CoinShares’ latest weekly report highlighted a notable shift in crypto investment products, with the sector experiencing its most significant outflows in three months.

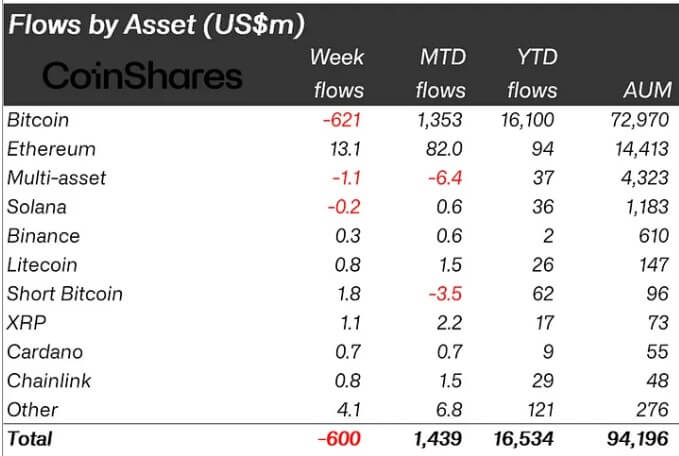

Last week, investors pulled $600 million from the market, with Bitcoin products bearing the brunt, facing $621 million in outflows.

Meanwhile, short-Bitcoin products saw nearly $2 million in inflows, reflecting the bearish sentiment.

James Butterfill, CoinShares’ head of research, attributed these shifting sentiments to a “more hawkish-than-expected FOMC meeting.” Last week, the Federal Open Market Committee of the US Federal Reserve decided to maintain the current interest rate, which many experts suggested meant there would be only one possible rate cut this year.

Butterfill explained that this move has forced investors to reduce their exposure to fixed-supply assets like Bitcoin. He added:

“These outflows and recent price sell-off saw total assets under management (AuM) fall from above $100 billion to $94 billion over the week.”

Meanwhile, the bearish trend in the US appeared to have impacted other countries. Canada, Switzerland, and Sweden saw outflows of $15 million, $24 million, and $15 million, respectively. On the other hand, Australia, Brazil, and Germany saw modest inflows of $1.7 million, $700,000, and $17.4 million, respectively.

Moreover, the trading volume for crypto ETPs was $11 billion last week, significantly lower than the $22 billion weekly average. Despite this, these products accounted for 31% of all trading volumes on major exchanges.

Inflows continue in altcoin.

Despite the bearish trend for Bitcoin, most altcoins had a positive week, attracting significant funds.

Ethereum continued its upward trajectory with an additional $13.1 million in inflows, bringing its month-to-date total to $82 million. Its turnaround can be attributed to the highly anticipated launch of spot Ethereum exchange-traded fund (ETF) products in the US, which experts believe would enhance market accessibility for the emerging industry.

Meanwhile, other altcoins like Cardano and Lido attracted more than $1 million, while other assets like Litecoin, Chainlink, and others saw modest flows.

The post Bitcoin sees $621 million outflow as investors react to Fed’s cautious stance appeared first on CryptoSlate.