After concerns early this week, Bitcoin has rebounded sharply at spot rates. At the time of writing, the world’s most valuable coin is up 20% from July 2024 lows.

Considering the upsurge from July 25, there is a high chance it will pierce $70,000 over the weekend and even break above the all-important liquidation level of $72,000.

Analyst: Expect Bitcoin To Range Between $75,000 And $95,000

As Bitcoin regains footing, much to the excitement of bulls, some analysts now believe this is the beginning of the next leg up. This preview is positive, at least based on the recent price action.

Taking to X, one analyst said the zone between $75,000 and $95,000 will be the next “hated” region. At this zone, the coin would have broken above all-time highs at $74,000, last printed in March, adding roughly 30% to peak at $95,000. When this happens, the analyst said the Bitcoin market “will not be as generous to bears as it is now.”

The precise timeline remains uncertain even as traders expect the coin to rip higher. Traders must wait until bulls clear the roadblock at $72,000 and all-time highs.

Looking at price action between March and July, it is evident that buyers, though in charge, struggled. The correction from around $74,000 to $53,500 in early July represented a nearly 27% dip, one of the deepest when the market rallied.

Bitcoin Market Shakes Off Mt. Gox Fears

Multiple factors will drive demand from now on. One of them is the general resilience among bulls as the collapsed Mt. Gox exchange distributes coins. So far, on-chain data shared by one analyst reveals that the Mt. Gox BTC reserve has fallen by 66%, distributing nearly 95,000 BTC.

Interestingly, despite initial fears that the market would drop, extending losses of early July, prices have been steady, recovering. The failure of this event to force prices lower or dampen trader or investor sentiment is a massive boost of confidence.

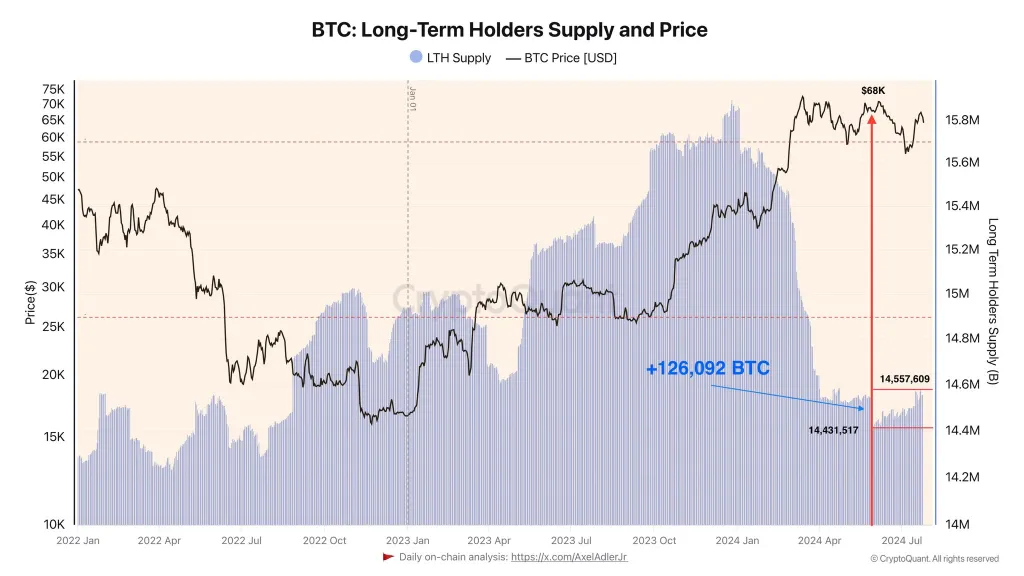

Moreover, other on-chain data shows that long-term holders (LTHs), most of whom are institutions or miners who have held for over 155 days, have been accumulating. One analyst noted that these entities exited when prices rose above $68,000 and all-time highs.

They could be doubling down after offloading 126,000 BTC worth over $8 billion at spot rates. Accordingly, the absence of selling pressure from this cohort will likely support prices, propping up bulls looking to breach $72,000 in the coming sessions.