The crypto market has recently seen some ups and downs, with Bitcoin facing many fluctuations. According to a recent post by a CryptoQuant analyst known as ‘Kripto Mevsimi,’ the Bitcoin Market Value to Realized Value (MVRV) ratio has dipped below its 365-day moving average.

This specific indicator often identifies potential market bottoms and zones where recovery could begin. While the drop in MVRV could suggest an “opportunity for long-term investors,” the analyst warns that caution is needed.

Bitcoin Will Recover If Its MVRV Does This

The MVRV (Market Value to Realized Value) ratio is a metric used in cryptocurrency to assess whether an asset, like Bitcoin, is overvalued or undervalued relative to its “realized value.”

Market Value refers to the asset’s current price multiplied by its total circulating supply, essentially the market capitalization.

Realized Value is calculated by summing the value of each coin at the price it was last moved on-chain, giving a picture of what the network participants paid for their holdings.

According to Mevsimi, historically, when the Bitcoin MVRV ratio breaks back above its 365-day average, it has been followed by a renewed sense of optimism in the market, often signaling the start of a “more sustainable upward trend.”

However, the current economic environment, marked by ongoing macroeconomic uncertainties, suggests that Bitcoin’s recovery could take longer.

In the meantime, the analyst advises investors to maintain a balanced outlook, noting:

Therefore, maintaining a measured and balanced perspective is essential. A positive outlook is understandable, but it should be tempered with awareness of the broader risks until the MVRV ratio confirms a more sustained upward momentum.

Buy Signal Identified In BTC

Meanwhile, Despite the current state of the MVRV ratio, Bitcoin’s price has shown some signs of recovery in as of today. After briefly dipping below the $58,000 mark earlier in the day, the asset has reversed its trajectory, gaining 1.2% to reach a price of $58,463 at the time of writing.

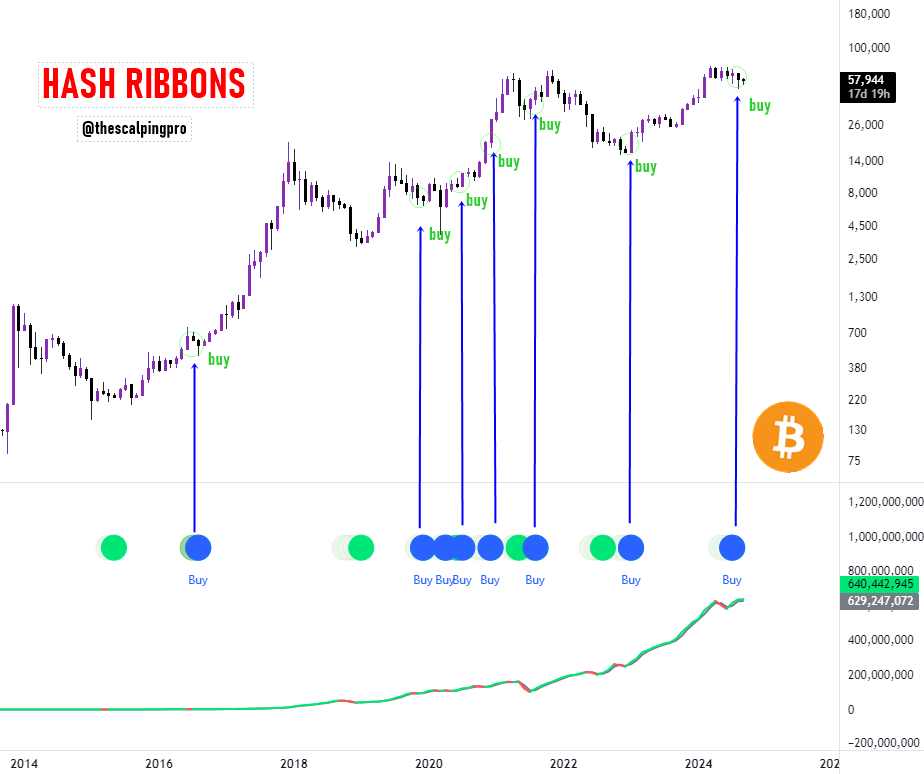

Crypto analyst Mags took to X to highlight a key bullish signal: the Bitcoin hash ribbon. According to Mags, the Bitcoin hash ribbon indicator has flashed a buy signal, historically one of the “most reliable” indicators for Bitcoin’s price movement.

Mags mentioned that every time this signal appeared, it was followed by a significant price surge, giving traders reason to believe that Bitcoin could see a bullish breakout soon.

#Bitcoin – hash ribbon flashed a buy signal.

Historically, this has been one of the most reliable indicators for Bitcoin.

Every time we’ve seen this signal, it’s often followed by a massive pump in BTC! pic.twitter.com/hXFLkTKXTH

— Mags (@thescalpingpro) September 13, 2024

Featured image created with DALL-E, Chart from TradingView