Data shows the Bitcoin market sentiment has recently seen a significant uplift as the cryptocurrency’s price has set new records.

Bitcoin Has Just Set A New All-Time High Above $93,000

Bitcoin had seen a bit of a pause in its bull run yesterday, but the uptrend has already returned for its price in spectacular fashion today as the coin has now achieved a new all-time high (ATH) beyond the $93,000 mark.

The chart below shows how the coin’s recent trajectory has looked.

Following this rally, Bitcoin is sitting in weekly gains of over 24%. As is generally the case, the other assets in the sector have also followed BTC in this run, with Ethereum (ETH), the largest of the lot, garnering similar profits.

However, many altcoins have outperformed these two giants, with Dogecoin (DOGE) particularly standing out with its impressive 120% positive returns.

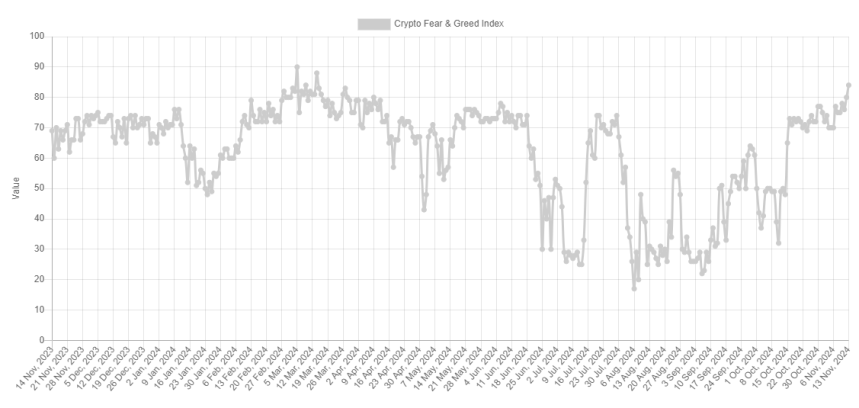

Whenever the market goes through such a bullish phase, investor sentiment shifts towards the better. The same has also happened this time, as the Fear & Greed Index shows.

Bitcoin Fear & Greed Index Is Now At A Value Of 84

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment among the investors in Bitcoin and the wider cryptocurrency markets.

This metric uses a numeric scale from zero to a hundred to represent the trader mentality. Values above the 53 mark imply the average investor is showing greed, while those under 47 suggest the presence of fear in the market. The region between these two cutoffs corresponds to a net neutral sentiment.

Other than these three main sentiments, there are also two special ones: extreme greed and fear. The former occurs at values above 75, while the latter is under 25.

Now, here is what the Bitcoin Fear & Greed Index is like right now:

As is visible above, the index is sitting at a value of 84. This naturally indicates that investor sentiment is firmly in extreme greed.

Historically, Bitcoin and other coins in the sector have tended to move opposite to the majority’s expectations. The probability of a contrary move also grows the crowd’s confidence.

As such, whenever the Fear & Greed Index has gone too far off into one extreme, a reversal has become likely for BTC. This effect was also witnessed during the top back in March of this year.

During that top, the indicator was sitting at 88, which isn’t much higher than the latest value. Thus, it’s possible that, at least from the perspective of sentiment, Bitcoin may be starting to become overheated.

That said, past bull markets have generally seen the cryptocurrency sustain in this extreme zone for a while before the actual cyclical top is reached, so the rally could still have room to run.