The price of Bitcoin looked set to reclaim $100,000 on Friday, rallying on the back of the United States Securities and Exchange Commission’s (SEC) decision to drop the lawsuit against crypto exchange Coinbase. However, the premier cryptocurrency failed to capitalize on this momentum shift following the $1.4 billion exploit of the ByBit exchange.

With the Bitcoin price now hovering above $96,000, recent on-chain data suggests that certain volatility metrics are nearing historically low levels. Here’s how the latest volatility trend could impact the BTC price performance over the coming weeks.

Is A BTC Price Rally On The Horizon?

In a recent post on the X platform, crypto analytics firm Glassnode explained how two key volatility indicators nearing historically low levels could impact the Bitcoin price and its future trajectory. The two relevant metrics here are the 1-week “realized volatility” and “options implied volatility.”

For context, realized volatility (also referred to as historical volatility) measures how much the price of an asset (BTC, in this case) has changed over a specific period. Implied volatility, on the other hand, is a metric that assesses the likelihood of future changes in an asset’s price.

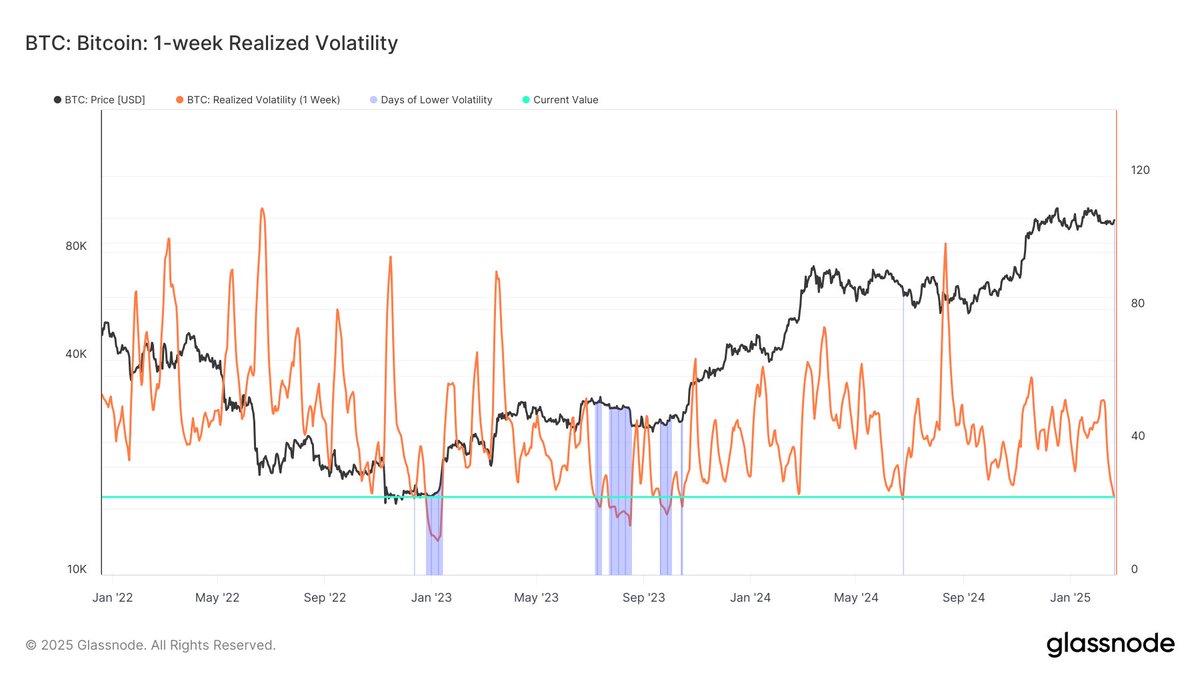

According to Glassnode data, Bitcoin’s 1-week realized volatility recently dropped to 23.42%. The on-chain intelligence firm noted that the metric’s current value is close to historical lows, as BTC’s realized volatility has only fallen beneath this level a few times in the past four years.

Notably, the 1-week realized volatility metric dropped to 22.88% and 21.35% in October 2024 and November 2024, respectively. These points have acted as bottoms, with the metric rebounding from this level in the past. From a historical perspective, such declines in realized volatility have preceded significant price movements, increasing the odds of a potential breakout – or even a correction.

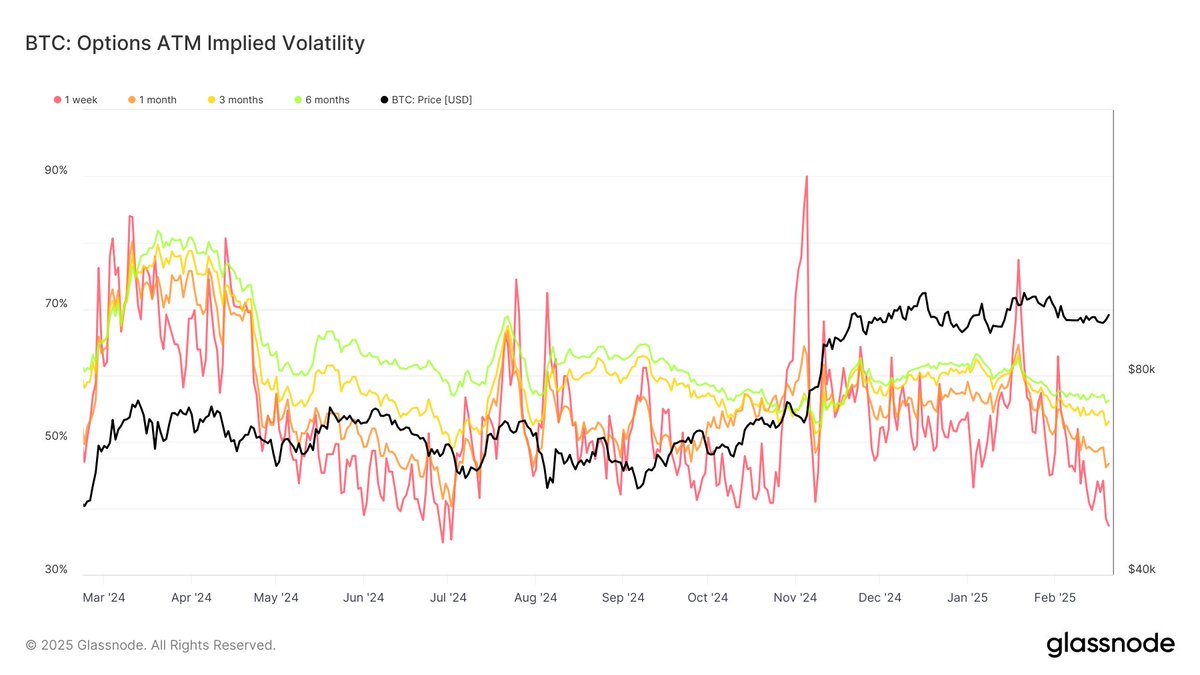

At the same time, Bitcoin’s 1-week options implied volatility has also experienced a significant decline to 37.39%. The indicator’s current level is close to multi-year lows — last seen in 2023 and early 2024. Similarly, the Bitcoin price witnessed substantial market moves the last time the implied volatility was around this level.

Moreover, it is worth noting that the longer-term options implied volatility is currently exhibiting a different trend. The 3-month implied volatility stands at around 53.1%, while the 6-month indicator is hovering at 56.25%. This suggests that market participants expect increased volatility over the coming months.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at roughly $95,340, reflecting an over 3% decline in the past 24 hours.