According to Goldman Sachs, Bitcoin (BTC) price appreciation in 2024 failed to compensate for its price volatility risks. Meanwhile, gold’s higher risk-adjusted returns reaffirmed its “safe haven” narrative.

Despite The Gains, Bitcoin Fails To Outshine Gold

The leading digital asset by reported market cap surged from roughly $42,000 at the beginning of the year to as high as $73,000 in March 2024, recording more than 73% gains. At its current market price of $62,790, BTC is still more than 40% up from its price in January 2024.

Notably, throughout 2024, Bitcoin has consistently outperformed major equity indices, fixed-income instruments, gold, and crude oil.

However, according to data tracked by Goldman Sachs, despite BTC’s impressive gains, its price performance in absolute terms fails to compensate for its volatility.

The analysis by Goldman Sachs puts BTC’s year-to-date (YTD) volatility ratio at just under 2%. In comparison, gold gave a risk-adjusted return of 3%, posting strong 28% gains in absolute terms.

For the uninitiated, the volatility ratio measures the return an asset generates for each unit of risk or volatility it carries. A higher ratio indicates that an asset provides better returns relative to the risk taken, while a lower ratio suggests less efficient performance.

The analysis notes that Bitcoin’s volatility ratio was only better than Ethereum’s native ETH token, S&P GSCI Energy Index, and Japan’s TOPIX index among the non-fixed income growth-sensitive investments.

Bitcoin’s low volatility ratio compared to gold cements the latter’s claim as a “safe haven asset.” This came under the limelight last week when BTC slumped, and gold surged following Iran’s offensive against Israel.

Still A Long Way To Go For Bitcoin

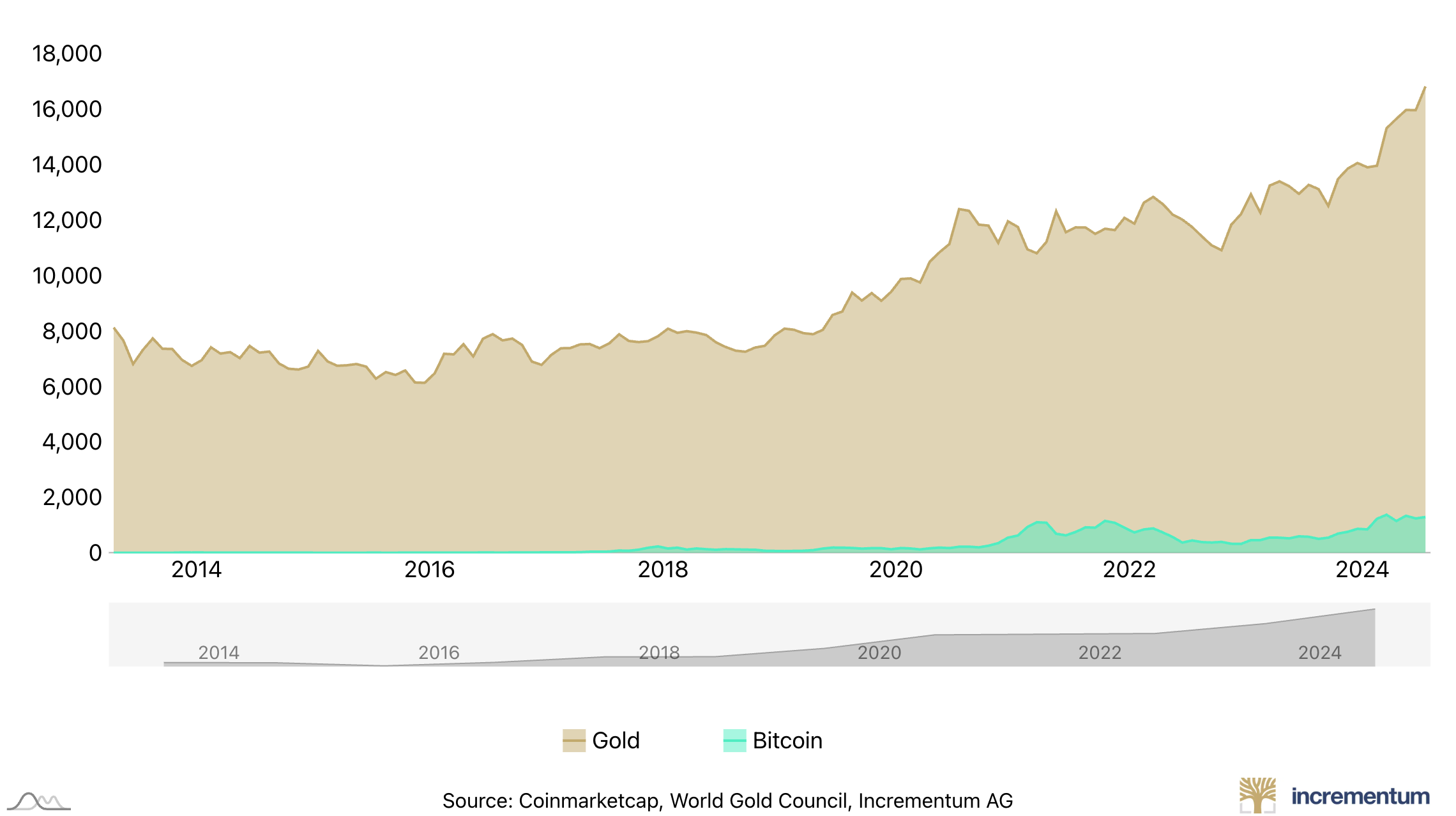

Since its inception following the 2008 financial crisis, Bitcoin’s ascent to a trillion-dollar market cap asset has been remarkable.

The fixed supply of 21 million, decentralized network architecture, and halving every four years make BTC an appealing asset. However, the market cap gap between Bitcoin and gold remains vast.

That said, several crypto analysts are confident that Bitcoin will outperform the shining metal in the coming years. For instance, seasoned analyst Peter Brandt recently made an ambitious prediction that by 2025, BTC could see its price jump 400% relative to gold.

Similarly, in August 2024, VanEck CEO Jan van Eck stated that BTC could surge to $350,000 on the back of greater adoption.

Most recently, investment management firm BlackRock declared Bitcoin a “gold alternative” due to its fixed supply and increasing investor confidence in its ability to tackle inflation and avoid value erosion during uncertain times.

On the contrary, billionaire Ray Dalio has expressed his opinion on the Bitcoin vs. gold narrative, saying that BTC will never fully replace gold. BTC trades at $62,790 at press time, down 2.3% in the last 24 hours.