Bitcoin’s short-term price direction remains uncertain as the market struggles to confirm its next move. Analysts and investors are divided, with some calling for a breakout into new all-time highs while others anticipate renewed selling pressure into lower prices. The price has been consolidating in a narrow range for the past twelve days, holding above the $94,000 demand level and facing resistance below the $100,000 mark.

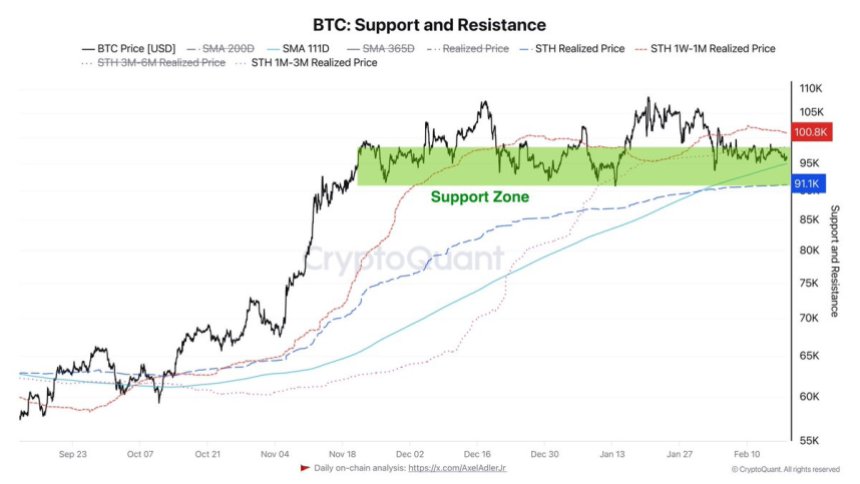

Key data from CryptoQuant reveals that the nearest support zone for BTC is forming between $91,000 and $95,000. This range is reinforced by two critical technical indicators: the 111-day simple moving average (SMA 111D), currently at $95,000, and the Short-Term Holder (STH) Realized Price, which sits at $91,000. These levels suggest that BTC is trading above historically significant support areas, where short-term holders have realized their profits or losses.

While the long-term structure remains bullish, investors are growing impatient as BTC fails to reclaim key resistance levels. If Bitcoin can push above $100K in the coming days, analysts expect a rally into price discovery. However, losing support around $94K–$95K could trigger increased selling pressure and a deeper correction into lower demand zones.

Bitcoin Prepares For A Decisive Move

Bitcoin’s recent consolidation phase has fueled speculation about a potential breakout, with many analysts suggesting that the market is witnessing the calm before the storm. While short-term direction remains uncertain, the long-term bullish structure remains intact, and many expect BTC to make a strong move toward new all-time highs soon.

Crypto analyst Axel Adler shared key CryptoQuant data on X, highlighting that Bitcoin’s nearest support zone is forming around $91,000–$95,000. This range is significant because it aligns with the 111-day simple moving average (SMA 111D) at $95,000 and the Short-Term Holder (STH) Realized Price at $91,000. These levels represent areas where short-term holders have historically realized profits or losses, making them crucial for maintaining bullish momentum.

On the resistance side, Adler notes that Bitcoin faces a key supply zone between $98,000 and $101,000. This area is defined by the aggregate exit prices of holders with a holding period of one week to one month at $100,800 and those with a one- to three-month holding period at $98,200.

As BTC continues to trade within this narrow range, investors are closely watching these levels for a decisive breakout. A push above $101K could trigger a rally into price discovery. While losing support at $91K could lead to further downside.

BTC Bulls Face A Big Test

Bitcoin is trading at $95,600 after nearly two weeks of sideways movement within a narrow range, fluctuating less than 4% in either direction. This extended period of consolidation has left traders on edge, as they await a decisive move in either direction.

For BTC to maintain its bullish structure, the $95,000 level must hold. This price point aligns with technical support, and a break below it could signal strong selling pressure. Bulls face a critical test at this stage, as they must defend this support and initiate a push above key resistance levels.

To confirm a breakout, Bitcoin needs to reclaim the $98,000 mark and, ultimately, the psychologically significant $100,000 level. A successful move above these levels would provide the momentum needed to challenge all-time highs and re-enter price discovery. However, failure to hold $95K could trigger a downside move, with BTC potentially testing support zones closer to $91K.

As Bitcoin consolidates, traders remain cautious, watching for volume spikes and increased buying pressure to confirm the next price movement. The coming days will be crucial in determining whether BTC resumes its uptrend or faces further correction.

Featured image from Dall-E, chart from TradingView