The post Bitcoin Surges 8% in 48 Hours – But Is a Market Trap Looming? appeared first on Coinpedia Fintech News

Bitcoin has finally crossed over $65,000 after months of struggle. The largest crypto has been trying to rise above this level since its fall at the end of July this year. This sudden movement has caused millions in liquidation but investors are happy as 93% are now in profit. There are still speculations if this is the start of a bull rally or a trap. Let’s try to find out what is happening in the market.

The Bitcoin Chart

Bitcoin currently trading at $67,126 has confirmed support on the upper level of the parallel channel. BTC has been moving downward in this channel since March 2024. As explained in an analysis covered on October 14, the median of this channel held the price from falling. This is the spot of bitcoin’s rise. Additionally, another trendline formed in March as well, provided the secondary support that finally pushed the price to $65,300 where it claimed the support. The asset is currently facing resistance from $67,000 which is an old time ATH.

The RSI and MACD are supporting this price rise, however the MACD histogram is displaying reduction in bull power. The price might retrace to $65,300 before taking further bounce.

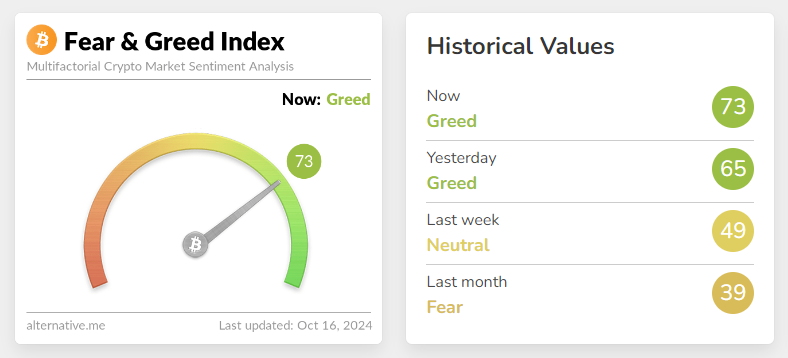

The Greed and Fear Index

This index shows the overall sentiment of the crypto market. Today it is recorded at 73 showing investors and traders are feeling the bullish sentiment. Yesterday it was 65. This shows the improvement in the market sentiment in the last 24 hours. In the last two days, Bitcoin has surged around 8.45% and RSI reached 73.16 from 55 in the last 48 hours.

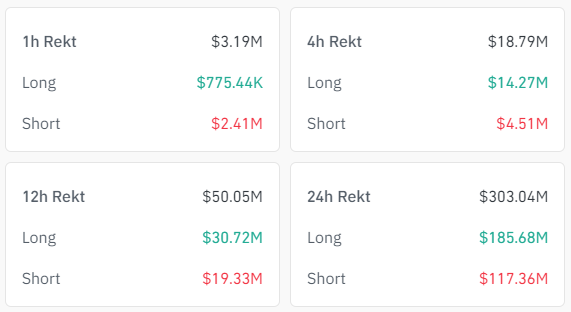

Market Liquidation

In the last 24 hours, the crypto market rekt over 93,400 traders. Traders lost a total of $303.04 million in trades because of sudden market movement. More interestingly, in the last 12 hours, $50.05 million worth of trades were vanished showing most of the damage was done between 24-12 hours ago.

The long and short ratio at the time of writing is at 1.1683 which represents long traders who are very optimistic towards the price rise. Among all the open Bitcoin trades, 53% are longs and 46% are short.

What To Expect

Despite the market feeling very happy about this price surge, there is always a fear of a sudden reverse. When the market gets filled with too much optimism, this becomes a great time for market makers to retrace the market and make huge profits. Though everyone in the crypto space is waiting for bitcoin to create a new all time high, we must practice caution in the market.