Bitcoin has made some notable recovery in the past day as data suggests buying pressure has returned on the cryptocurrency exchange Coinbase.

Bitcoin Coinbase Premium Has Flipped Back To Positive

As pointed out by CryptoQuant Netherlands community manager Maartunn in a post on X, the Bitcoin Coinbase Premium Gap has surged back into the positive territory.

The “Coinbase Premium Gap” here refers to a metric that keeps track of the difference between the BTC prices listed on Coinbase (USD pair) and Binance (USDT pair).

What this indicator tells us about is how the buying (or selling) behaviors differ between the userbases of the two platforms. The users of the exchanges would have some overlap, of course, but there is one key difference between them: the former platform is the preferred one for US-based institutional entities.

This means that the premium’s value can provide hints about whether these humongous American traders are buying more or less than the global investors Binance hosts.

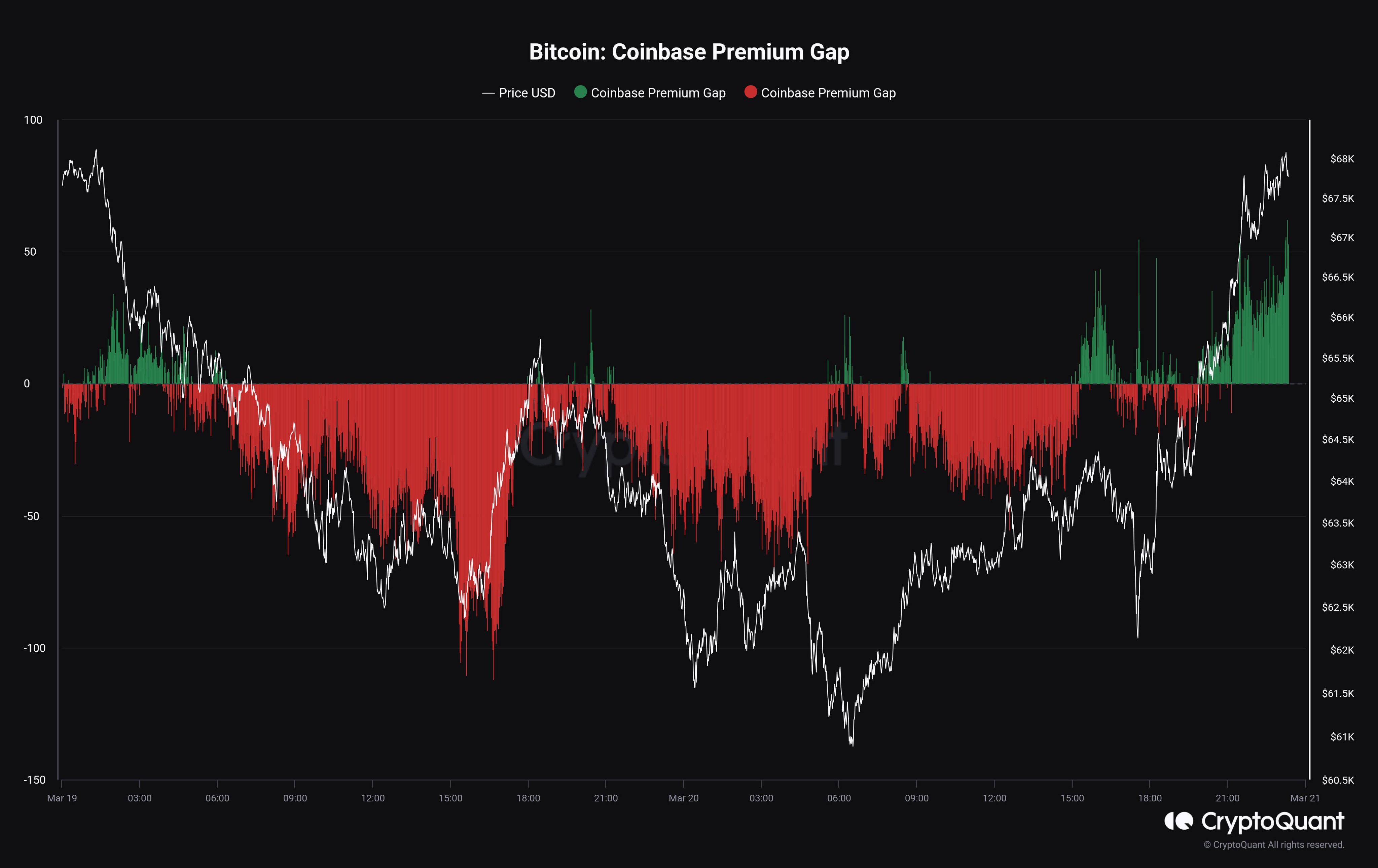

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past few days:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap had turned significantly red earlier. Alongside these negative values, BTC observed a steep decline that took its value as low as $60,600. This pattern implies that the selling pressure from American institutional investors may have played a role in the drawdown cryptocurrency went through.

And indeed, the trend is actually in line with what has been observed this year so far, as the Coinbase Premium Gap has appeared to have been guiding the price throughout. It would seem that BTC’s price action in this post-ETF environment is being notably influenced by the institutional entities.

From the chart, it’s visible that the indicator’s value has turned back green in the past day and just like the red values accompanied a net decline, this buying pressure has led to the coin registering some sharp recovery.

These positive premium levels have come as the US Federal Reserve has revealed in its latest meeting that the interest rates would remain unchanged for now and that there would still only be three cuts in the year ahead.

Given the relationship that the Bitcoin spot price and Coinbase Premium Gap have apparently held in this first quarter of 2024, the metric may be worth continuing to monitor, as any changes in it may reflect on the asset.

Should the current positive values of the indictor persist, BTC may become likely to further its surge, as it would mean that the large investors are backing the rally.

BTC Price

So far in Bitcoin’s recovery since the Coinbase Premium Gap has turned positive, the asset has managed to climb back towards the $67,000 level.