Data shows the Bitcoin Coinbase Premium Gap has just turned back positive, a sign that buyers have returned on the platform.

Bitcoin Coinbase Premium Gap Is Now Green Again

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Bitcoin Coinbase Premium Gap has just flipped back positive. The indicator of relevance here is the “Coinbase Premium Gap,” which, as its name suggests, keeps track of the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

The former cryptocurrency exchange is mainly used by the US-based investors, especially the large institutional traders, while the latter one hosts a global traffic. As such, the metric tells us about how the buying or selling behaviors differ between the American and foreign whales.

When the value of this indicator is positive, it means the the asset is going for a higher rate on Coinbase than on Binance. Such a trend implies the US-based investors are participating in a higher amount of buying (or lower amount of selling) than the global entities.

On the other hand, the metric being under zero suggests the Binance users may be applying a higher buying pressure as the cryptocurrency is trading at a higher price on there.

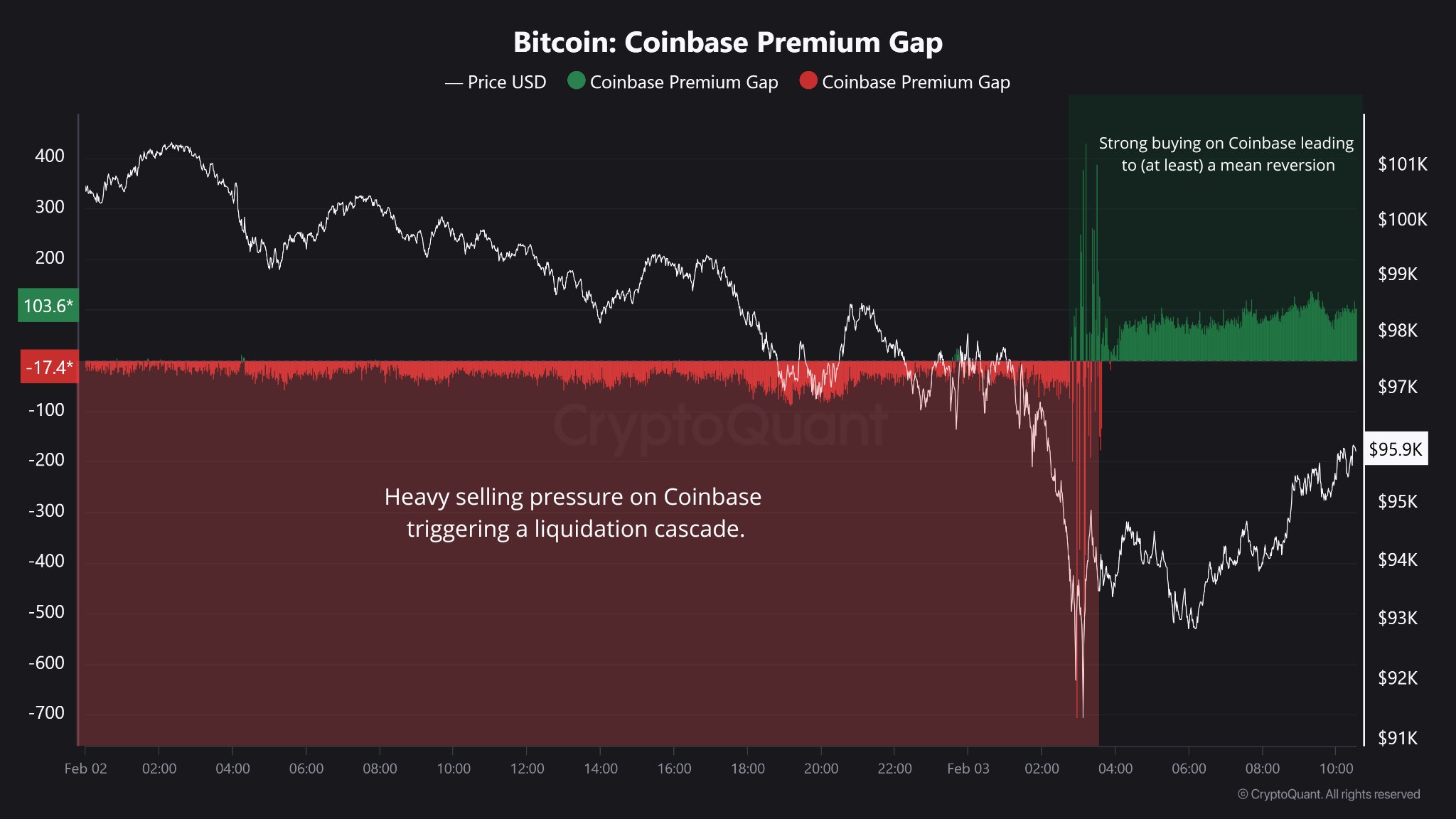

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin Coinbase Premium Gap over the last couple of days:

As is visible in the above graph, the Bitcoin Coinbase Premium Gap was inside the negative territory yesterday, implying Coinbase was witnessing a higher amount of selling pressure than Binance.

The selloff from the American investors intensified as the crash to $92,000 occurred for the cryptocurrency, but since the bottom, the metric has seen a reversal into the green zone.

Throughout 2024, the US-based institutional entities were the main drivers of the market, with the price of Bitcoin often finding itself tracing the same path as the Coinbase Premium Gap. It would appear that 2025 is so far no different in this, as BTC has seen a recovery push beyond $98,500 alongside the revival of accumulation on Coinbase.

Given the pattern, it may be wise to keep an eye on the indicator in the near future as well. A continued stay in the positive region would naturally be a bullish sign for BTC, while a decline under zero could bring back bearish momentum.

In some other news, the Bitcoin Korea Premium Index, a metric similar to the Coinbase Premium Gap that tracks the premium on South Korean platforms, hit a three-year high of around 12% following the crash.

The trend would imply that the users on the Korean exchanges, who had already constantly been accumulating recently, heavily bought the Bitcoin dip.

BTC Price

At the time of writing, Bitcoin is floating around $98,400, down around 1% in the last seven days.