Bitcoin is trading near the $103,000 level following a highly bullish Friday that has energized the market. The recent surge has positioned BTC for a potential rally toward new all-time highs, with analysts closely monitoring its next moves. This renewed momentum comes after a significant breakout that many believe has cleared the path for further price appreciation.

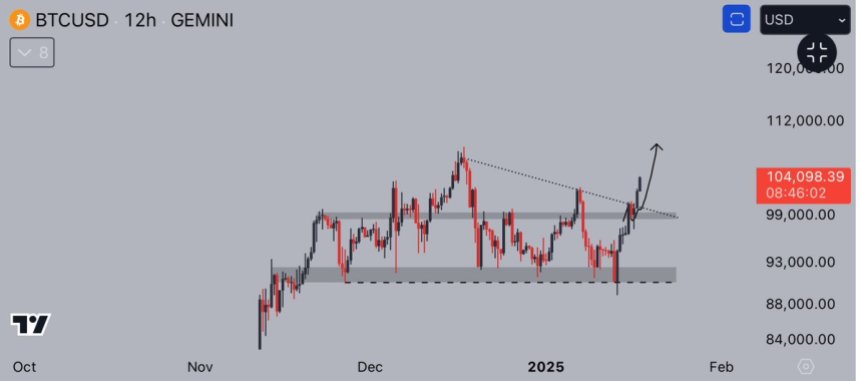

Top analyst Jelle has shared a technical analysis that highlights the bullish outlook for Bitcoin. According to Jelle, BTC now faces virtually no resistance following the recent breakout, suggesting that the cryptocurrency could be poised for a rapid ascent. This lack of overhead resistance is a rare and encouraging sign, bolstering investor confidence in Bitcoin’s ability to sustain its upward trajectory.

The coming days will be pivotal for Bitcoin as traders and investors look for confirmation of this bullish trend. If BTC continues to hold key support levels and build on its momentum, a rally to uncharted territory appears increasingly likely.

With market sentiment turning optimistic and technical indicators aligning, Bitcoin’s current position could mark the start of a transformative phase for the leading cryptocurrency. All eyes are now on BTC as it edges closer to rewriting its own history.

Bitcoin Enters A Key Phase

Bitcoin has officially entered a pivotal phase as it broke above the highly anticipated $100,000 mark, signaling the start of what many expect to be an explosive rally. This breakout has ignited widespread optimism among investors, who now believe BTC is on the verge of entering price discovery—a phase where it explores uncharted territory beyond its previous all-time high (ATH).

Top analyst Jelle recently shared a detailed technical analysis on X, emphasizing the significance of Bitcoin’s recent price action. According to Jelle, Bitcoin’s ability to reclaim critical supply levels has effectively cleared the last major resistance zones. With these levels now behind it, BTC faces virtually no resistance as it prepares to surge higher. Jelle also highlighted that the recent breakout aligns with broader market dynamics, adding further weight to the bullish narrative.

The next few days will be crucial as Bitcoin tests its newfound strength above the $100K level. Holding this psychological and technical support is essential for sustaining the rally. If BTC maintains its position above this threshold, the move into price discovery becomes almost inevitable, paving the way for rapid gains and new ATHs.

This bullish momentum comes at a time when market sentiment is overwhelmingly positive. Investors are positioning themselves for what could be one of Bitcoin’s most transformative periods yet. With fundamentals, technicals, and sentiment all pointing upward, Bitcoin is poised to lead the cryptocurrency market into a new era of growth. As the rally unfolds, the potential for unprecedented price levels underscores Bitcoin’s enduring role as the flagship of the crypto world.

BTC Prepares To Surge

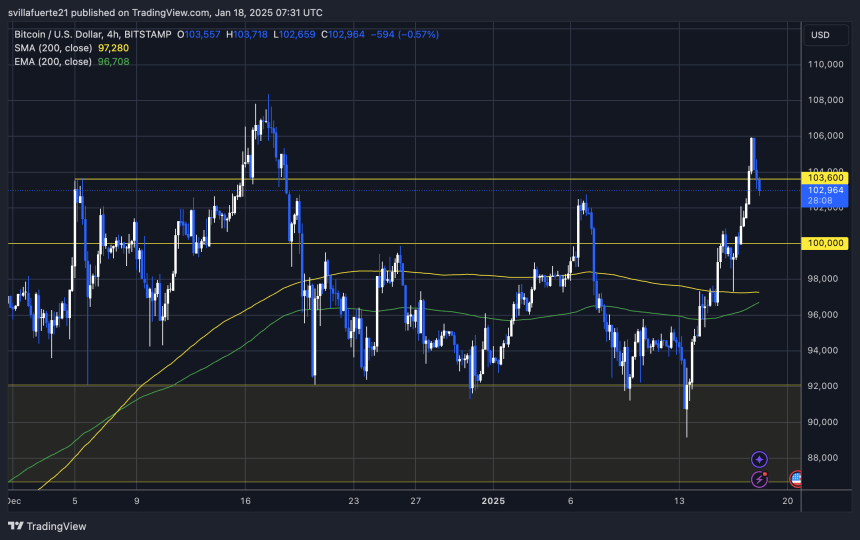

Bitcoin (BTC) is currently trading at $103,000, maintaining its bullish momentum after an impressive surge on Friday. The price is now holding above the previous local high, signaling strength as it tests demand in a former supply zone. This critical level has shifted from resistance to support, showcasing the market’s growing confidence in Bitcoin’s upward trajectory.

Analysts are optimistic that if BTC continues to hold above the $102,000 mark, a push toward new all-time highs (ATH) becomes inevitable. This level represents a strong foundation for the ongoing rally, and maintaining it would confirm short-term strength while supporting the long-term bullish trend. A decisive move above $103,000 would likely trigger heightened market activity, further fueling Bitcoin’s rally into price discovery.

However, losing the $102,000 level could lead to a period of consolidation. Such a pullback might delay Bitcoin’s ascent but could also provide an opportunity for the market to regroup before making another attempt at breaking ATH.

With Bitcoin now in a pivotal position, traders and investors are watching closely for confirmation of the next big move. Holding key support levels will be essential to sustaining the bullish momentum and keeping Bitcoin on track for its next major breakout.

Featured image from Dall-E, chart from TradingView