On-chain data from Santiment suggests the latest Bitcoin rally may have been fueled by USD Coin (USDC) shifting into the cryptocurrency.

USD Coin Shark And Whale Addresses Have Declined Recently

According to data from the on-chain analytics firm Santiment, USDC whale and shark addresses have gone down by almost 8% in the last two months. The relevant indicator here is the “Supply Distribution,” which tells us the total number of addresses that belong to each wallet group in the market right now.

The wallet groups here are divided based on the number of USDC tokens that they are holding currently. For example, an address that’s holding five coins will be included in the 1-10 coins group.

If the Supply Distribution metric is applied to this particular group, it will measure, among other things, the total number of addresses on the network whose balances fall inside this coin range.

Now, in the context of the current discussion, the wallet groups of interest are the ones covering the 100,000-100 million coins range.

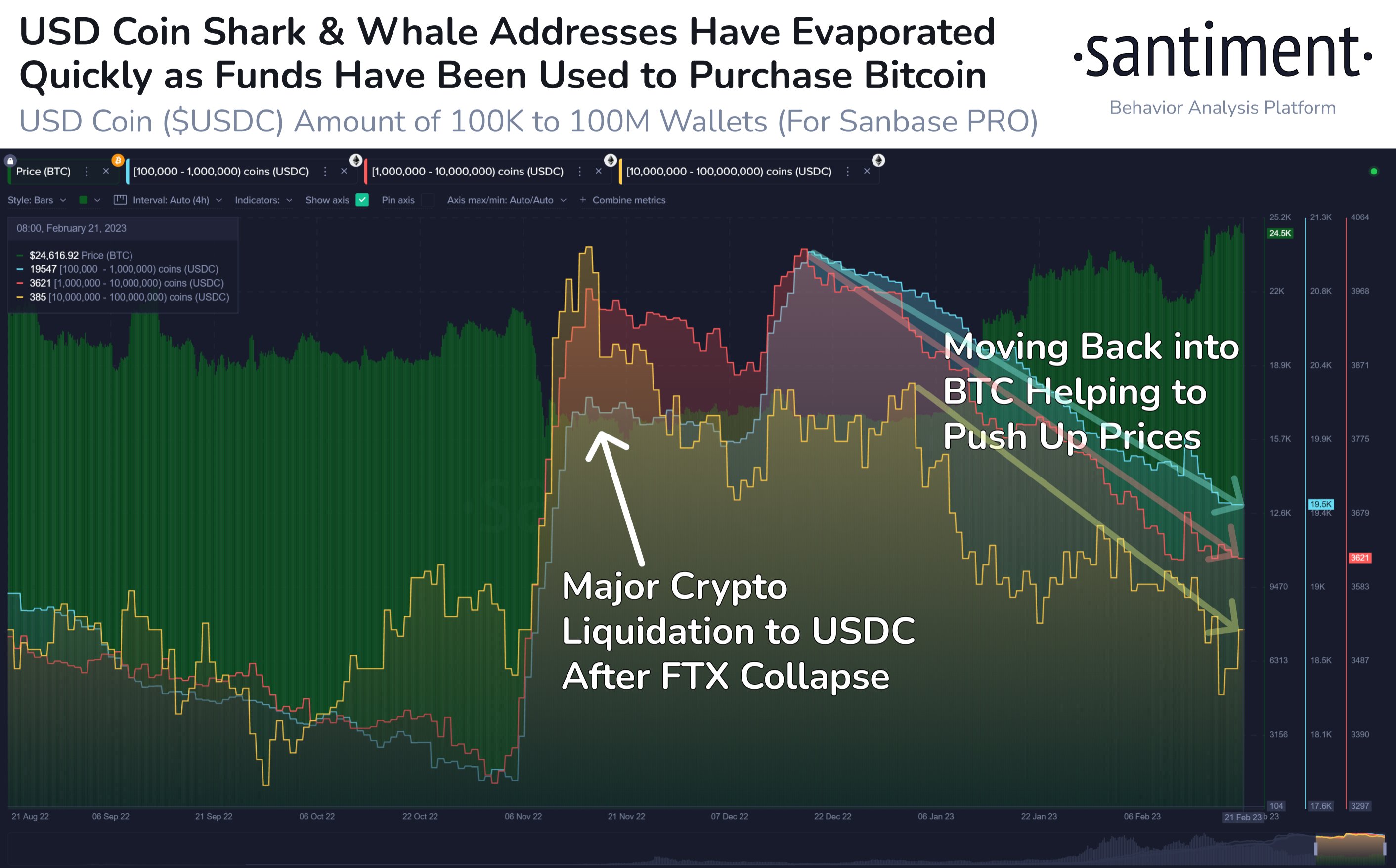

Here is a chart that shows the trend in the Supply Distribution data for the three address cohorts that make up this range over the last few months:

The significance of this coin range is that it includes two important USDC cohorts called the sharks and whales. As shown in the graph, the wallet groups that cover these investors had seen a rapid increase in their total addresses when the FTX collapse took place back in the November of 2022.

The reason behind this rise was that investors cashed out of cryptocurrencies like Bitcoin into the stablecoin as the crash occurred. In the last couple of months, however, the metric looks to have been going down instead.

In total, these three wallet groups have lost around 2,001 addresses, which represents a decrease of about 7.8%. This suggests that these sharks and whales have been leaving the stablecoin in this period, possibly for other cryptocurrencies like BTC.

Generally, investors use stables when they want to avoid the volatility that usually comes with the other assets in the sector. However, once they feel that the time is right to jump back into these volatile markets, they rotate back into their desired coins, thus applying buying pressure to them.

This buying pressure can naturally show up as a surge in the price of the cryptocurrencies that they have been shifting into. From the chart, it’s visible that since the USDC shark and whale addresses have started to trend down, Bitcoin has caught an upwards momentum.

A potential interpretation of this trend can be that the latest BTC rally has been, at least in part, fueled by the buying pressure applied by these USDC sharks and whales.

Bitcoin Price

At the time of writing, Bitcoin is trading around $24,000, up 6% in the last week.