After its latest halving event, Bitcoin sent a positive signal throughout the crypto market. Historically, this big drop in supply has been connected to notable price gains, which has inspired investor hope.

The halving, which cut the rate at which new Bitcoins were made, has actually slowed the flow of new Bitcoins into the market. This sudden drop in supply, along with growing interest from institutions and wider use, is likely to push Bitcoin prices up.

Many investors are attentively observing these dynamics and expect a similar trend in the near future; previous halvings have sometimes followed significant price rebounds.

Bitcoin: Changing Investor Attitudes

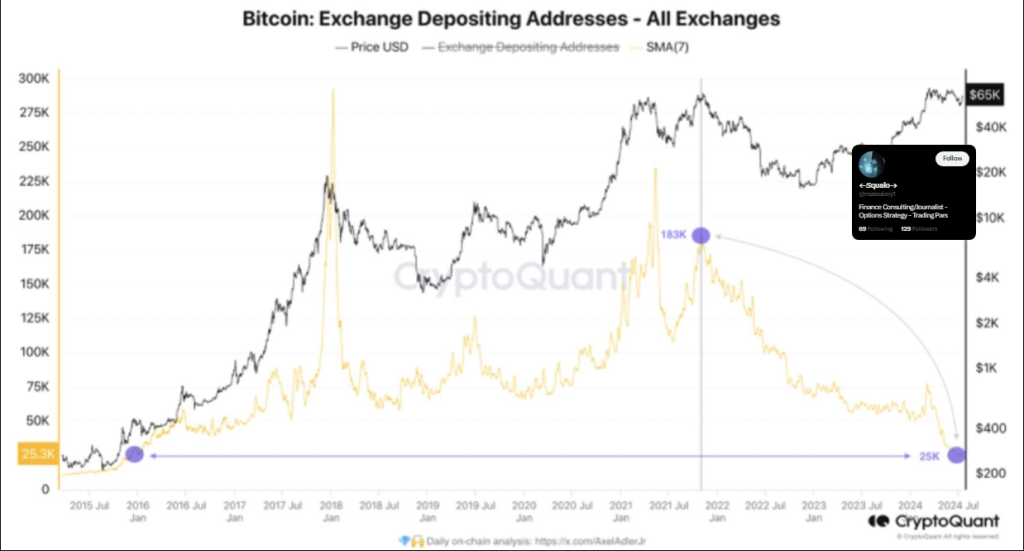

The substantial decline in the number of new deposit addresses on cryptocurrency exchanges marks a clear trend in the Bitcoin market. Data from the well-known analysis tool CryptoQuant shows that just 25,000 rather than 70,000 freshly registered Bitcoin deposits exist. This decline in selling pressure denotes a change in investor behavior towards holding rather than trading their Bitcoin.

Investors are unwilling to sell #Bitcoin

“A decreased willingness to sell assets could lead to a reduction in the supply of Bitcoin on the market, which, with steady or increasing demand, may cause price increases.” – By @AxelAdlerJr

Full post

https://t.co/HdipPeIh6h pic.twitter.com/jhNDHiSKst

— CryptoQuant.com (@cryptoquant_com) July 23, 2024

According to CryptoQuant analyst AxelAdlerJr, this decline in selling pressure denotes a change in investor behavior towards holding rather than trading their Bitcoin.

Such behavior shows that the market is mature. As investors gain more faith in Bitcoin’s long-term value, they trade less. They spend in a more stable way, which might make the market less volatile and more stable. This trend shows that buyers are beginning to see Bitcoin as an asset with value, not just a way to speculate, which is good news for the cryptocurrency.

Institutional Confidence And Market Psychology

As more and more investment firms are pouring money into Bitcoin, everything has changed. Big investment businesses and institutional investors provide the market legitimacy and security, which can affect how regular individuals think about investing. Big players may inspire trust and long-term thinking among smaller investors.

This dynamic is much enhanced by behavioral economics. The activities and confidence levels of additional institutional investors entering the market might affect the sentiment of individual investors. This phenomena can result in a positive feedback whereby rising confidence stimulates more investment.

One important statistic emphasizing this change in investor attitude is the declining deposit addresses. It implies that anticipating better future prices, investors are less ready to sell their Bitcoin. Supported by both lower supply and higher demand from both institutional and individual investors, this line of thinking fits the growing conviction that the price of Bitcoin will keep rising.

Featured image from Pixabay, chart from TradingView