Data shows the Bitcoin Open Interest has seen a sharp jump alongside the latest recovery in the BTC price, a sign that may not be positive.

Bitcoin Has Recovered Back Above $105,000 During Past Day

Bitcoin kicked the week off with a crash towards the $98,000 mark, but it would appear that the cryptocurrency is moving toward a positive end to the week as it has now recovered back above the $105,000 level.

The below chart shows how the asset’s trajectory has looked over the last few days.

As is visible in the graph, Bitcoin even briefly broke above $106,000 earlier today, before retracing back to the current $105,700 level. Despite this pullback, BTC is up around 4% in the last 24 hours.

One question that’s now bound to be on the minds of the investors’ minds is: will this recovery be sustainable? There are many factors involved here, but one that might point to a negative outcome is the trend in the Open Interest.

BTC Open Interest Has Just Seen A Big Jump

As explained by CryptoQuant community analyst Maartunn in a new post on X, the Bitcoin Open Interest has seen some rapid growth alongside the latest rally in the cryptocurrency’s price.

The “Open Interest” here refers to an indicator that keeps track of the total amount of BTC-related positions that are currently open on all centralized derivatives exchanges.

When the value of this metric rises, it means the derivatives users are opening up fresh positions on the market. Generally, the leverage present in the sector goes up when this trend forms, so the asset can start behaving in a more volatile manner.

On the other hand, the indicator going down implies the holders are either closing up positions of their own volition or ending up getting forcibly liquidated by their platform. BTC can see calmer price action following such a decrease.

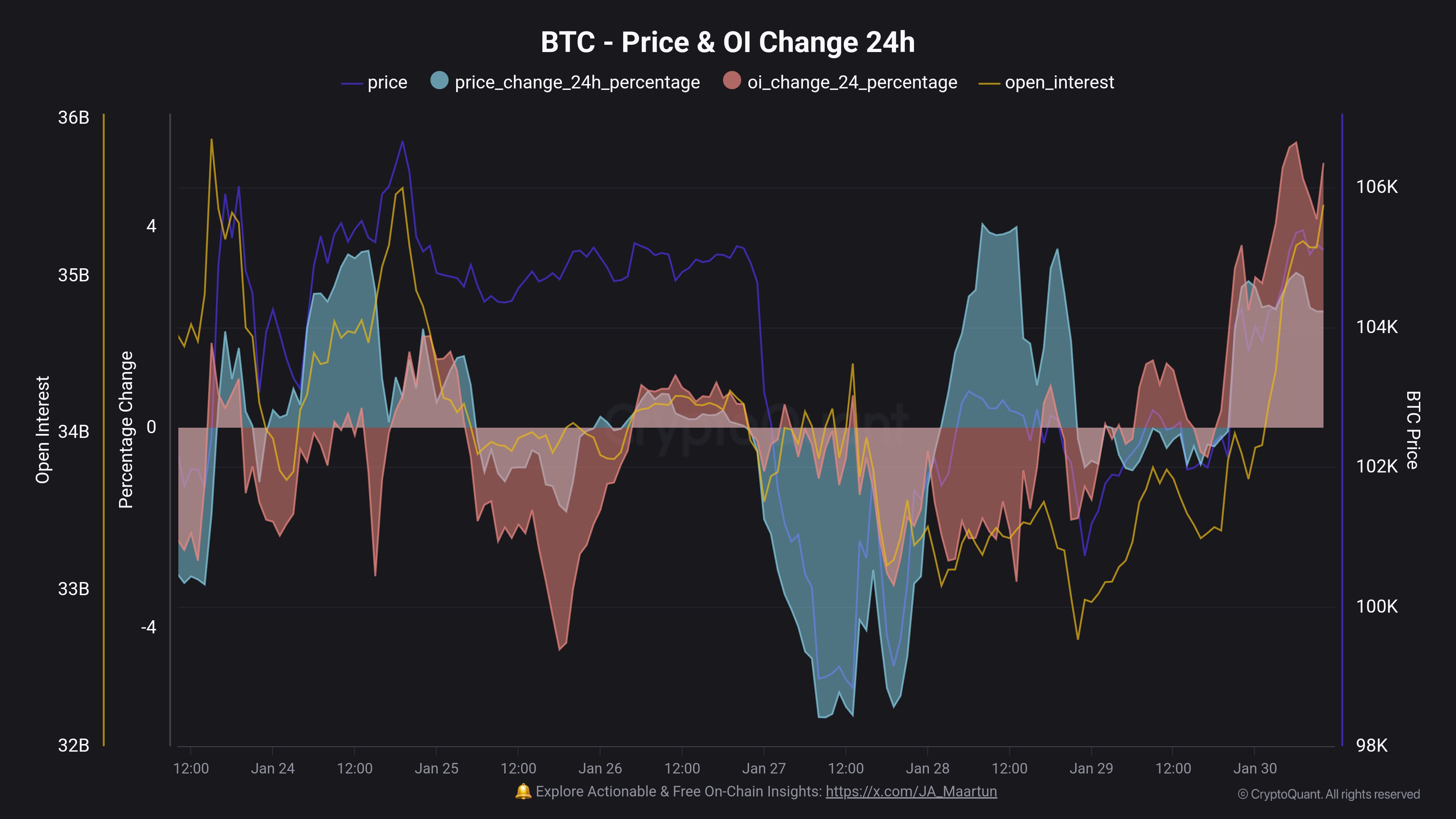

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin Open Interest, as well as its 24-hour percentage change, over the past week:

As displayed in the above graph, the Bitcoin Open Interest has shot up over the past day, which suggests the investors have opened up a large amount of positions on the derivatives market.

The scale of the increase is quite notable, as is visible from the plot of the 24-hour percentage change. Maartunn has noted that this means the asset’s rally is driven by leverage.

Historically, this is something that hasn’t been a good sign for any price move’s longevity, as mass liquidation events can become probable to take place in these market conditions.

Such events tend to be quite violent and can flip the market in the blink of an eye. It now remains to be seen whether the rally can push on regardless of the overheated derivatives market, or if a squeeze will cause at least a temporary pullback.