Crypto analyst Rekt Capital recently discussed the Bitcoin price action and provided insights into the flagship crypto’s future trajectory. Specifically, he alluded to BTC’s RSI, which is showing a similar pattern to last year, just before the rally to new highs.

Bitcoin’s RSI Targeting Daily Retest That Triggered 2024 Price Rally

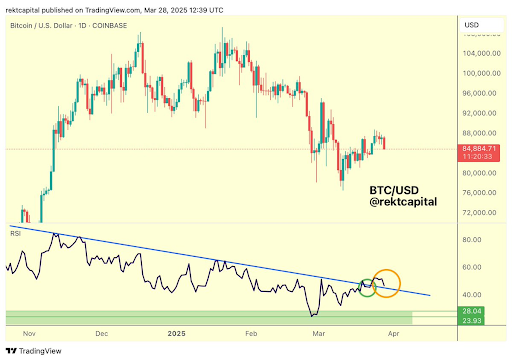

In an X post, Rekt Capital revealed that Bitcoin’s RSI is targeting a daily retest that triggered the 2024 price rally. He mentioned that last week, the daily RSI successfully performed a post-breakout retest of the RSI downtrend, which dates back to November 2024, to confirm the breakout. He added that the RSI is now going for another retest of that same downtrend.

The Bitcoin price rallied to $100,000 during this November 2024 period following Donald Trump’s victory in the US presidential elections. Rekt Capital’s accompanying chart showed that the RSI is retesting the 40 zone, with a break below this level likely to spark another downtrend for the flagship crypto. On the other hand, holding above this RSI level could spark another uptrend for BTC, sending its price to new highs.

However, the Bitcoin price looks more likely to face another major correction at the moment, having dropped from its weekly high of around $88,500 to below $84,000 on Friday. Macro factors like Donald Trump’s tariffs and the US Federal Reserve’s quantitative tightening policies are weakening the flagship crypto’s bullish momentum.

Trading firm QCP Capital opined that any short-term upside for the Bitcoin price remains capped as markets wait for clarity from Trump’s next move in the escalating trade war. The PCE inflation data, which was released on Friday, also sparked a bearish outlook for BTC as the core index rose beyond expectations.

BTC Could Form Local Bottom At Current Price Level

Crypto analyst Titan of Crypto suggested that the Bitcoin price could form a local bottom at its current price level. He noted that BTC is still holding above a strong confluence of supports, including the monthly Tenkan and midline of the monthly Fair Value Gap. The analyst added that the last two times BTC has held these supports, it has marked a local bottom.

In an earlier post, Titan of Crypto had raised the possibility of the Bitcoin price rallying to $91,000 soon. He stated that a bullish pennant had formed on the 4-hour chart. According to him, if this pattern breaks to the upside, the BTC target is around $91,400. Meanwhile, legendary trader Peter Brandt looks bearish as he recently predicted that BTC could drop to as low as $65,635.

At the time of writing, the Bitcoin price is trading at around $83,900, down over 2% in the last 24 hours, according to data from CoinMarketCap.