Onchain Highlights

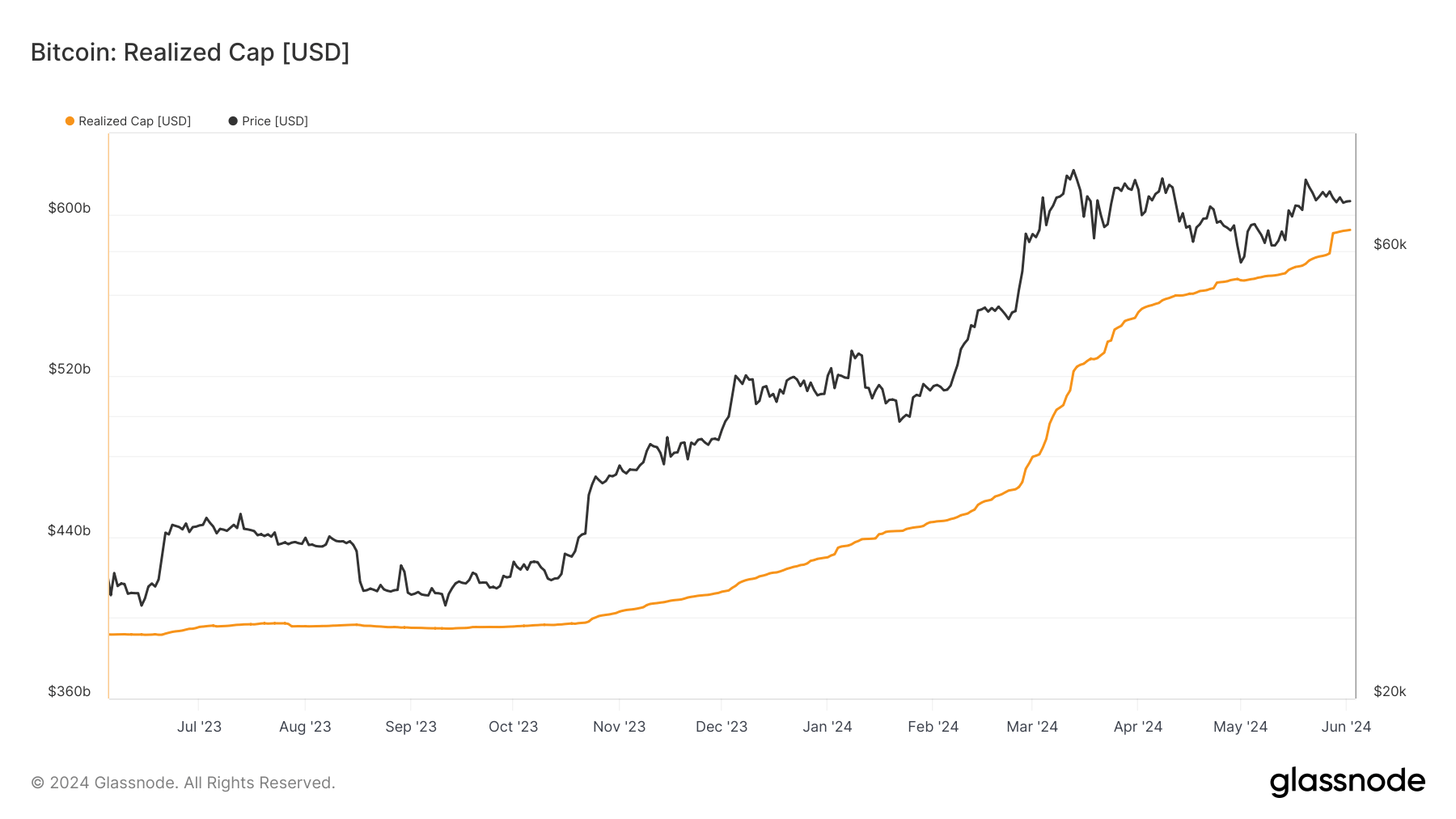

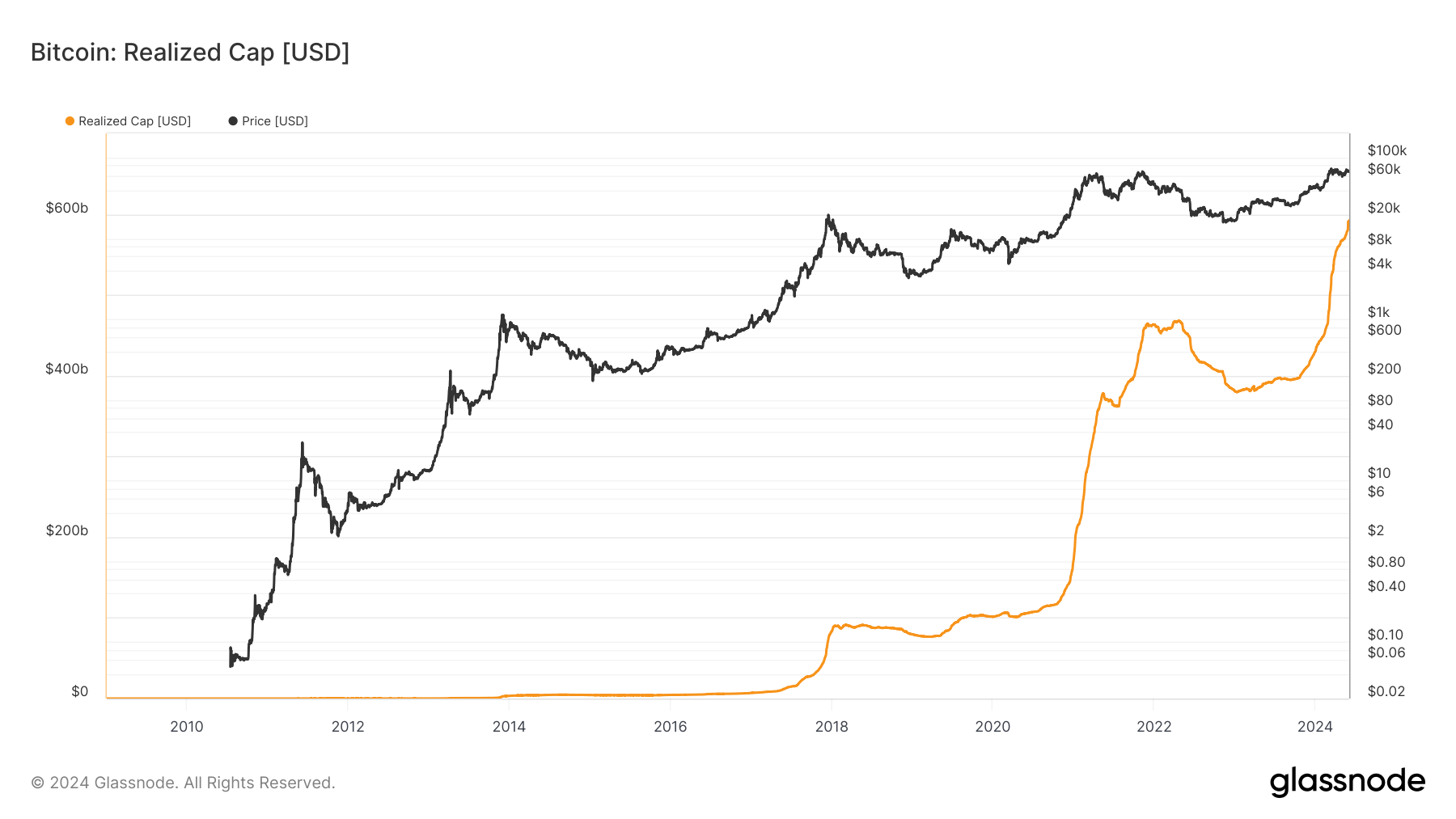

DEFINITION: Bitcoin’s realized cap highlights the Realized Cap values of different parts of the supplies at various prices (instead of using the current daily close). Specifically, it is computed by valuing each UTXO by the price when it was last moved.

Bitcoin’s realized cap has shown substantial growth, approaching $600 billion, reflecting the increased investor confidence post-2024 halving. The realized cap metric offers a nuanced valuation by accounting for the price at which each Bitcoin last transacted, providing a more accurate measure than market cap, which is susceptible to price fluctuations of inactive coins.

Recent data highlights a surge in realized profits, peaking at $3.3 billion in early April, signaling significant profit-taking by investors. Despite these sell-offs, the overall market trend indicates accumulation within 2024, suggesting a robust underlying demand for Bitcoin. This dynamic emphasizes the market’s resilience amidst short-term volatility.

The realized cap also serves as an indicator of market sentiment, where its growth often aligns with increased on-chain activity and investor optimism. This can be contrasted with periods of drawdowns, such as the 18.9% decline during the 2022/23 bear market, which marked the second-worst realized cap drawdown in Bitcoin’s history.

As investors navigate the post-halving landscape, monitoring the realized cap offers critical insights into the capital flow and market valuation trends of Bitcoin, shaping future market strategies.

The post Bitcoin realized cap approaches $600 billion, signals rising investor confidence post-halving appeared first on CryptoSlate.