Following the last trading window, the US Bitcoin Spot ETFs have recorded another week of overwhelming net outflows with investors pulling over $900 million from the market. This development marks the fifth consecutive week of redemptions indicating weak market confidence among institutional investors of the premier cryptocurrency.

Bitcoin Institutional Investors Withdraw For The Fifth Straight Week

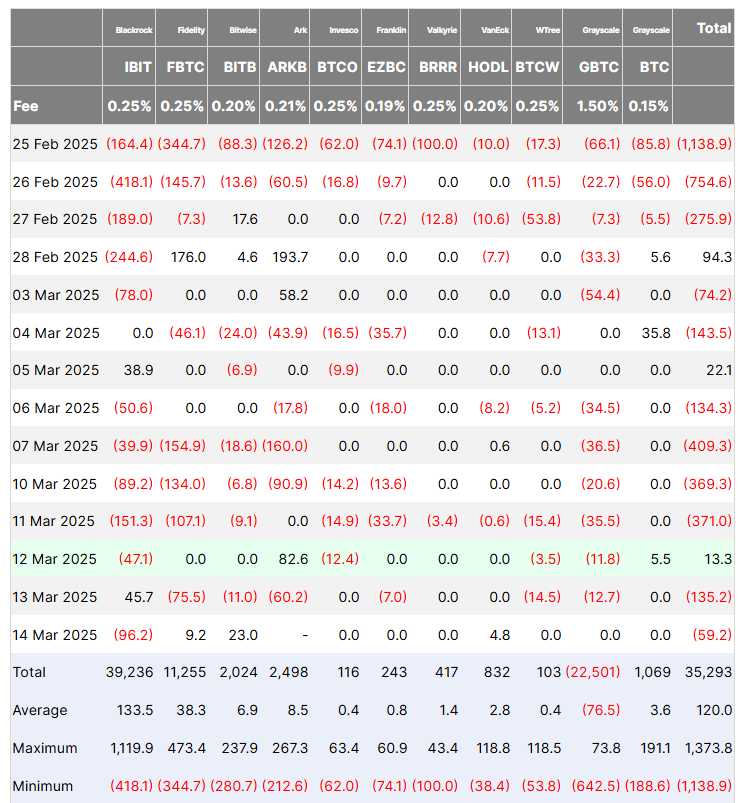

After a strong start to the year which saw the Bitcoin ETFs attract over $5 billion in investments, institutional investors have shown much caution in recent weeks indicated by massive withdrawals. According to data from Farside Investors, the Bitcoin Spot ETFs registered $921.4 million in net outflows during the past week culminating in an estimated total of $5.4 billion in the last five weeks.

The majority of withdrawals from last week were pulled from BlackRock’s IBIT which recorded $338.1 million in net outflows. Fidelity’s FBTC followed closely with investors with fund redemptions outpacing deposits by $307.4 million. Other Bitcoin ETFs such as Ark’s ARKB, Invesco’s BTCO, Franklin Templeton’s EZBC, WisdomTree’s BTCW, and Grayscale’s GBTC all saw moderate net outflows between $33 million-$81 million.

Meanwhile, Bitwise’s BITB, Valkyrie’s BRRR, and VanEck’s HODL all recorded minor net outflows not greater than $4 million. Grayscale’s BTC emerged as the only fund to have a positive showing with net inflows of $5.5 million.

The consistently high levels of withdrawals from the Bitcoin ETFs can be associated with the recent BTC market price correction. Over the last month, the maiden cryptocurrency has experienced a price decline of 11.95% reaching levels as low as $77,000. During this period, institutional investors have shown much caution, with the total net assets of the Bitcoin Spot ETFs decreasing by 21.70% to $89.89 billion according to data from SoSoValue.

Ethereum ETFs Lose $190 Million In Withdrawals

Amidst the Bitcoin ETFs’ struggles, the Ethereum Spot ETFs market is experiencing similar investor sentiment following net outflows of $189.9 million in the last week. This development marks the third consecutive week of withdrawals, bringing the total net outflows to $645.08 million within this period.

Similar to its Bitcoin counterpart, BlackRock’s ETHA experienced the largest withdrawals of the past week valued at $63.3 million. At the time of writing, total cumulative inflows into the Ethereum ETF market are valued at $2.52 billion with total net assets standing at $6.72 billion i.e. 2.90% of the ETH market cap.

Meanwhile, Ethereum continues to trade at $1,924 reflecting a 0.73% gain in the past 24 hours. On the other hand, Bitcoin is valued at $84,009 with no significant price change on its daily chart.