The moves of the Bitfinex whales have been reliable indicators for moves in the price of Bitcoin itself, as explained by this analyst.

Bitfinex Whales Have Shown Smart Money Behavior In Recent Years

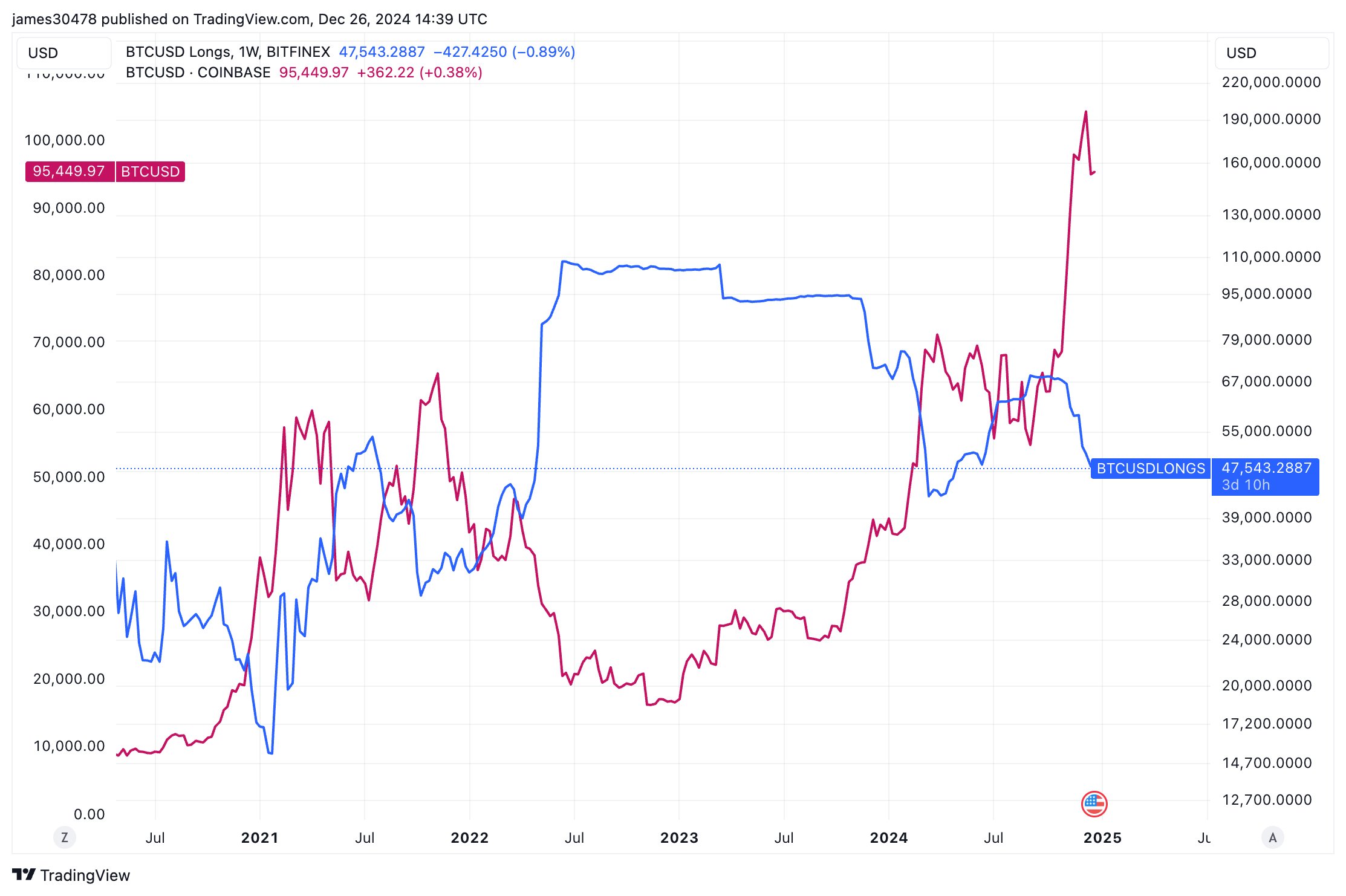

In a new post on X, analyst James Van Straten has discussed about the trend in long Bitcoin positions present on the cryptocurrency exchange Bitfinex. Here is the chart shared by the analyst:

As is visible in the above graph, the Bitfinex long positions have shown some interesting changes with respect to the BTC price during the last few years. It would appear that the movements on the platform have generally come ahead of price action in the asset.

“Bitfinex whales have been a great indicator of BTC price movements,” notes Van Straten. During the 2022 bear market, the large investors on the platform opened massive bullish positions and sat tight on them until 2024 rolled around.

These investors then closed a notable amount of positions during the rally that took place in the first quarter of the year and what followed this trend was a downturn in the asset’s price.

During the consolidation phase, the Bitfinex whales gradually opened up fresh long positions. Once the recent leg of the bull run came, these humongous entities again showed smart money behavior as they realized their profit.

Since this profit-taking event has come from this cohort, the Bitcoin price has once more been showing signs of bearish momentum. So far, the Bitfinex long positions haven’t reversed their downtrend, implying the whales don’t think the current market conditions are right for setting up new bullish bets.

Naturally, it’s possible that the Bitfinex whales could turn out to be wrong about the cryptocurrency this time around, but considering that they have tended to be right about the market’s direction, a surge in their long positions may have to take place if BTC has to restart its run.

Speaking of cryptocurrency exchanges, the total Exchange Reserve, a measure of the amount of Bitcoin held by the wallets of all centralized platforms, has registered an increase recently, as an analyst has pointed out in a CryptoQuant Quicktake post.

Generally, one of the main reasons why investors use exchanges is for selling-related purposes, so a large amount of deposits don’t tend to be good news for the cryptocurrency’s price.

During the latest Exchange Reserve jump, the various platforms have received a total of 20,000 BTC in inflows. This could prove to be another obstacle in Bitcoin’s attempt at restarting bullish momentum.

BTC Price

Bitcoin has overall shown sideways movement during the past week as its price is still trading around the $96,000 mark.