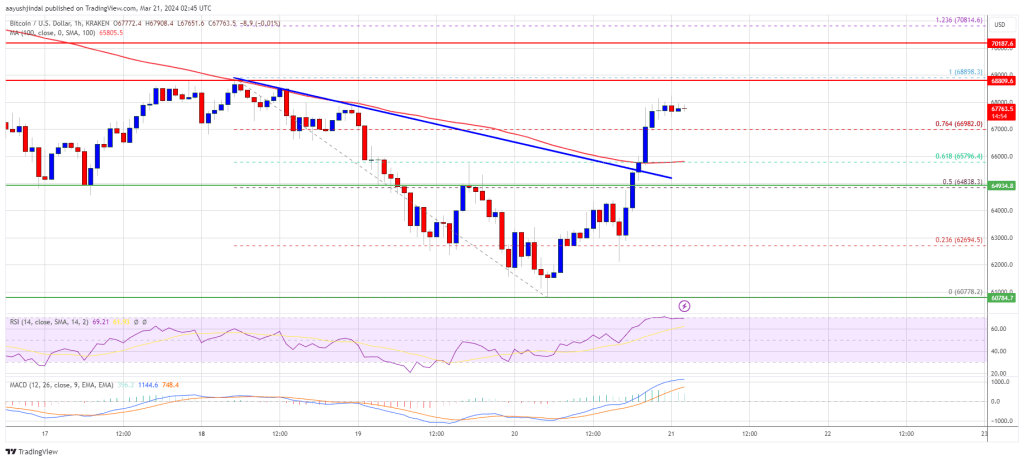

Bitcoin price started a strong recovery wave from the $60,800 zone. BTC is up nearly 10% and now facing hurdles near the $68,800 resistance.

- Bitcoin price started a decent increase from the $60,800 support zone.

- The price is trading above $64,500 and the 100 hourly Simple moving average.

- There was a break above a key bearish trend line with resistance at $65,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair must clear the $68,800 resistance zone to start a fresh uptrend.

Bitcoin Price Recovers 10%

Bitcoin price extended its decline below the $62,500 zone. BTC even spiked below the $61,200 level before the bulls appeared near $60,800. A low was formed near $60,778 and the price is now moving higher.

There was a decent increase above the $63,000 and $64,000 resistance levels. The price even cleared the 50% Fib retracement level of the downward move from the $68,898 swing high to the $60,778 low. There was a break above a key bearish trend line with resistance at $65,000 on the hourly chart of the BTC/USD pair.

Bitcoin is now trading above $64,500 and the 100 hourly Simple moving average. It is also above the 76.4% Fib retracement level of the downward move from the $68,898 swing high to the $60,778 low.

Source: BTCUSD on TradingView.com

Immediate resistance is near the $68,000 level. The first major resistance could be $68,800. If there is a clear move above the $68,800 resistance zone, the price could continue to gain strength. In the stated case, the price could even clear the $70,000 resistance zone in the near term. The next key resistance sits at $72,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $68,800 resistance zone, it could start another decline. Immediate support on the downside is near the $66,800 level.

The first major support is $65,500. The next support sits at $64,800. If there is a close below $64,800, the price could start a drop toward the $63,000 level. Any more losses might send the price toward the $62,500 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 60 level.

Major Support Levels – $65,500, followed by $64,800.

Major Resistance Levels – $68,000, $68,800, and $70,000.