Bitcoin slipping to $29,200 followed a two-month trading period in which BTC retained a tight range between $30,000 and $31,000.

The drop was substantial, causing the most significant liquidation event in recent weeks, accounting for around $85 million. This shift was particularly unexpected given Bitcoin’s previously robust support level of $30,000.

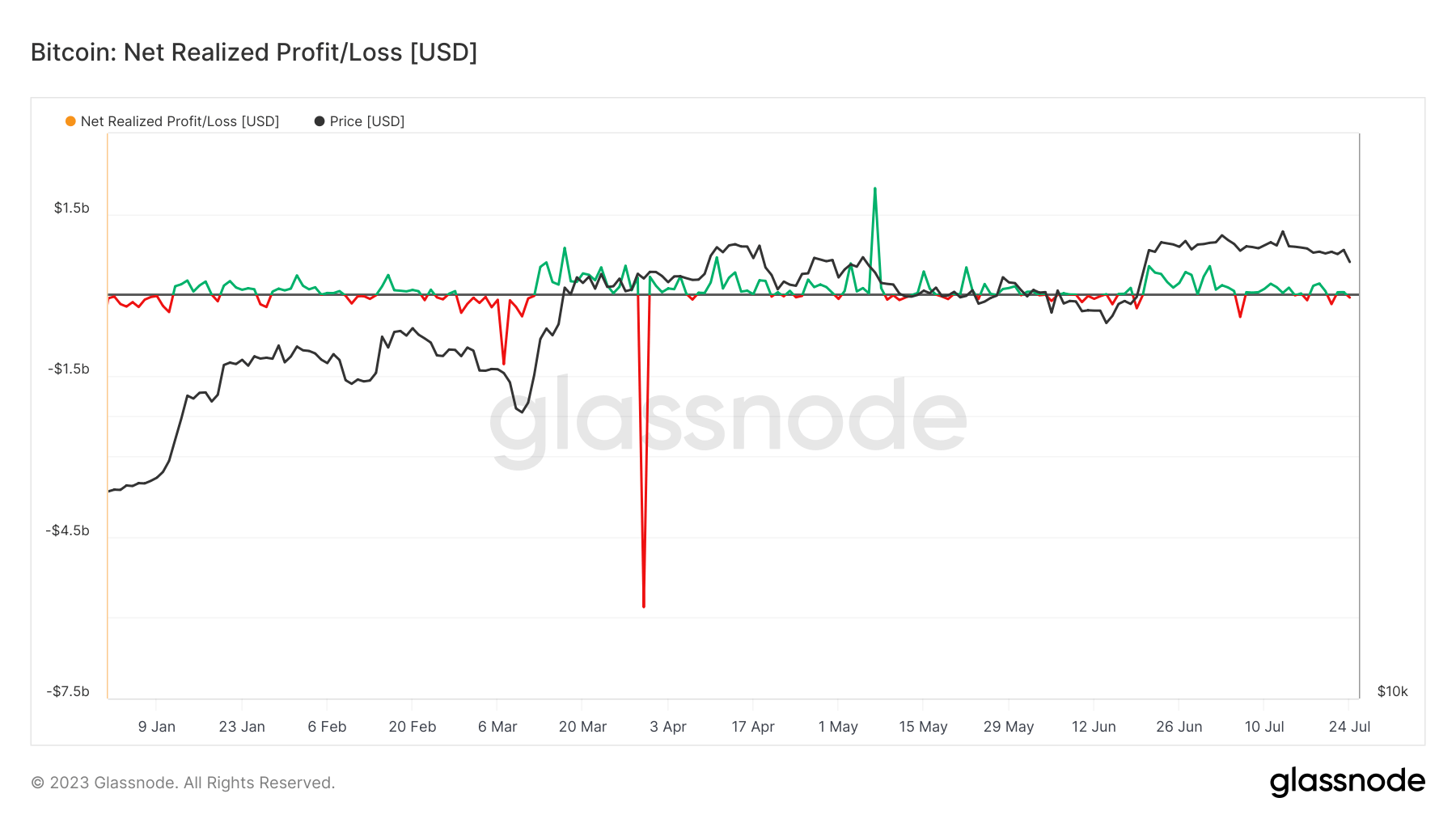

To unpack Bitcoin’s price slump, we use the concept of net realized profit/loss, which refers to the difference between the price of all on-chain coins when they were last moved and the price when they were created.

The importance of this metric is multifold—it offers insights into market sentiment, trader behavior, and financial performance. According to on-chain data, this market downturn resulted in a net realized loss of more than $49.6 million.

The Bitcoin market has witnessed several significant loss realizations in 2023. The most significant one occurred on March 30, culminating in losses worth $5.8 billion—the most significant loss realization event in Bitcoin’s history. Despite these substantial losses, the market has remained on a profit-realizing trajectory for most of the year.

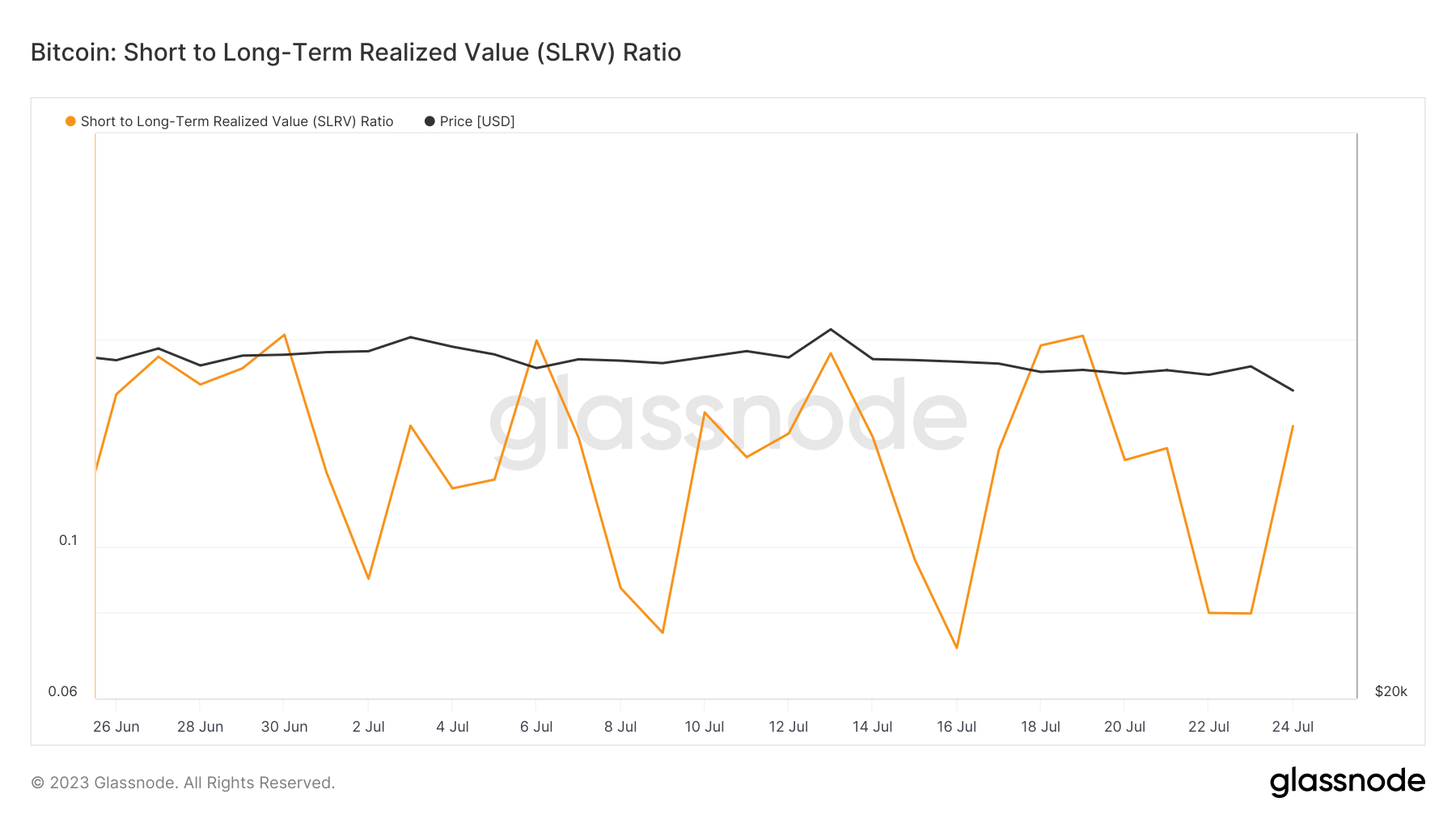

The Short to Long-Term Realized Value (SLRV) ratio provides another critical lens to evaluate Bitcoin’s performance.

It measures the proportion of realized value from short-term holders (those holding Bitcoin for less than 155 days) to long-term holders (those holding Bitcoin for more than 155 days).

A rising SLRV ratio signals that short-term holders, often more speculative, are realizing value. Conversely, a decreasing ratio indicates that long-term holders are realizing more value, suggesting a more stable market.

Of notable importance is the fact that the SLRV ratio experienced a dramatic upswing on June 24, leaping from 0.07 to 0.14.

The sudden spike in the SLRV ratio points to an increase in speculative behavior by short-term traders who are realizing their values. Given the context of recent market movements, this could be interpreted as a response to the market downturn. Traders, especially those with shorter time horizons, could be closing their positions to cut losses or take profits, thereby exerting downward pressure on the Bitcoin price.

The post Bitcoin sees realized losses as it dips below $30K appeared first on CryptoSlate.