Bitcoin price was able to clear the $44,500 and $44,700 resistance levels. BTC is up over 5% and might soon attempt a move toward $48,000.

- Bitcoin is gaining pace above the $45,500 resistance zone.

- The price is trading above $45,000 and the 100 hourly Simple moving average.

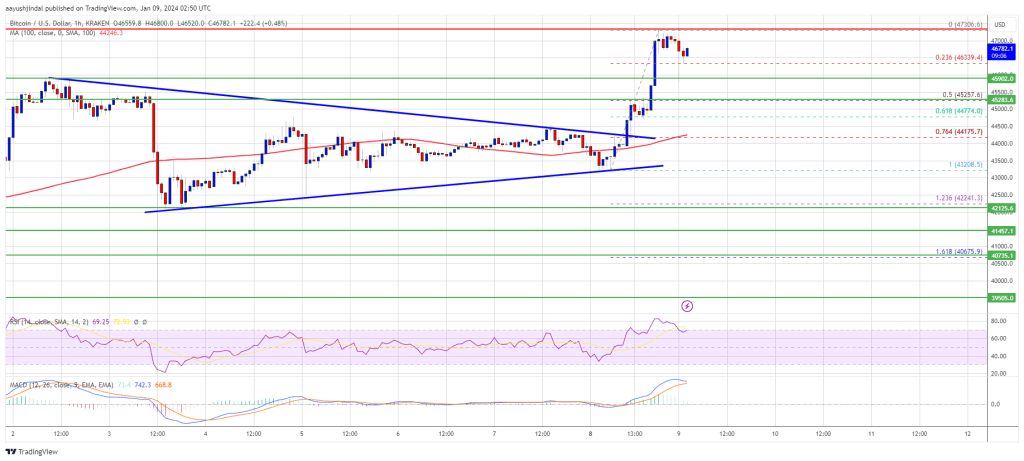

- There was a break above a key contracting triangle with resistance near $44,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to move up toward the $48,000 level unless there is a close below $44,000.

Bitcoin Price Starts Fresh Increase

Bitcoin price started a fresh increase above the $43,500 resistance zone. BTC gained bullish momentum above the $44,000 and $44,500 levels to move into a positive zone.

There was a break above a key contracting triangle with resistance near $44,000 on the hourly chart of the BTC/USD pair. The bulls pumped the price to a new multi-day high at $47,306 and the price is now consolidating gains.

Bitcoin is now trading above $45,000 and the 100 hourly Simple moving average. It is also above the 23.6% Fib retracement level of the upward move from the $43,208 swing low to the $47,306 high.

On the upside, immediate resistance is near the $47,000 level. The first major resistance is $47,200. A clear move above the $47,200 resistance could send the price toward the $48,000 resistance. The next resistance is now forming near the $48,800 level.

Source: BTCUSD on TradingView.com

A close above the $48,800 level could send the price further higher. The next major resistance sits at $49,250. Any more gains above the $49,250 level could open the doors for a move toward the $50,000 level.

Another Drop In BTC?

If Bitcoin fails to rise above the $47,200 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $46,400 level.

The next major support is near $45,900. If there is a move below $45,900, the price could gain bearish momentum. In the stated case, the price could drop toward the $45,250 support or the 50% Fib retracement level of the upward move from the $43,208 swing low to the $47,306 high in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $46,400, followed by $45,250.

Major Resistance Levels – $47,000, $47,200, and $48,000.