An analyst has explained how the data of an oscillator for Bitcoin could suggest the cryptocurrency still has plenty of room to run in this rally.

Bitcoin VWAP Oscillator Could Imply Potential For Further Upside

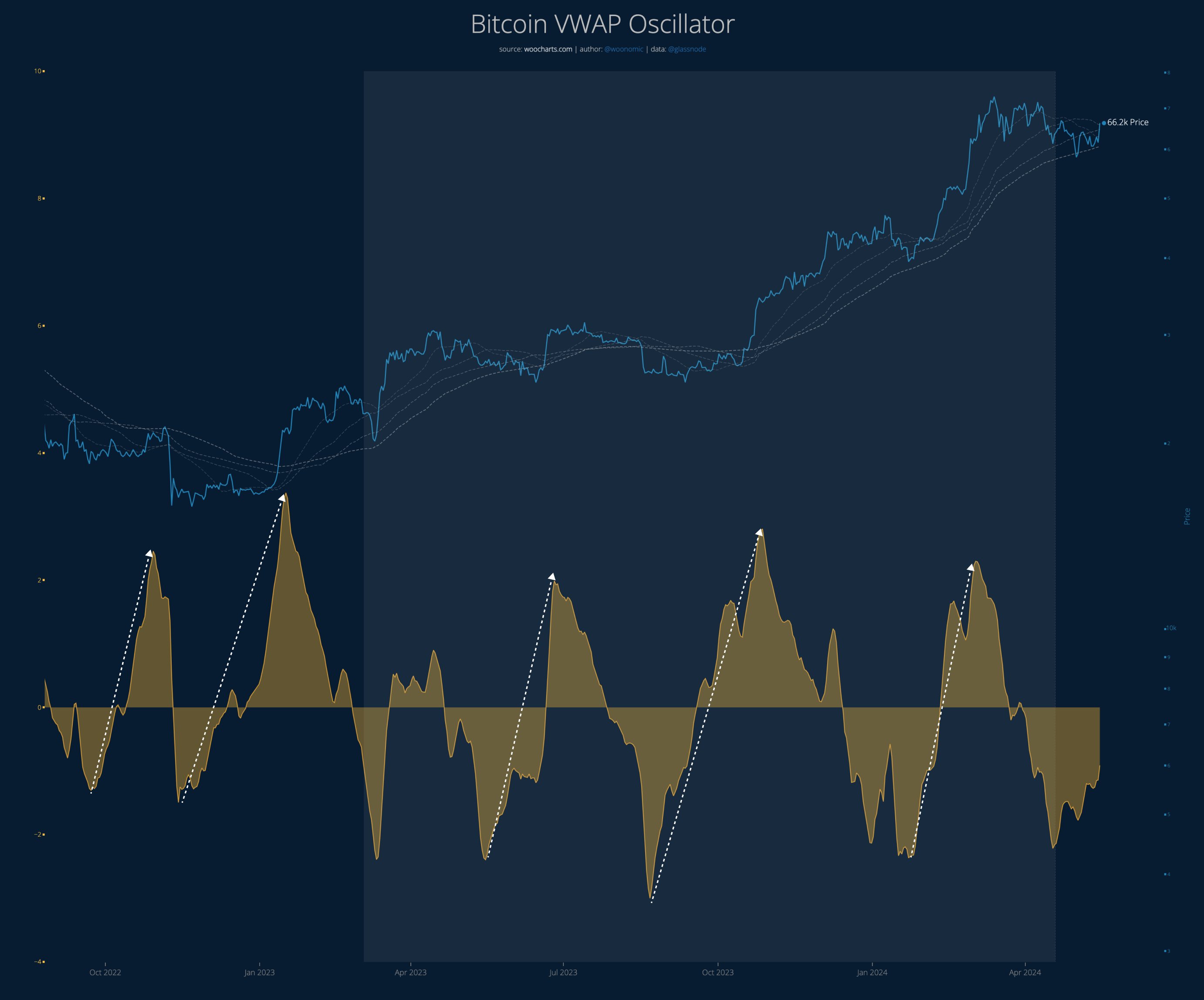

In a new post on X, analyst Willy Woo discussed what the latest trend in the Volume-Weighted Average Price (VWAP) Oscillator for BTC might suggest regarding what could be next for the cryptocurrency.

The VWAP is an indicator that calculates the average price for any asset by taking into account the price fluctuations themselves and weighing the values against the trading volume.

This means that the prices of the assets where there was a higher volume of trading have a higher weightage in the average than those with only a low amount of volume.

Traditionally, the VWAP is a technical analysis indicator that considers the information available through spot exchanges. In the context of the current topic, the VWAP uses the on-chain volume of Bitcoin instead, which is readily viewable by anyone thanks to the blockchain’s transparency.

The indicator of interest here isn’t the VWAP but rather the VWAP Oscillator, as mentioned earlier. This metric keeps track of the ratio between the BTC spot price and the VWAP and presents it as an oscillator of around zero.

The chart below shows the trend of this Bitcoin indicator over the past couple of years.

The above graph shows that the Bitcoin VWAP Oscillator has been in negative territory for the past couple of months. However, the metric’s value has been rising recently, so if it continues on this trajectory, it might approach the neutral mark shortly.

In the chart, Woo has highlighted a trend that the indicator and the cryptocurrency’s price have historically shown. It seems that whenever the metric has formed a bottom in negative territory and rebounded back to the upside, the asset has enjoyed some bullish momentum.

The resulting price surge may last until the indicator reverses into the positive territory and forms a top. That hasn’t happened for the VWAP Oscillator this time yet. “Still a lot of room to run before reversal or consolidation,” says the analyst. “Hate to be a trapped Bitcoin bear right now.”

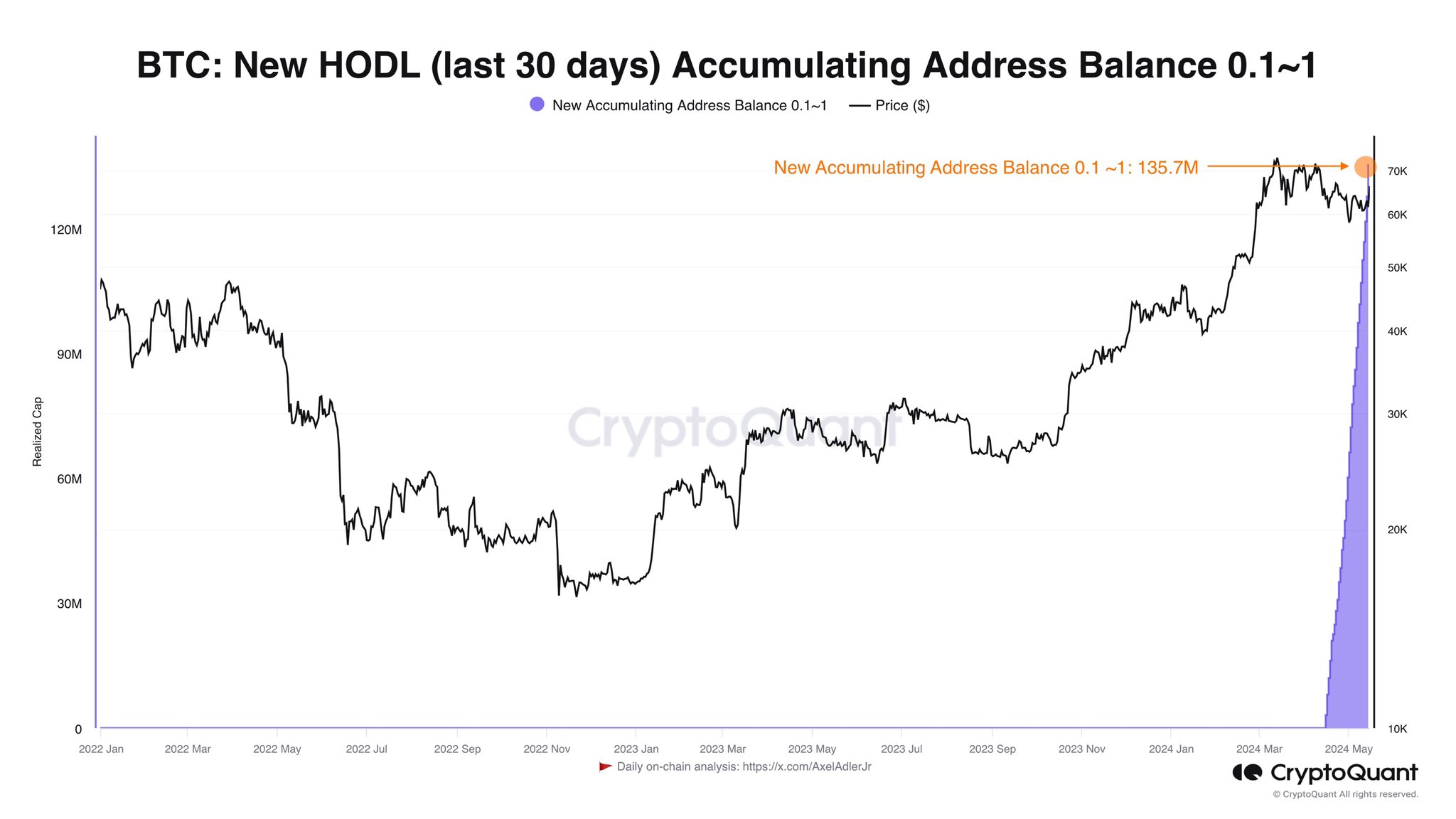

In other news, as CryptoQuant author Axel Adler Jr. pointed out in an X post, retail investors have bought $135.7 million worth of the asset over the past month.

BTC Price

At the time of writing, Bitcoin is floating around $65,000, up 5% over the last week.