Although traders are on edge due to the price behavior of Bitcoin, some analysts think a breakout is just around the corner.

One of the vocal supporters of Bitcoin is “Titan of Crypto,” who suggests that Bitcoin’s stochastic relative strength index (StochRSI) is about to signal a major move. Could BTC be about to start a fresh climb as institutional interest grows and technical signals line up?

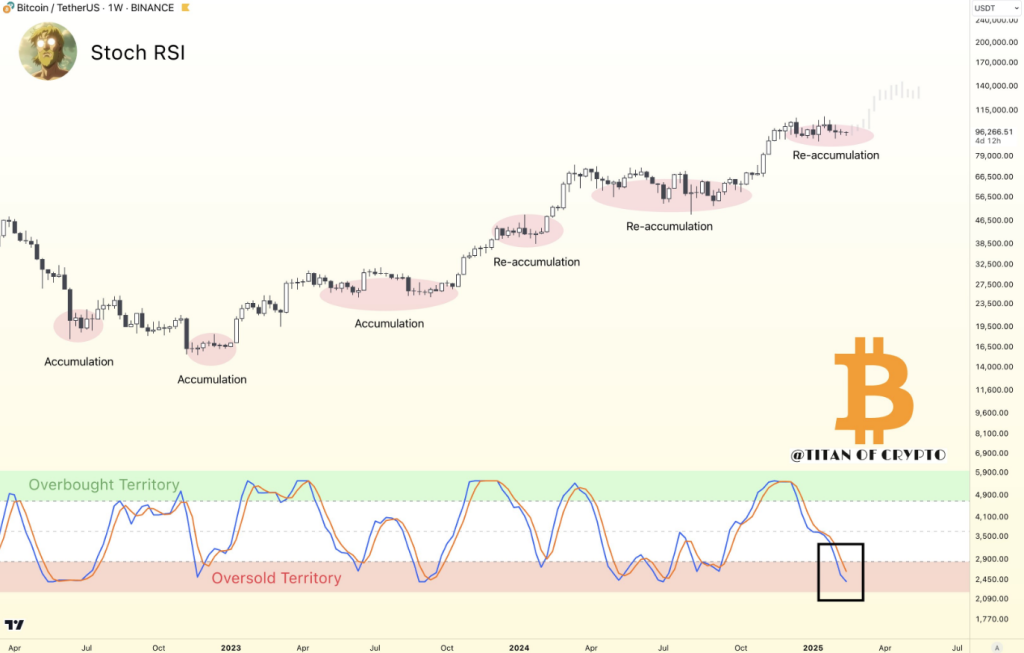

Bitcoin: Strong Reversal From StochRSI Signals

Titan of Crypto claims that the weekly StochRSI of Bitcoin is in oversold zone, a situation that has always preceded notable positive reversals. Measuring momentum, this indicator points to BTC maybe preparing for a push higher. The analyst said:

“Bitcoin could be ‘about to take off.’”

The top crypto is currently trading around $96,910, marking a 1.36% increase from the previous session. Showing indications of increasing volatility, the intraday range has varied from $95,400 to $97,300. Should the StochRSI trend follow, BTC could bounce back to higher levels.

#Bitcoin About to Take Off?

#BTC has entered oversold territory on the weekly Stoch RSI, a signal often marking accumulation or re-accumulation. pic.twitter.com/DHyEKXT31E

— Titan of Crypto (@Washigorira) February 19, 2025

Institutional Demand Still Remains Strong

Institutional engagement is one of the main elements showing great promise for Bitcoin. Well-known for its aggressive acquisition of the crypto, Strategy (previously MicroStrategy) has revealed intentions to purchase more Bitcoin by means of $2 billion raised via convertible notes. This action underscores mounting belief in the long-term value proposition of Bitcoin.

Bitcoin ETFs, with total assets amounting to $120 billion, have garnered substantial inflows. Due to the popularity of these investment products, which has strengthened their standing in the financial markets, organisations now have easier access to the most widely utilized digital asset globally.

BTCUSD trading at $96,980 on the 24-hour chart: TradingView.com

Market Contradictions Raise Questions

Despite hopeful signals, not everyone thinks Bitcoin will boom soon. Crypto stocks underperform conventional stocks, say some experts. BTC remains below its January peak, suggesting market uncertainty despite the S&P 500’s highs.

Recent Bitcoin price swings indicate investor uncertainty. Despite positive macro indications, bitcoin has stalled, sparking some reservations regarding its next trajectory.

Bitcoin’s Next Move: Breakout Or Consolidation?

Bitcoin’s future is still hotly debated given institutional investors’ ongoing curiosity and technical signals pointing to a probable breakout. Should previous trends hold, the market might be about to experience an extraordinary climb. Macroeconomic events and investor mood will eventually, however, decide whether BTC can maintain a breakout or keep trading sideways.

Right now, everyone’s focused on the next technical confirmation for Bitcoin. Will the bulls take over, or will doubt help to control prices? For the biggest cryptocurrency in the world, the next weeks could be crucial.

Featured image from Gemini Imagen, chart from TradingView