Heightened bearish pressure continues to hinder Bitcoin, causing its price to drop as low as $89,000 Today after a recent attempt to recover the pivotal $100,000 mark. With the current decline in price, many investors are witnessing significant losses in their BTC investments, increasing the likelihood of a sell-off.

A Persistent Decrease In Bitcoin’s Realized Losses

Bitcoin’s price recently experienced a notable decline considered to be triggered by broader market volatility. Following the pullback, on-chain expert and author Axel Adler Jr outlined a negative trend in BTC’s market dynamics as investors face mounting losses in their positions.

This constant loss highlights the ongoing struggle for BTC to maintain and regain upward momentum. Furthermore, it suggests that many investors are either holding at a loss or selling at a loss, reflecting weak market sentiment and potential capitulation. As BTC’s price fails to hold key support levels, investors’ losses may grow larger, which could lead to huge selling pressure in the short term.

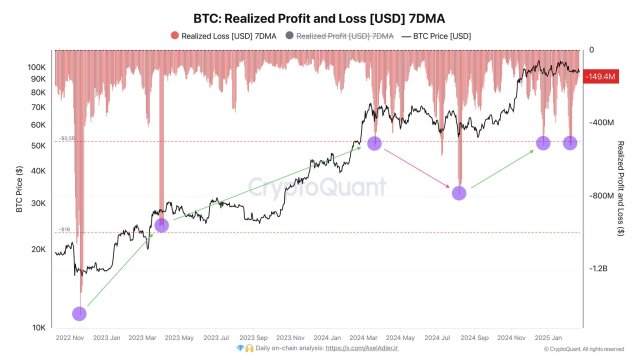

Axel Adler revealed a persistent rise in realized losses after examining the Bitcoin Realized Profit and Loss Metric in the 7-day time frame. However, the expert noted that the magnitude of these losses is far less than it was during the panic sell-offs in late 2022.

Given that the losses are lower compared to 2022, this points to a more stable market structure for Bitcoin, where investors are selling more carefully and some are not in a haste to exit at any price.

Even though realized losses are increasing, on-chain data shows that the total realized losses are still at a moderate level. Such development indicates an overall positive attitude and consistent demand for BTC amidst unfavorable market conditions. If the current pattern continues, even periodic increases in loss-taking sales are unlikely to change the general upward trend.

BTC’s net realized profit/loss metric has managed to stay flat and at its lows despite the recent hack carried out on the Bybit crypto exchange. While the development influenced Bitcoin’s price, Negentropic highlighted that the hack only stalled its push to $100,000, which caused its value to decline to the $95,000 level.

In the meantime, the key liquidity zone is still at the $92,000 mark. Should the realized loss surge, Negentropic believes that the formation of a bottom will be more strongly confirmed.

BTC’s Price Gearing Up For A Breakout

In the past few days, BTC may have undergone waning performances, increasing the possibility of a further bearish move. However, Captain Faibik, a crypto expert has spotted an encouraging trend on the 1-day chart, suggesting that upside momentum is building.

Specifically, the expert has hinted at an impending breakout from the Falling Wedge chart formation. Once BTC successfully breaks out of the pattern, Captain Faibik is confident that the asset could rally toward the $105,000 crucial resistance level in the upcoming days.