Onchain Highlights

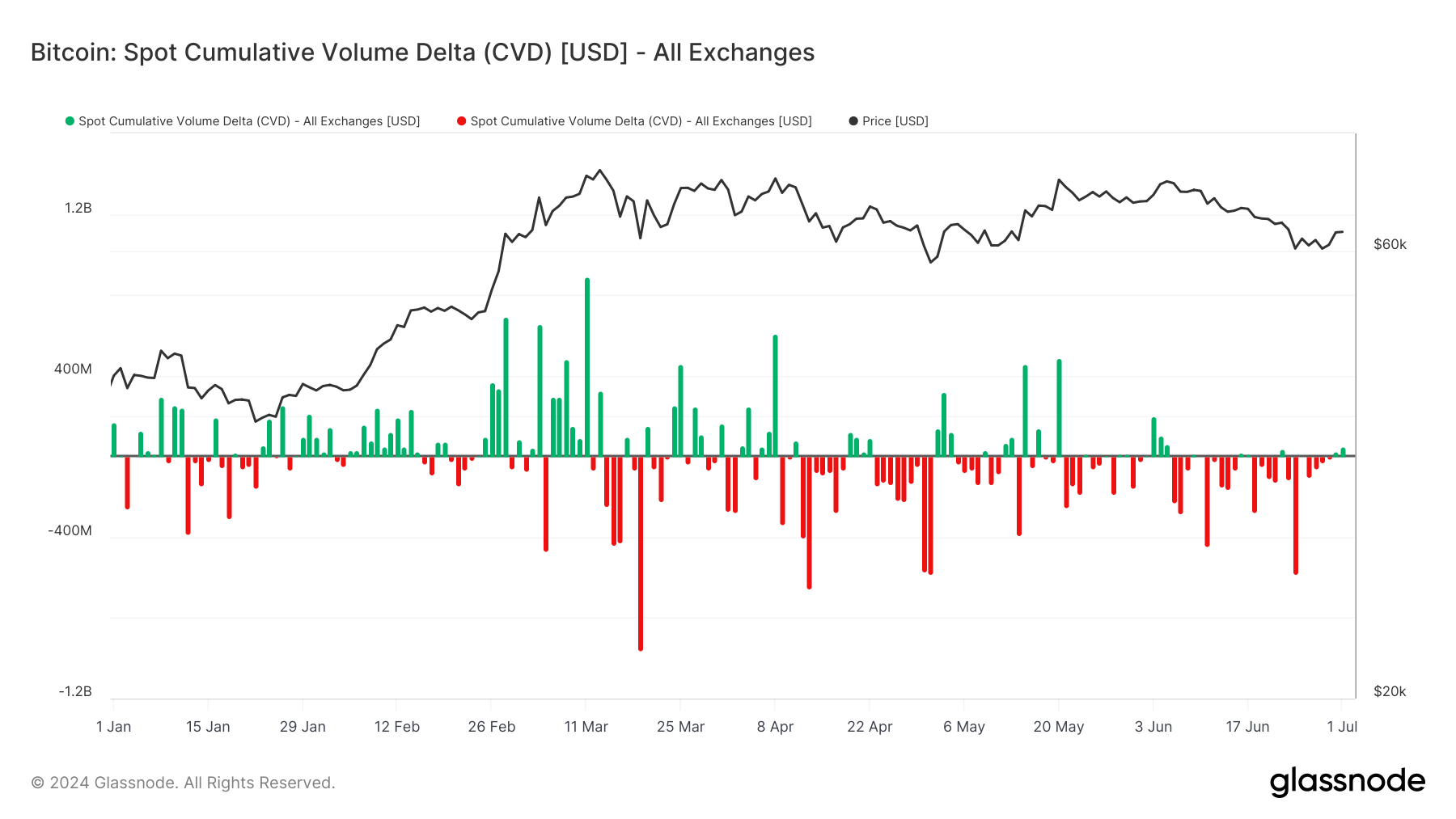

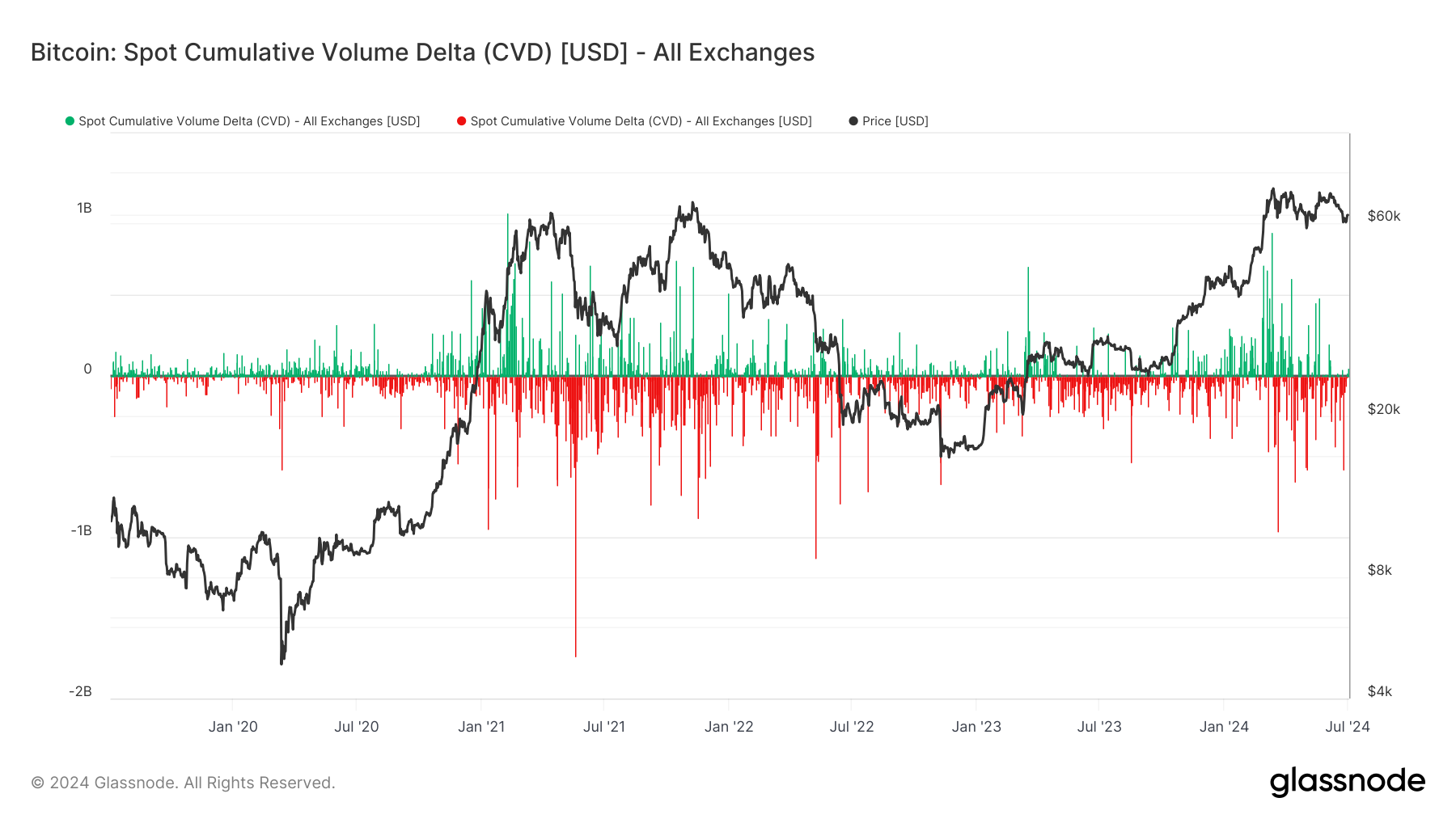

DEFINITION: Spot Cumulative Volume Delta (CVD) measures the net difference between buying and selling trade volumes, specifically highlighting the difference in volume where the buyer or seller was the aggressor. It includes trades where USD or USD-related currencies serve as the quote currency, encompassing both fiat and stablecoins.

Bitcoin’s Spot Cumulative Volume Delta (CVD) data reveals notable trading behavior across exchanges. In early 2024, significant buying pressure was evident, correlating with Bitcoin’s all-time high in March.

The surge may be attributed to increased investor confidence following the launch of spot Bitcoin ETFs in January, as well as growing institutional interest, which has been a key driver of recent market trends.

Post-halving, the CVD indicates fluctuating volume with occasional spikes in buying activity, though the market also witnessed substantial selling pressure, particularly in May and June. This selling pressure coincided with regulatory developments in key markets, influencing investor sentiment and causing temporary price corrections.

Historically, the long-term CVD chart shows periods of intense buying and selling activities aligned with Bitcoin’s price cycles. The significant buying volumes in late 2020 and early 2021, followed by periods of selling in 2022, highlight the cyclical nature of market behavior.

Current trends suggest that while Bitcoin faces short-term volatility, underlying buying pressure may support its long-term bullish outlook.

The post Bitcoin spot volume data shows significant buying pressure pre-halving appeared first on CryptoSlate.