By freezing accounts of everyday citizens, the Canadian government demonstrated the necessity of Bitcoin. Russia is learning the same lesson through U.S. sanctions.

In early 2022, in a short period of time, Canadian truckers went from being a “fringe minority” to being so dangerous that Prime Minister Justin Trudeau invoked emergency powers for the first time in half a century with the specific Emergencies Act being declared for the first time since its creation in 1988.

The rarely-used emergency powers allowed Canadian authorities to ban public assembly, restrict travel, and maybe more importantly, freeze bank accounts without the need for court orders. This announcement was already following the blockage of more than $10 million by GoFundMe. Also preceding this extraordinary measure was a Canadian judge issuing an injunction for another $9 million in donations given via the GiveSendGo platform. With over $19 million dollars obstructed from people who were peacefully protesting, bitcoin was the only money (besides cash) that could make it directly into the hands of truckers and other protestors.

Bitcoin To The Rescue

Bitcoiners from all over the world banded together to raise over 22 bitcoin for the Canadian Freedom Convoy protest. The outpouring of donations was so overwhelming, the organizers of HonkHonkHodl shut down the donation page and some even briefly deactivated their Twitter accounts out of emotional distress and/or fear of government retribution. So how were people able to donate to this cause when the Canadian government announced plans to freeze protestors corporate and personal bank accounts? With the aid of Tallycoin, a noncustodial crowdfunding platform (and bitcoin of course!)

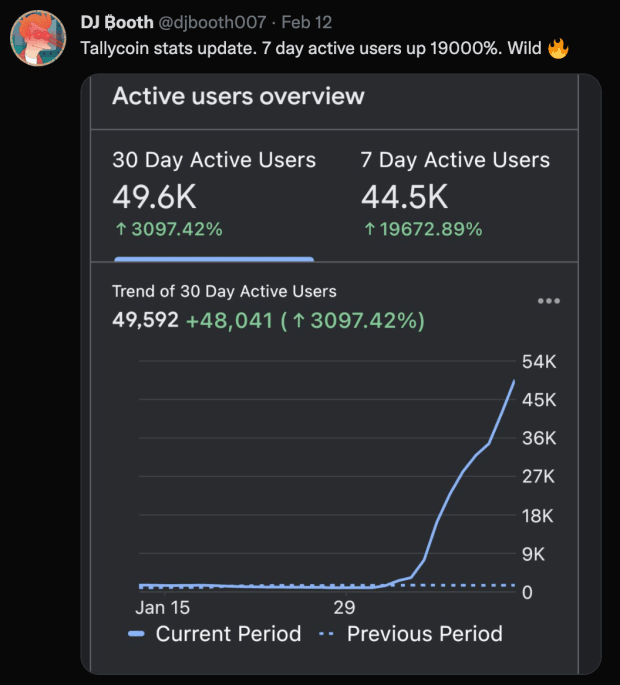

Tallycoin has been around for many years and allows projects to raise bitcoin for various purposes. The projects range from documentary films to books about the Lightning Network to raising money for beers for a bitdevs meetup. It wasn’t until the Canadian protests that the platform experienced a massive popularity boost in a short period of time.

With the Canadian government having frozen accounts of people with views which were deemed “unacceptable,” Bitcoin took the spotlight as a way for people to receive value from donors around the world without the possibility of being stopped. That didn’t mean truckers and those fielding the donations are in the clear. The Royal Canadian Mounted Police (RCMP) and Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) issued sanctions against 34 crypto addresses (29 of which are bitcoin addresses). At least some of these addresses were directly tied to organizers of the Tallycoin fundraiser.

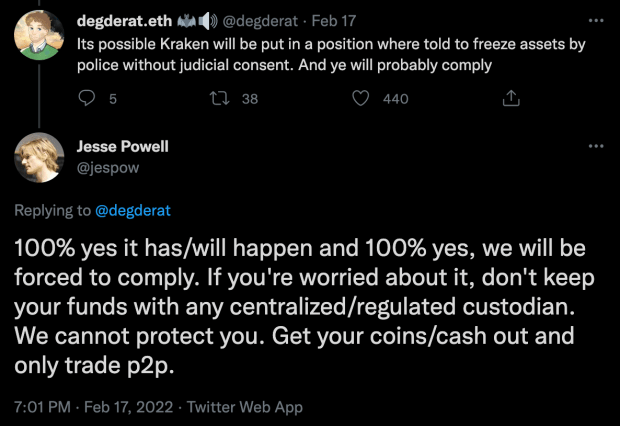

Fortunately, the Bitcoin network doesn’t know nor care about sanctions. The owners of the private keys from blacklisted addresses could still send those “illicit” funds to any other Bitcoin address and chances are, the transaction would get confirmed in the next block (as long as the fee is set accordingly to the going market rate). Getting those funds onto an exchange in order to sell that bitcoin for fiat is another story.

Can Governments Paralyze Bitcoin?

As the cofounder and CEO of KrakenFX exchange, Jesse Powell, explained, regulated exchanges must comply with judicial orders. Any trucker who receives bitcoin from one of those 29 addresses and then tries to sell it for Canadian dollars (CAD) on an exchange will have their funds frozen and may also risk further legal action since their personal information is almost definitely stored in the exchange’s database due to Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. The issue of freedom to control one’s own money was discussed with Tucker Carlson when he questioned Marty Bent about Bitcoin’s ability to be used in such an adversarial environment. In the clip, Carlson asserts that people will most likely lose faith in banks if governments don’t approve of how they use their money and Bent assures him that the promise of Bitcoin holds true, so long as users hold their own private keys.

Truckers are limited in the use of bitcoin for the purpose of cashing it out for CAD, but would they face the same challenges putting this donated bitcoin to work in a circular bitcoin economy? My guess is no. But most truckers weren’t going to protest with the plans of being forced to adopt Bitcoin or even choosing to fall down the Bitcoin rabbit hole (also known as getting orange-pilled). Learning about Bitcoin wasn’t on the agenda when these protestors headed to Ottawa to make their voices (and horns) heard. Spectators around the world began noticing the frightening trend of the government freezing the assets of those with dissenting opinions and the observers who were savvy began to realize that it might be their opinion that gets them locked out of their bank account next.

How To Distribute The Donated Bitcoin?

There were numerous discussions around how the HonkHonkHodl team should distribute the donated bitcoin. Many people, including myself, were curious about the transparency of how the bitcoin would be used and allocated to protestors. After some of the notably reputable and public organizers deactivated their Twitter accounts for fear of government retribution and general stress, one Twitter user, who has established a reputation of a controversial nature amongst many prominent members of the Bitcoin community, became extremely vocal about the lack of immediate action to pass out bitcoin to the truckers, going so far as to threaten legal action. This same person then offered their support by joining the organizers in strategizing how to proceed, which led to a deeper conversation around Bitcoin privacy and best practices due to the questionable privacy practices the team chose in handing out donated bitcoin.

According to a piece by Vice, organizers planned the distribution of funds publicly on Google Docs and destroyed devices used that interacted with the seed words for the truckers’ bitcoin. Based on the suggestion of this new person who added himself to the HonkHonkHodl team, truckers who received bitcoin would also be recorded on video as they received their donation in order to provide photographic proof that donations were being handled appropriately. After witnessing the severity of financial repercussions for participants of these protests, it is astonishing that the organizers were willing to put themselves on camera as well as the truckers to whom they donated the bitcoin, but that is exactly what they chose to do. Arguments have been made that the truckers are making no attempt to hide their identities while at the protest, but does that mean we should have put them on camera as they received those precious sats?

Since that time, one of the HonkHonkHodl organizers, Nobody Caribou, had his house raided and one set of private keys confiscated by a joint police task force.

Financial freedom and privacy are fundamental human rights. Many people who observed the Canadian government’s response to protestors’ financial assets would be wise to think about what could happen to their own bank accounts should they choose to voice concerns about a decision with which they disagree that was made by the government. Bitcoin is an avenue for freedom as long as it’s used in a private and secure way. It’s also a completely open and transparent public ledger, which is how the Canadian government was able to easily pinpoint 29 specific addresses connected with the protest. My personal thoughts about digital privacy are that it is a spectrum and users should be able to choose how private they intend to be. Choosing to be less private (or not even having the opportunity to make a choice about privacy, such as being filmed receiving donations) in this scenario with truckers could have serious livelihood and financial ramifications if these protestors are identified by entities looking to label them as an associate or participant in a targeted group. Filming truckers as they receive their first bitcoin ever does not provide those users with the same type of non-KYC opportunity as it could have had they received the bitcoin off camera.

Eventually, the Freedom Convoy was put to an end with pepper spray, stun grenades and tow trucks. In addition, some of the bitcoin donations were reportedly seized. Though bitcoin itself is an unstoppable monetary force, it is as susceptible to seizure as its users. This demonstrates the need for better Bitcoin privacy and mixing practices, but does not limit its utility and value. By making the donations publicly and on film, Nobody Caribou (or Nicholas St. Louis as he’s been identified) made himself an easy target. Though the government eventually began lifting the asset freeze on more than 200 accounts, many people began waking up to the authoritarian capabilities of their government.

Russia And Ukraine Take Center Stage

Before the gravity of the gross mishandling of Canada’s use of the Emergencies Act for the purpose of freezing its own citizens’ accounts had time to settle in, Russia invaded Ukraine. Ukrainians were forced to flee or stay to fight. Banks continue to operate, but with no possibilities for getting more cash reserves. ATMs were overrun and electronic cash transfers were suspended. Ukrainians who left and had bitcoin were able to flee with at least some of their wealth intact. More than $4.4 million worth of bitcoin was donated from all over the world to the Ukrainian military. A week into the conflict, the G7 countries decided to freeze Russian assets that are held in their jurisdiction and the U.S. imposed “unprecedented and expansive” sanctions in order to bar Russia from the worldwide financial system.

Bitcoin Can’t Be Stopped

Unlike the U.S. Treasurys, which can be seized at the blink of an eye or bank accounts that will be frozen if citizens voice an “unacceptable” viewpoint, Bitcoin cannot be stopped. No government anywhere in the world can effectively assert jurisdiction over a borderless, decentralized monetary network. That doesn’t mean they won’t try. It’s up to Bitcoiners to educate newcomers and bring them on board the Bitcoin lifeboat in as private a way as possible. The decision by the Canadian government to freeze protestors’ assets is not a new strategy known by authoritarian governments. But now, people in constitutional republics are beginning to realize that it’s possible and maybe even likely that their funds are also at risk. Many people around the world are starting to see the importance and value of a digital asset that is seizure-resistant, censorship-resistant, borderless, and sovereign. It’s imperative that we handle this opportunity with privacy and education in mind. Never before have we been on the precipice of orange-pilling the entire world. With the financial freezes of citizens in Canada and the financial freezes of an entire country (Russia), hyperbitcoinization might be closer than we think.

This is a guest post by Craig Deutsch. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.