Quick Take

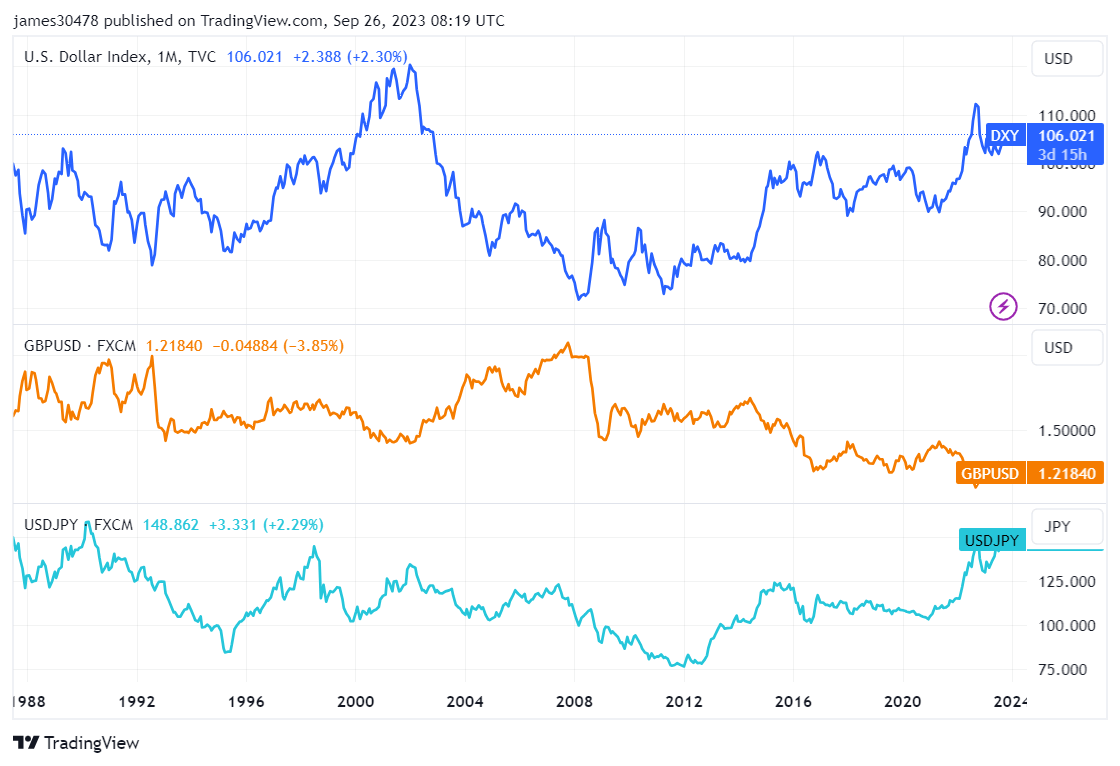

Despite intensifying macroeconomic conditions, Bitcoin has demonstrated remarkable resilience, holding steady at $26,000. This is a noteworthy observation, considering the instability reflected in traditional markets. The Japanese yen is witnessing a swift depreciation against the dollar, currently at 149, indicative of the tumult in the Asian financial sphere.

On the other side of the globe, the pound remains static against the dollar for the year, positioned at 1.21, reflecting stability amidst the turmoil. However, a clear shift in the global financial landscape emerges when we focus on the bond market. Yields are escalating across the yield curve, but it’s particularly significant to note that the 10-year treasury yield has breached the 4.5% mark, and the 30-year yield exceeds 4.6%. These figures signify cycle highs unseen since 2007, hinting at potential turbulence ahead.

The DXY index has had one of its best runs for over a decade, with eleven consecutive green weeks as it pierces over 106.

In this evolving economic scenario, Bitcoin’s steadiness underlines its potential as a ‘digital gold,’ further solidifying its position in the world of finances.

The post Bitcoin shows resilience as traditional markets quake, yen stumbles, bond market looms with turbulence appeared first on CryptoSlate.