Data shows the Bitcoin investor sentiment has plunged to the lowest level since the middle of October. Here’s what this could mean for BTC’s price.

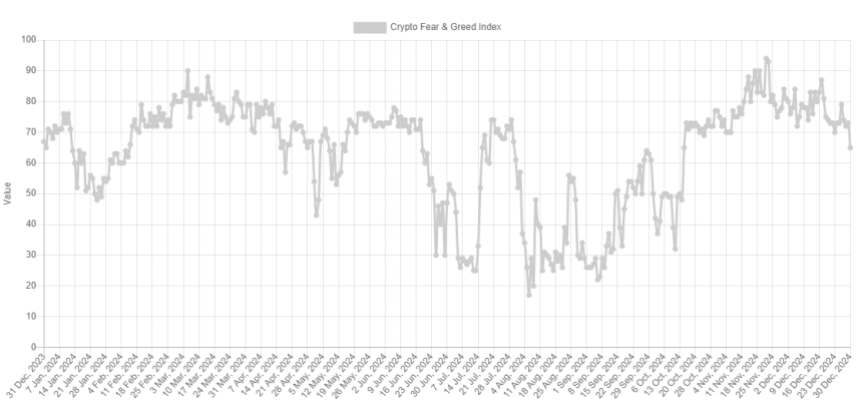

Bitcoin Fear & Greed Index Has Seen A Decline Recently

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the general sentiment present among the traders in the Bitcoin and wider cryptocurrency markets.

This metric takes into account for the data of five factors in order to calculate its value: volatility, trading volume, market cap dominance, social media sentiment, and Google Trends.

When the value of the index is greater than 53, it means the sentiment shared by the majority of the investors is that of greed. On the other hand, it being under 47 implies fear is dominant in the sector. Naturally, the indicator being between these two cutoffs suggests a net neutral mentality.

Now, here is how the Bitcoin Fear & Greed Index is like at the moment:

As is visible above, the latest value of the indicator is 65, which implies the investors share a sentiment of greed. This is a sharp decrease from where the metric was yesterday, as the below chart shows.

Even ignoring the decrease in the past day, it’s apparent that the Bitcoin Fear & Greed Index has been going downhill for a while now. The reason behind this worsening in the sentiment is the price decline that BTC has been going through lately.

The index’s value was 73 yesterday, which is quite close to a special region known as the extreme greed. The market is said to be holding this sentiment when the index is at 75 or higher.

For most of this month, the indicator has actually been inside this zone, as a result of the hype of the cryptocurrency exploring new highs above the $100,000 mark.

Historically, Bitcoin has actually tended to move in the direction opposite to what the crowd is expecting, with the probability of such a contrary move occurring only growing the more the investors become sure about a side.

Extreme greed is a territory where tops have often occurred for the BTC price as this likelihood is the strongest there. There is a similar region for the fear side as well, called extreme fear and occurring at 25 or lower.

With the Bitcoin sentiment seeing a notable decline recently, the asset’s price may no longer be at risk of seeing another major correction. The sentiment is still that of greed, however, so another rally may also not be too likely to happen.

BTC Price

Bitcoin has furthered its drawdown in the last 24 hours, with its price now dropping to $91,900.