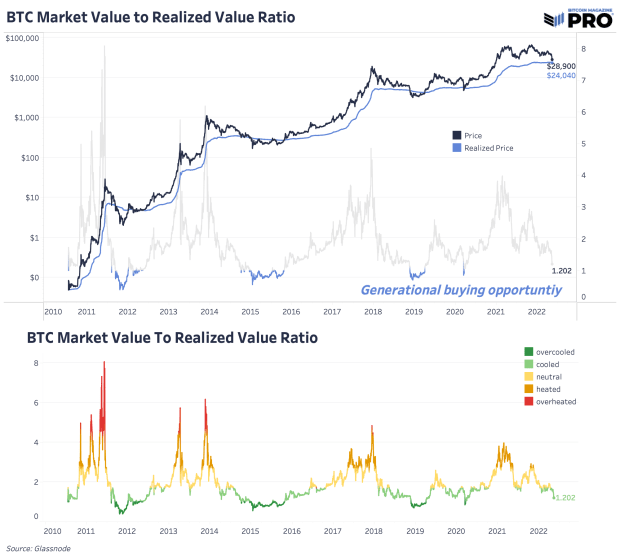

The realized price of bitcoin is around $24,000 and a lack of long-term holder capitulation means there is potentially more downside to come.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In a previous issue, we highlighted that based on the level of realized losses, unrealized losses and capitulation trends in the past, we had yet to see a bear case capitulation play out:

“The key on-chain price areas to watch are still those that make up the cost basis. Currently the market’s realized price is around $24,000 while long-term holders realized price is around $17,000. As short-term holders realize losses, short-term holders realized price has dropped to around $48,000. If we’re to get the long-term holder market capitulation we’ve seen in the past, there’s potentially more downside to come.”

Today, as bitcoin hovers above a critical $28,000 price and technical level, we’ve yet to see major capitulation play out in the broader equities market as bitcoin reaches its all-time highest equity market correlations. The bitcoin bottom will likely come with a broader risk-on asset bottom and will depend on the reversal of tightening financial conditions and fleeting liquidity.

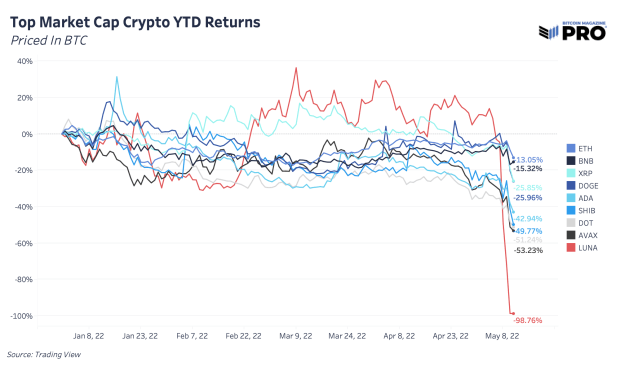

Capitulation-like sell-offs across broader cryptocurrencies, in BTC terms, played out over the last few days with Luna losing 98.76%. High-beta investments relative to bitcoin are getting crushed year-to-date and especially this week as second-order effects of the Terra (UST) blowup ripple through the market. Whether it’s a repricing of protocol risks, forced selling, liquidations and/or damage control from UST and LUNA exposure, the entire market is selling off much worse than bitcoin.

Although bitcoin was hit in the larger sell-off across the market, all other crypto assets were hit much harder, as shown by the chart above which is using BTC as the benchmark. It is also worth noting that if 2022 brings an extended period of consolidation/bear market price action, the fully diluted market cap of many altcoins is much larger as a percentage of market cap today (i.e., further inflation/dilution of the asset). Monetary properties matter over the long run, which is why we remain laser-focused on the prospects of bitcoin and choose to dismiss other “projects” in the crypto space.

Subscribe to access the full Bitcoin Magazine Pro newsletter.