US wholesale inventory growth data for June came in at 0.2%, lower than the previous 0.6% and the estimated 0.5%, suggesting cautious inventory management amid uncertain demand. If this reflects weakening consumer spending, it could potentially ease inflationary pressures. Retail inventories, excluding auto, grew 0.2%, supporting a trend of reduced consumer spending, particularly on non-essential items.

Bitcoin was seemingly unaffected by the data, trading sideways for the past few hours at around $66,400.

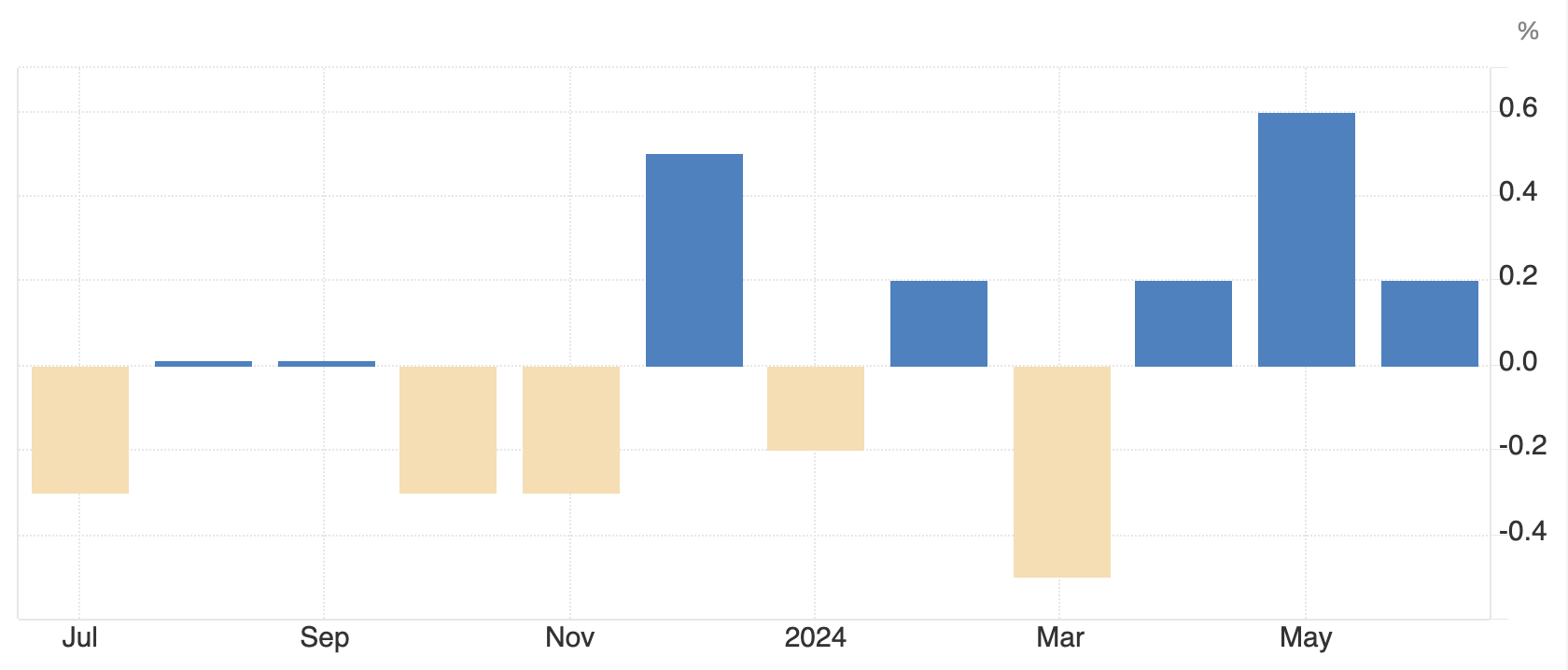

Based on the latest economic data, the US inflation landscape shows signs of moderation but remains complex. The annual inflation rate decreased to 3% in June 2024, down from 3.3% in May, indicating ongoing disinflation. This trend aligns with the Federal Reserve’s efforts to stabilize prices.

The goods trade deficit also narrowed to $96.84 billion in June, better than the previous $99.37 billion and the estimated $98.90 billion. However, both imports and exports decreased, signaling constrained economic activity. The reduction in imports could lead to higher domestic prices for some goods due to supply constraints, while decreased exports might increase domestic supply, potentially moderating prices in specific sectors.

These mixed signals indicate that underlying pressures remain while overall inflation is trending downward. The interplay between inventory levels, trade conditions, and consumer demand will be crucial in shaping future inflation trends.

The post Bitcoin steady on US wholesale inventory growth miss, supporting falling inflation appeared first on CryptoSlate.