Onchain Highlights

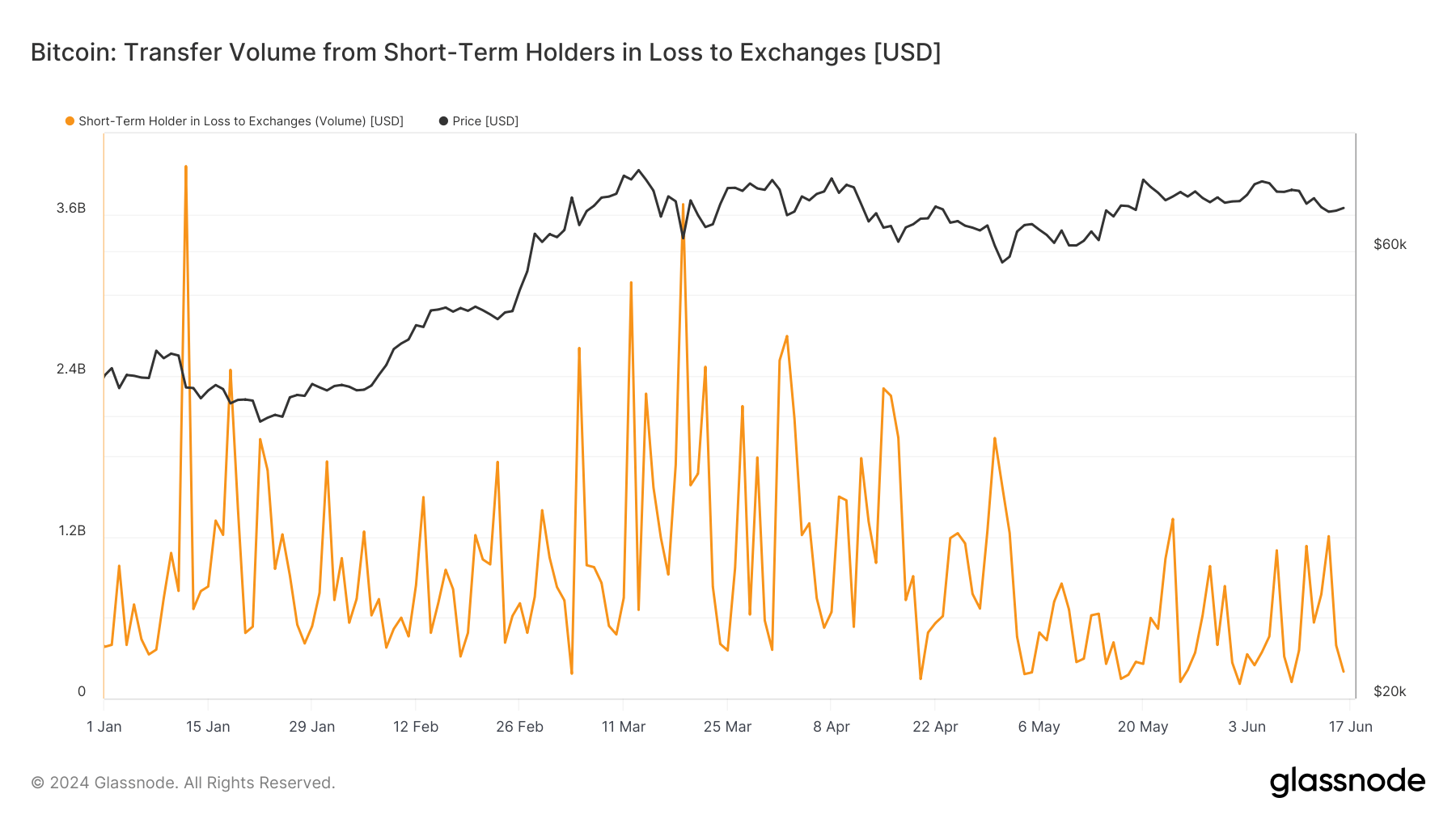

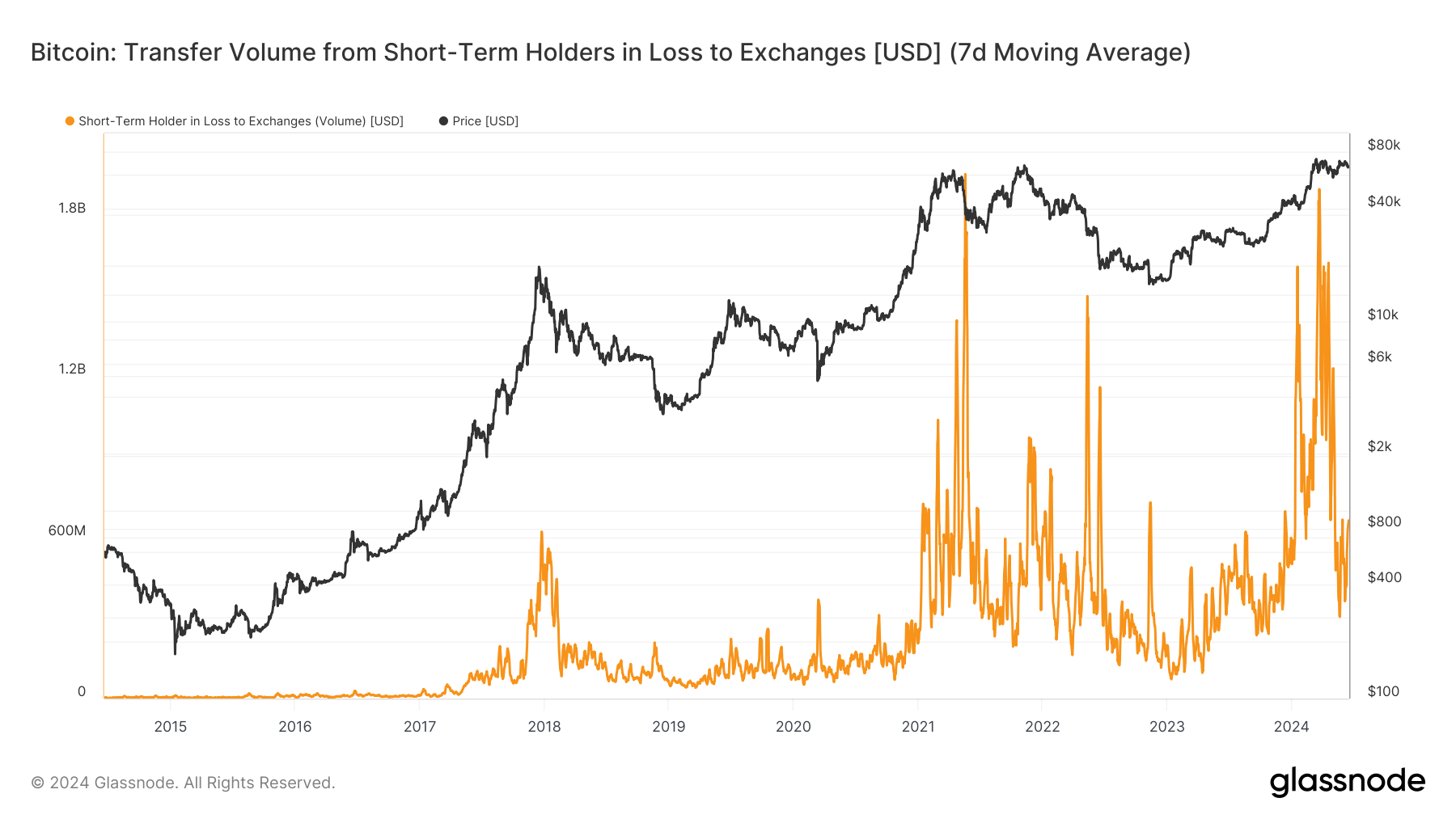

DEFINITION: The total amount of coins (USD Value) transferred from short-term holders in loss to exchange wallets. Only direct transfers are counted. Coins are considered to be in loss when the price at the time the coins are spent is lower than the entity’s average on-chain acquisition price for the tokens.

Bitcoin’s transfer volume from short-term holders to exchanges has shown notable fluctuations in 2024. According to Glassnode data, the first half of the year witnessed significant activity, particularly among holders who acquired Bitcoin less than 155 days ago. This cohort repeatedly reacted to market volatility by offloading their holdings at a loss.

On several occasions, sharp price declines triggered large sell-offs by these short-term holders. A significant spike occurred on May 23, when over $1 billion worth of Bitcoin was sent to exchanges at a loss, the highest since early March. This activity indicates a pattern of heightened sensitivity among short-term investors to sudden price drops.

However, there are signs of changing behavior among these holders. Despite the heavy sell-offs, subsequent data suggests a decrease in selling pressure during similar market conditions. This trend points to a potential maturation among short-term holders as they become more accustomed to Bitcoin’s inherent volatility.

A recent analysis highlights that even amid substantial price drops, the volume of Bitcoin sent to exchanges by short-term holders was lower compared to previous dips, suggesting a growing resilience.

The post Bitcoin sell-offs by short-term holders peak in March amid growing resilience appeared first on CryptoSlate.