The Bitcoin Spot ETFs, one of the most exciting financial markets at the moment, closed out another week with net inflows resulting in three consecutive weeks of gains. In tandem, the Ethereum Spot ETFs also produced an overall positive performance to record their first weekly net inflows in 2025.

Related Reading: Bitcoin At Risk Of Supply Shock As ETF Issues Buy More BTC Than Was Produced In December

Bitcoin Spot ETFs Register $2.42 Billion Net Flows In 2025

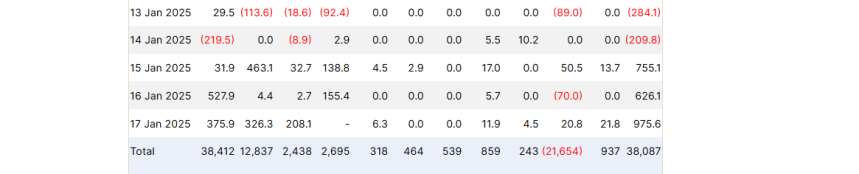

Following a turbulent end to December 2024, the US Bitcoin Spot ETFs have launched 2025 on a strong bullish note with significant market inflows reminiscent of their impressive performance in the majority of Q4 2024. According to data from ETF analytics site Farside Investors, these Bitcoin ETFs recorded an aggregate inflow of $1.862 billion in the third trading week of 2025 resulting in a total net flow of $2.42 billion in the new year.

Interestingly, this week started on a negative note as these ETFs suffered withdrawals valued at $493.9 million between 13 January – 14 January amidst a Bitcoin flash crash to below $90,000. However, a surge in Bitcoin prices in the remaining three trading days corresponded with a rise in investors’ confidence translating to a cumulative inflow of $2.35 billion during this period.

In familiar fashion, BlackRock’s IBIT registered the largest net inflows of the week valued at $745.7 million, with Fidelity’s FBTC taking second with investments worth $680.2 million. Bitwise’s BITB and Ark’s ARKB also registered significant inflows, totaling $216 million and $204.7 million, respectively.

Other ETFs such as Invesco’s BTCO, Grayscale’s BTC, WisdomTree’s BTCW, VanEck’s HODL, and Franklin Templeton’s EZBC recorded modest net inflows of not more than $40.1 million. Unsurprisingly, Grayscale’s GBTC produced the only net outflow of the week valued at $87.7 million. Meanwhile, Valkyrie’s BRRR was also another outlier registering zero net flows.

At the time of writing, BlackRock’s IBIT maintains its market dominance with $38.41 billion in cumulative net inflow. IBIT also boasts $59.28 billion in net assets accounting for almost half of the total net assets ($120.95 billion) in the Bitcoin Spot ETF market.

Ethereum ETFs Return To Positive $212 Million Inflows

In addition to the strong performance of Bitcoin Spot ETFs, Ethereum ETFs recorded a net inflow of $212 million, signaling a return to positive gains after a rocky start to 2025. The BlackRock ETHA emerged as the focal center of these gains, registering $151.3 million in net flows over the week.

At the time of writing, the Ethereum Spot ETFs now hold a total net asset of $12.66 billion representing 2.99% of Ethereum’s market cap. On the spot market, Ethereum continues to trade at $3,297, with Bitcoin now valued at $104,837.