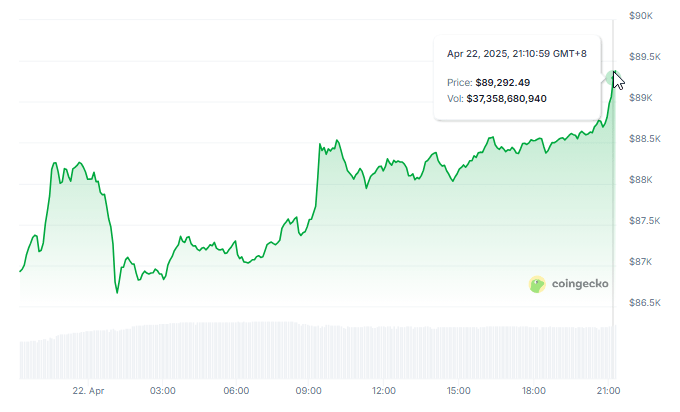

Bitcoin rose to $89,292 today, its highest since April 2, as traders injected funds into cryptocurrency markets. The top-ranked cryptocurrency rose 3.0% in 24 hours amid increased market activity, based on the latest market figures.

Market Observers Notice Fundamental Shift In Bitcoin Activity

CryptoQuant’s trading data reveals Bitcoin’s price increase coincided with an enormous $3.1 billion rise in open interest within one day.

The sudden increase indicates a large number of traders are taking significant positions in the future price increases of Bitcoin. Open interest refers to the value of outstanding unsettled futures contracts on the market.

The reversal follows a downward streak earlier this month as open interest declined from $29 billion to about $24 billion between March 22 and April 10.

But the trend switched abruptly after April 10, with open interest rising consistently to hit $30 billion on April 21 – the highest level since early February.

Options Trading Volume Soars By More Than 300%

Bitcoin’s options market also experienced even more sensational changes. Options market volume surged by 347% to $3.57 billion. Meanwhile, options open interest increased by 3.80% to $32.30 billion.

These figures indicate traders either hedging their positions or betting on larger price fluctuations in the future. The long to short position ratio now is 1.06, indicating somewhat more traders are bullish than bearish.

Whale Investors Continue Steady Accumulation

Behind the day-to-day market action, bigger investors referred to as “whales” have been quietly accumulating more Bitcoin. Based on figures from CryptoQuant, whale balances increased from 3.38 million BTC on January 1 to 3.50 million BTC as of April 20.

Though the 30-day high of 3.50 million BTC was reached, the increase in whale holdings in the last month was only 0.62%. This consistent accumulation by large investors indicates that some big investors still have faith in the long-term prospects of Bitcoin despite short-term fluctuations in prices.

Price Recovery Indicates Market Resilience

The surge to more than $89,000 is a good omen for Bitcoin after it had remained at around $84,400 the day before. The 3.60% weekly price increase indicates a possible return of buying pressure.

Market analysts explain that growth in open interest amid a price rise trend is generally seen as bullish. When money enters the market while prices are rising, it tends to signal increasingly high confidence on the part of traders.

But the rapid growth in speculating with borrowed money also increases the potential for steeper price fluctuations in the future.

If sentiment in the markets changes rapidly, heavily leveraged positions have the potential to create a waterfall of forced buying or selling, potentially magnifying future price changes in either direction.

Featured image from Unsplash, chart from TradingView