Bitcoin’s wild price swings have kept the market on edge, as volatility remains the norm for crypto traders. This week alone, BTC surged from $97K on Monday to a high of $106K yesterday before settling around $102K. Investors are now watching closely to see if Bitcoin can break above key resistance levels or if another retrace is on the horizon.

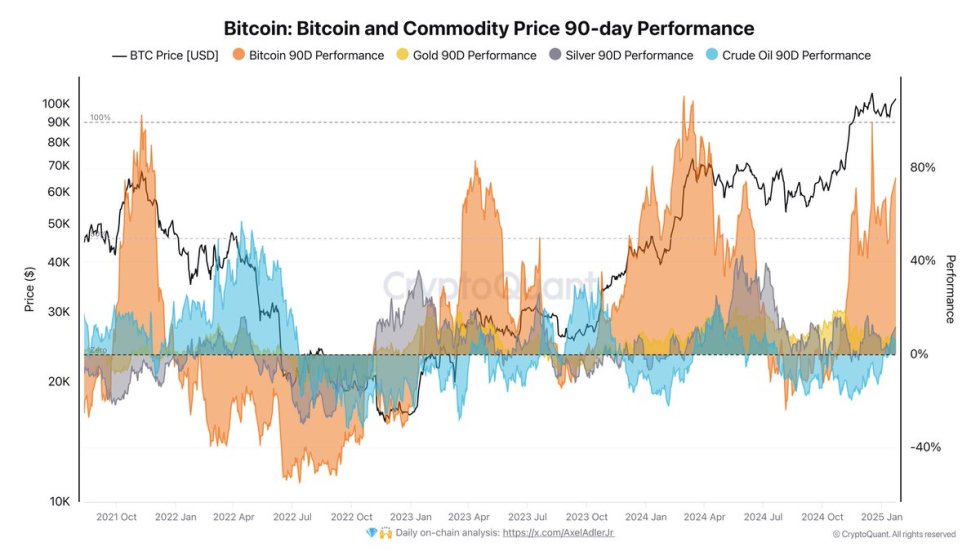

While uncertainty dominates the short-term outlook, long-term trends suggest BTC remains the best-performing asset compared to traditional investments. Top analyst Axel Adler shared a BTC chart comparing it to commodities, revealing that BTC has significantly outperformed assets like gold and silver over the past two years. This performance highlights a shift in investor preference toward digital assets as a store of value.

With Bitcoin consolidating below all-time highs, traders are waiting for a clear breakout or a deeper correction. Will BTC push past $110K and enter price discovery, or will it see another pullback toward key support levels? The coming days will be crucial in defining the next phase of Bitcoin’s market cycle.

Bitcoin At A Key Level, Eyes $110K Breakout

Bitcoin remains one of the hottest assets in the market, consolidating below its all-time high (ATH) and preparing for its next big move. After failing to break ATH recently, BTC is now searching for support to build momentum for the next leg up. The $110K mark is now in focus, a psychological barrier that, once broken and held as support, could ignite a full-scale market rally.

Despite short-term uncertainty, Bitcoin continues to dominate traditional assets in long-term performance. Top analyst Axel Adler shared key metrics revealing that BTC has been the strongest-performing asset among those analyzed over the past two years.

Comparisons with gold and silver show that both commodities have underperformed significantly, suggesting a paradigm shift in safe-haven asset preference. Investors are increasingly viewing BTC as the preferred store of value, surpassing traditional assets that have historically held that role.

Adler further emphasized Bitcoin’s dominance by stating that “there’s not even a point in writing about oil”, implying that BTC has vastly outperformed it. As BTC steadies itself for its next move, the market watches closely. Will it finally break ATH and enter price discovery, or will it consolidate further before the next major rally? The coming days will be crucial for determining Bitcoin’s trajectory.

Bitcoin Price Consolidates Between Key Levels

Bitcoin is trading at $102,300, navigating a tight range between $106K and $100K as volatility remains high. The market is at a crucial inflection point, where a decisive move in either direction will determine the next short-term trend.

If BTC breaks below $100K, it could lead to further consolidation or even a correction, potentially delaying a breakout to new highs. Losing this key psychological level might trigger selling pressure, pushing prices lower as investors seek more confirmation of support.

However, if BTC reclaims and holds above $106K, it would signal renewed bullish momentum and set the stage for a surge past ATH. Historically, when Bitcoin enters price discovery, rallies tend to be swift and aggressive.

Market uncertainty remains the dominant theme, with investors waiting for a clear signal to determine BTC’s next move. Until then, the battle between bulls and bears continues, with $100K acting as a key support level and $106K as the resistance barrier to break. A strong move above this range could trigger the next major rally toward $110K and beyond.

Featured image from Dall-E, chart from TradingView