Early on Oct. 11, Bitcoin dipped below $59,000 for the first time since Sept. 18, triggering long liquidations across the crypto market. At the start of the week, Monday, Oct. 7, Bitcoin reached a local high of $64,400 before falling to $61,200 by Thursday, Oct. 10.

It dropped to $58,800 overnight before recovering to $60,700 as of press time. The digital asset is currently down 5.8% since the week’s high.

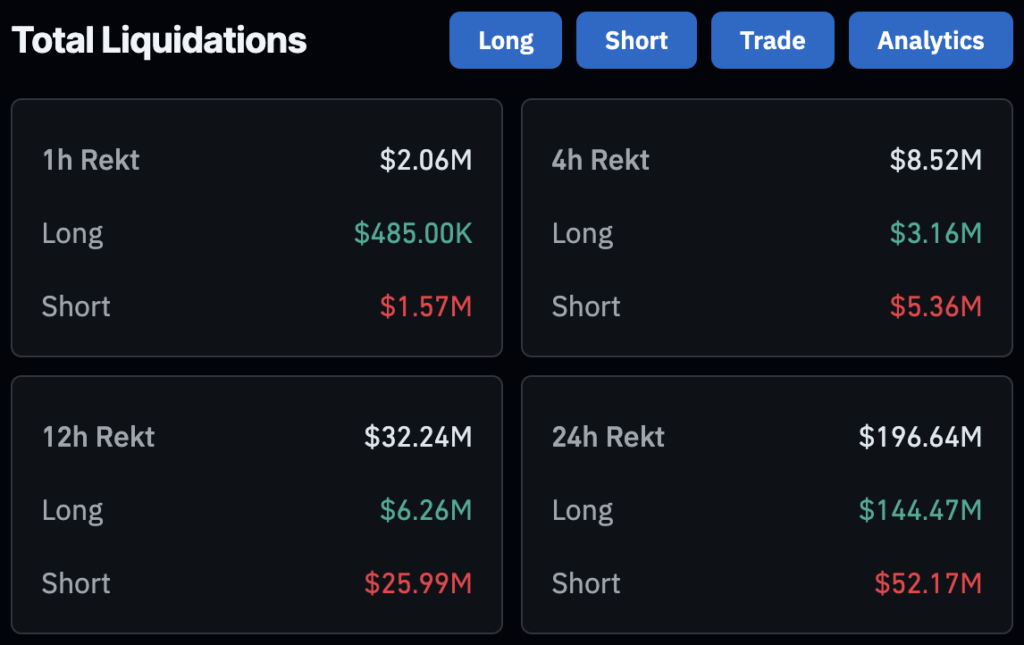

According to Coinglass data, 58,176 traders were liquidated in the past 24 hours, amounting to $196.65 million in total liquidations. The most significant single liquidation order, valued at $10.51 million, occurred on Binance’s BTCUSDT pair.

Liquidations were highest in Bitcoin at $67.99 million, followed by Ethereum at $39.05 million, Solana at $8.39 million, and Sui at $5.85 million. Other cryptocurrencies accounted for $19.54 million in liquidations.

Long positions dominated the liquidations, with $144.47 million in longs compared to $52.17 million in shorts over the past 24 hours. On Binance, long liquidations totaled $27.62 million, making up 91.36% of total liquidations on the exchange. Similar patterns were observed on OKX and Bybit, where long positions accounted for over 90% of liquidations.

The price drop and liquidations highlight the current volatility in the crypto market. Traders using leverage faced losses as prices moved against their positions.

The post Bitcoin sees $196 million in liquidations following dip below $59,000 appeared first on CryptoSlate.