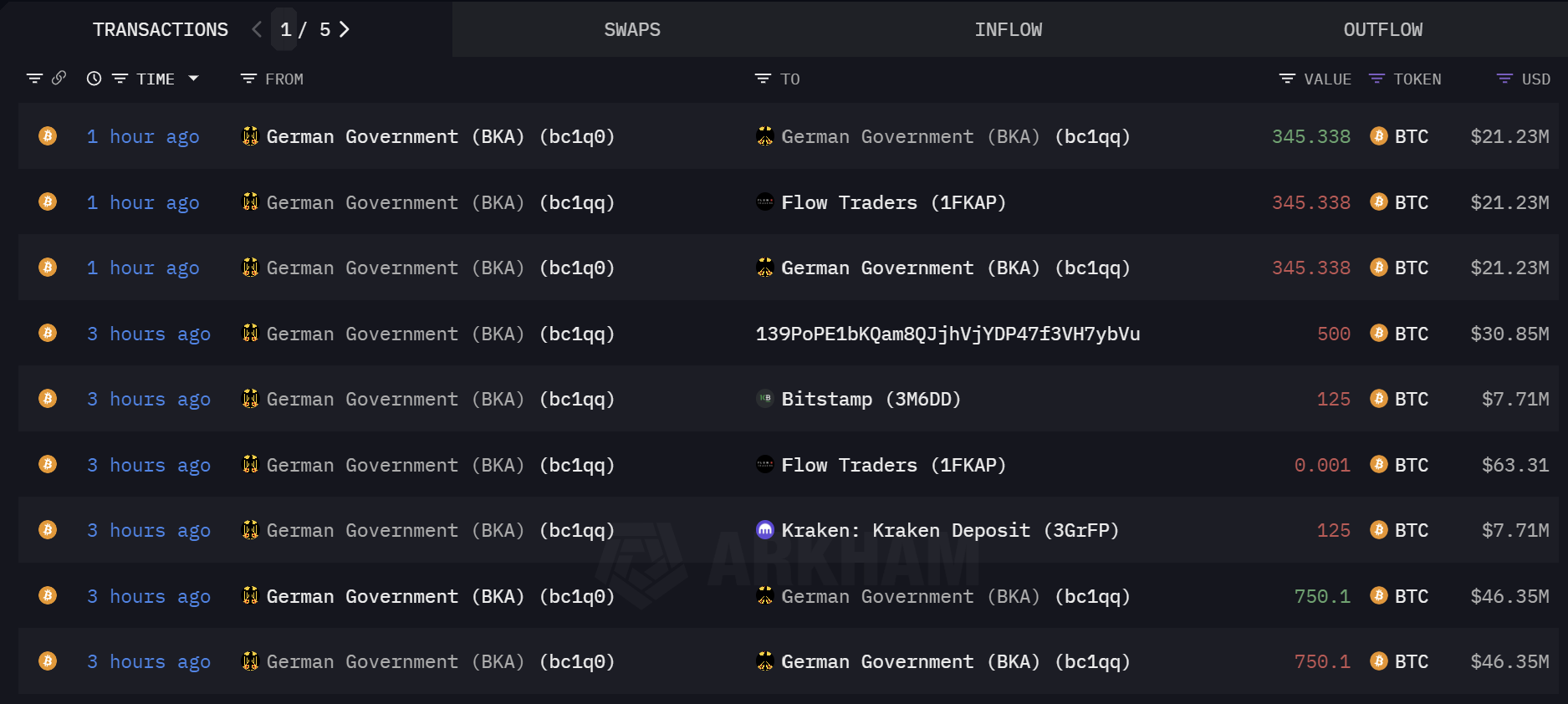

In a continued effort to liquidate its substantial Bitcoin holdings, the German government has once again engaged in significant transactions involving BTC, according to data from blockchain analytics platforms Arkham Intel. This morning, the Federal Criminal Police Office (BKA) executed nine transactions involving a total of roughly 2,786 BTC.

German Gov’t Continues Its Bitcoin Sell-Off

Arkham Intel’s data shows that four of them are internal transfers while five transactions were direct transfers to crypto exchanges and market makers, suggesting an intent to sell. The five potential sales amount to 1,095.339 BTC worth approximately $67 million. Specifically, the BKA made two 125 BTC transfers, each worth approximately $7.7 million, to well-known crypt exchanges Bitstamp and Kraken.

An additional transaction involved a minute test transfer of 0.001 BTC to Flow Traders, a leading market maker. This small transaction was soon followed by a much larger transfer of 345.338 BTC to the same entity, strongly suggesting preparation for a substantial sell order.

Another noteworthy transfer of 500 BTC was directed to an enigmatic address tagged as “139Po.” This address has seen previous activity linked to the German government but remains shrouded in mystery, speculated to be another sale point.

These transactions form part of a broader trend observed since last week. Just a day prior, on June 25, the government had disposed of 400 Bitcoin worth $24 million on Kraken and Coinbase, as well as 500 BTC to address “139Po.”

This is in addition to significant movements earlier last week: $130 million worth of BTC were transferred to exchanges on June 19 and $65 million on June 20. Counterbalancing these outflows, the government received $20.1 million back from Kraken and $5.5 million from wallets associated with Robinhood, Bitstamp, and Coinbase.

Currently, the German government’s holdings amount to 45,264 BTC, valued at around $2.8 billion. This makes Germany one of the top nation-state holders of Bitcoin, trailing only behind the United States, China, and the United Kingdom, which hold 213,246 BTC, 190,000 BTC, and 61,000 BTC respectively, according to data from Bitcoin Treasuries.

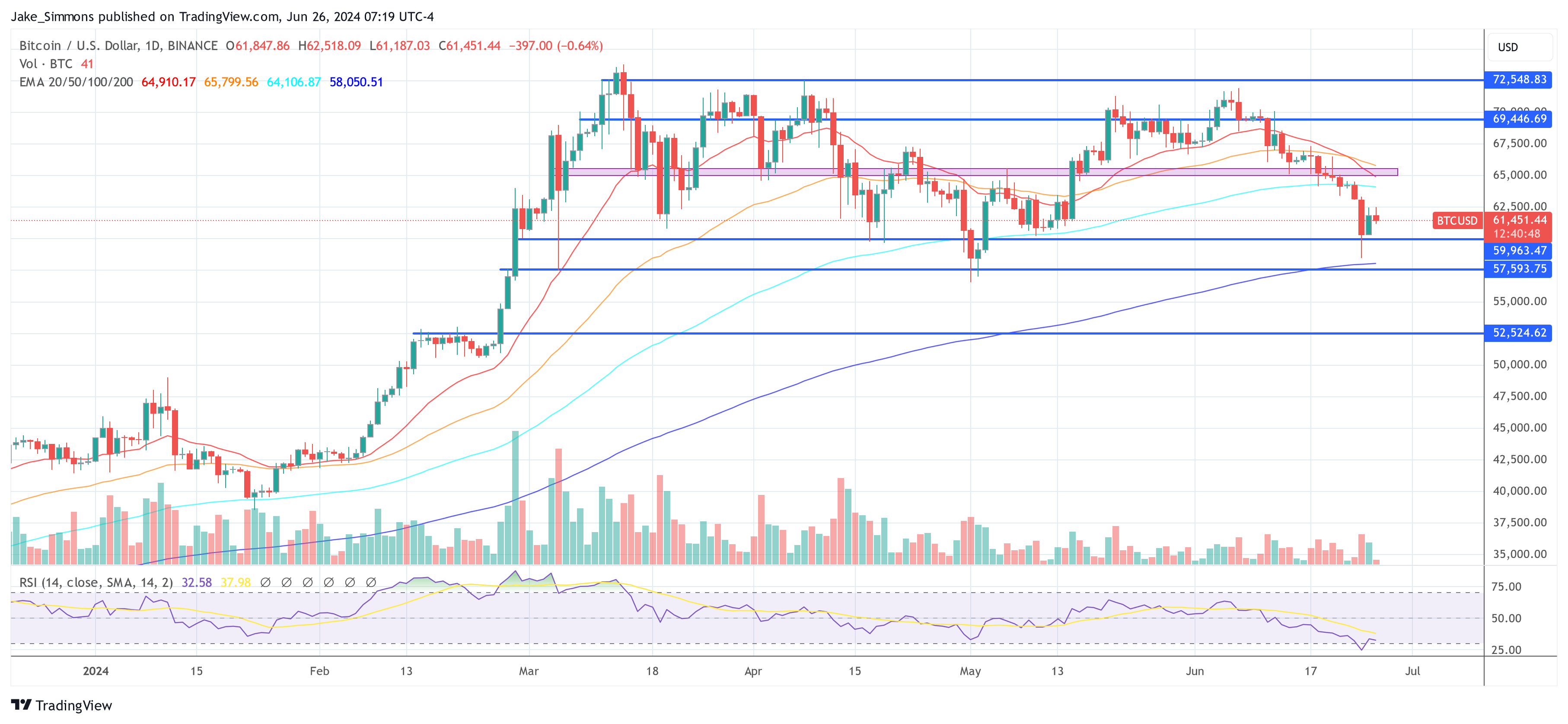

BTC Price Hangs Above Critical Level

The pattern of large-scale disposals by the German government has contributed to fluctuations in Bitcoin’s market price, which has experienced a decline of approximately 6% since the onset of these transactions. Bitcoin’s value briefly fell below the $60,000 threshold following the announcement from Mt. Gox about disbursing approximately $9 billion worth of Bitcoin and Bitcoin Cash starting in July.

Market analysts and investors are also keenly observing these governmental actions as the sell-off seems to continue at a slow pace. This strategic liquidation by the German government arrives at a pivotal juncture for market sentiment, with Bitcoin prices teetering just above critical support levels. Should the daily trading price close below the $60,000 threshold, it could potentially trigger a more pronounced downturn in Bitcoin’s price, exacerbating market volatility and uncertainty.

At press time, BTC traded at $61,451.